The “Great Wealth Transfer” Has Begun …

This article is about The Great Wealth Transfer. But before we get to that, a quick hypothetical question to help me explain why this is so important …

What would happen if you took all the money in the world and split it up evenly across all the people in the world?

Let’s say there’s $360 trillion in ‘wealth’ floating around the world right now, and we divided it up equally between the world’s 7.8 billion people…

Each person would get about $46,000.

Forget for a second whether this is fair or if the numbers are correct… This is just a fake scenario to get you thinking about what would happen afterward.

How long would the equal transfer of money last? If this happened tomorrow, how would people spend their money? Would it be invested? Or would people blow their $46k on consumer crap and lifestyle upgrades? Maybe a bit of both?

Experts believe that within 5 years, all of the world’s money would end up right back in roughly the same hands that it is in today. It’s crazy to think that a massive global event like this would be so short-lived!

It’s because the way people manage wealth strongly depends on their financial education and money habits. People with high financial IQ tend to build and maintain wealth easily. Whereas people with bad money habits or little money knowledge find it hard to hold onto wealth. This is also why most lottery winners go broke quickly.

Of course all of this is a hypothetical scenario, because a global money division will never happen in real life.

But, do you know which large-scale money transfer event will happen in real life…?

In fact, it’s happening right now…

The Great Wealth Transfer

Over the next 20 years, the most prosperous generation that has ever lived (Baby Boomers) will be passing down $68 trillion in wealth to their heirs. The recipients are Gen Xers and Millennials.

The reason this is more significant than previous wealth transfers in history is because:

- Baby Boomers represent a huge percent of the population

- Their ownership percentage of current wealth is ridiculous

- The money habits of the younger generation are grossly different

Here are some stats around the great wealth transfer that will blow yo’ mind  :

:

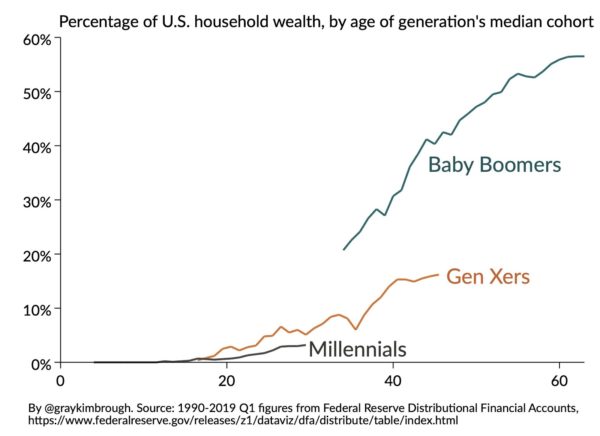

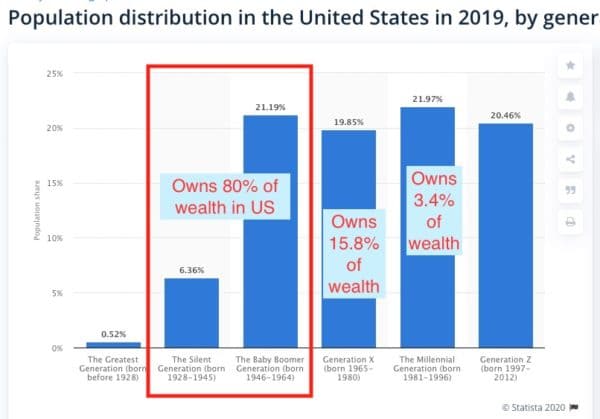

The Baby Boomer generation currently owns more than 56% of the wealth in the U.S. And their parents own 24% of the U.S. wealth. This totals a whopping 80%!

Gen Xers own 15.8% and the Millennial group only holds 3.4% of total U.S. wealth.

The chart below shows our current population split by generation. And it’s projected that in 2029 (when the last baby boomer turns 65), boomers will still represent 17% of the population.

It’s estimated that women will inherit 70% of the Great Wealth Transfer, according to Boston College’s Center on Wealth and Philanthropy. And by the year 2030, women will control 2/3rds of the nation’s wealth.

Studies suggest that 80% or more of heirs will look for a new financial advisor or wealth manager after inheriting their parents’ wealth.

70% of wealthy families lose their wealth by the second generation, and a stunning 90% by the third, according to the Williams Group wealth consultancy.

*All the sources I used for these stats are linked at the bottom of this article, along with other interesting articles about generational wealth.

So What Does This All Mean?

First, it’s important to note that this “great transfer” is more like a “slow trickle.” The shift of wealth will be rapid, but not sudden. We all have time to prepare and adapt as things change around us over the next 20 to 30 years.

Also, recognize that assumptions and predictions around this event are very generalized. We can’t predict exactly what will happen because the world hasn’t experienced something like this before. And each individual country, business, and person is affected differently when money changes hands.

One thing’s for sure though… Just like in the hypothetical example at the beginning of this article, financial education will be the biggest deciding factor of whether wealth grows or shrinks within your household.

Why Should You Care About This?

Many of you might be thinking, “Hang on a sec… My parents don’t have much money, so I’m not expecting an inheritance. Why should I care about all this anyway?”

Well, think beyond the direct transfer for a moment. When money rains down on people, in general, it only sticks around as long as the recipients know how to keep it. Sadly, there are millions of Gen Xers and Millennials who have poor financial education. Over time, wealth will flee from their accounts if they are not prepared or taught responsibility.

When money evaporates due to bad financial habits, do you know where the money goes? It goes to business owners, shareholders, investors, savers, hoarders, side hustlers, net worth trackers, FIRE walkers, and the sexy readers of this blog. Money is attracted to people with good financial education and habits. You will indirectly benefit from more money changing hands and as the economy is redesigned to support aging boomers.

Financial Planning for the Next Few Decades

These tips are useful if you’ll be giving or receiving wealth directly, but they are also just good general advice all around!

Talk about money more often! Financial conversations with family members can be awkward, ugly, and sometimes lead to fights. But, the more that money is discussed and problems are addressed early, the higher the likelihood of a family succession plan working out well. Remember, when talking to people from different generations about money, go in with a complete open mind. We all hold different values and motives around money.

Keep increasing your financial education! There’s always something new to learn. If you are confused or need help with wealth management, there are professionals and advisers in every single industry that can help you with hard financial planning decisions. If you’re already very financially literate, help educate others out there!

Consider charitable giving and directing money to services that are needed in the world. Many people inherit more money than they need, and some accumulate more than their heirs need to inherit. Take some notes from this guy, who built a fortune and donated it all anonymously.

Estate planning and tax planning. Uncle Sam is rubbing his hands together just waiting for the wealthiest generation to make mistakes in the wealth transfer process. Inheritors usually find out too late that they pay major estate taxes on family wealth … and that much of it could have been avoided if proper planning had been done earlier!

Consider the “burden” of some assets. Some wealthy people are asset rich but cash-flow poor. If they hand down complex assets (for example, a large real estate portfolio or a unique business that requires constant upkeep), there’s a chance the offspring or loved ones can’t handle the maintenance or annual expenses. Think about simplifying wealth before transferring family assets. This goes hand in hand with planning ahead of time and educating younger investors!

I’m curious to hear your thoughts. Got any predictions on how this will impact our lives over the next few decades?

Reference articles for this post:

All of the world’s wealth in 1 visualization (2020)

Wealth percent by generation, (Interesting data since 1989!)

US Generational Wealth Trends (Deloitte study from 2015)

Considerations for Women In Wealth Transfer

70% of rich families lose wealth by 2nd generation

What the Great Wealth Transfer means for the Economy

2018 US Trust Insights on Wealth and Worth

Via Finance http://www.rssmix.com/

No comments:

Post a Comment