Net Worth Report – Numero Uno!

Can you believe it’s October already! As much as I love the holiday season, the tight-ass inside me calls the next 3 months the “expensive season” where our costs get a little crazy on food, travel and gifts!

.

.

Today I’m sharing my very first ever net worth report. Well, kind of … this is a partial and simplified version, which excludes shared rental properties and private partnerships. This report is the first of many I’ll publish monthly going forward.

Why I’m Sharing Net Worth Tracking With You

There are hundreds, (maybe even thousands?) of bloggers who are tracking their assets and net worth online. But what’s cool is that everyone does it in a slightly different way. Also everyone shares it publicly for different reasons.

Here are my reasons:

-

- To keep encouraging others to track their net worth, too. In fact, everything I write online is to share processes and methods that have helped me, and hopefully can help others out there increase their financial situation. If you don’t track your net worth – start TODAY. If you don’t know how, start here and email me if you have any questions!

- A unique-ish perspective. Since my wife and I are pursuing “Coast FI” we are pretty much solely relying on the compounding growth of our existing assets. Even if we don’t add any more contributions, we *hopefully* will still reach our FI number. We’re trying to prove that the slow and boring path to FI is just as good as any other! This slow strategy lets us work in jobs we enjoy, even if it means having a 0% or even a negative savings rate for a few years. You will never hear us complain about our jobs, which is rare these days.

- It’s about the process, not the numbers. It’s always fun to check out someone’s net worth or assets statement… But, the true value is watching how things change over time. Plans change. Things fail. Life gets in the way. We all approach obstacles and windfalls differently. It’s the tiny decisions we make along our journey that have the biggest impact in the long run. Each monthly report is just a snapshot. But together, over time, they all tell a story.

Drumroll, Please …

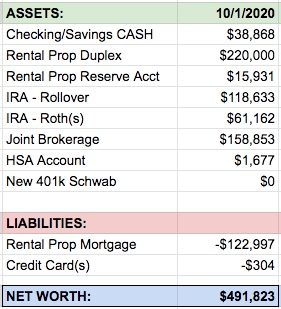

Let’s jump into the big-picture numbers, then afterwards delve into the details and whatnot. Here’s a list of our assets (for my wife and me) and their balances as of October 1, 2020:

Breakdown of Assets

Checking & Savings Accounts ($38,868): This is the liquid cash across our regular bank accounts, including our personal emergency fund. I know, it’s probably a little too high for what we need going forward. My wife and I are just getting back into regular W2 income after our lengthy sabbatical, so we will reduce this cash balance over time.

Rental Property, and Reserve Account ($235,931): The backstory of this duplex is posted here. I recently ordered a Market Comp for the property which confirmed a $220k evaluation. The reason I keep a dedicated reserve account for this rental (and I recommend people do this for all their investment properties) is because I track it separately from my personal income/expenses. I view each rental property like a self sufficient business – all of the incoming rent gets paid into the reserve account, and all expenses taken out of it.

IRA – Rollover ($118,633): This account is the combination of a few old employer 401k plans rolled over into an IRA. The full backstory is posted here. Since my new workplace offers a 401k plan, I won’t be contributing to this specific IRA, and its growth solely depends on the overall stock market.

IRA – Roths ($61,162): We were a little late to the Roth game, starting both our accounts in 2016. Going forward, our plan is to max out our Roth contributions each year, even if we have to pull from other retirement accounts to do so.

Joint Brokerage Account ($158,853): This is an after-tax, self managed brokerage account. Since my wife and I will most likely need access to retirement funds before we turn 59½, this account is a big part of our early withdrawal strategy. Our long term plan is to slowly sell off our real estate holdings and move money into this brokerage account (and our Roths) going forward.

HSA ($1,677): Quick update on my healthcare situation… I’ve enrolled in a shithouse HDHP plan, but one of the benefits is the ability to invest in a Health Savings Account. Although its purpose is for healthcare expenses only, the tax advantages of an HSA make it an excellent investment vehicle. The max contribution I can make is $3,550 this calendar year, which I’ll be adding shortly when my coverage kicks in.

New 401(k) at work ($0): I was on the fence about contributing to my new workplace 401k plan. Since my wife and I have almost a 0% saving rate (making just as much as we spend), adding any money into this 401k would put us in a negative cash flow situation each month. But, since our emergency fund and cash position is quite high right now, we feel OK living off of our checking account cash and investing parts of my income. At least for a little while.

Breakdown of Liabilities

Rental Property Mortgage (-$122,997): This balance will slowly decrease over time as principal is applied with each mortgage payment. There are options for refinancing this rental property and borrowing more money, but we need to stabilize our income a bit more so we can qualify for a new loan :)

Credit Card Balances (-$304): Although we pay off our credit cards in full each month, there’s typically a few hundred or maybe a couple thousand dollars in new charges. This balance represents whatever we owe at the time we do a net worth snapshot.

My wife and I have no other consumer debt. :)

Stuff Not Included in These Monthly Net Worth Reports

Our Car: Personally, I don’t consider a car as an “asset” because it’s something that takes money out of our pockets each month, and doesn’t contribute towards growing our wealth. Our Prius (nicknamed “The White Shite”) is owned outright, so there are no payments or debt attached.

Wife’s CalSTRS Retirement Plan: The saddest and most frustrating thing about being a teacher is the tiny compensation and absolute ripoff retirement options. The State of California deducts a small portion of my wife’s paycheck (involuntarily) and hides it in a secret, invisible, web of trickery. It’s almost impossible to determine where her contributions are actually being invested, and if she’ll ever get them back one day. Needless to say, this retirement account is about as dependable as Social Security later in life. It’s an asset we hope to one day benefit from, but unfortunately something we can’t control or rely on.

Australia SuperAnnuation: If you think the USA has confusing government sponsored retirement plans, you should check out Australia’s weird fee-ridden system! The good news is I have about $25k AUD in a self-managed Super account down there… The bad news is the account is growing at a rate of about -2% YoY even though it’s invested in the best available index funds. The only way I can access this money is either when I turn 60, or if I renounce my Australian Citizenship. :(

Joint Rentals, Real Estate Partnerships & Reserves: My long term strategy is to slowly downsize and eventually exit from owning and managing rental real estate. Shifting money from these assets over time into our IRA & Brokerage account will simplify our withdrawal strategy and be way less crap to manage in retirement. I’ll chat more about this real estate stuff over time.

Goals and Future Milestones

In the short term, like 3-6 months, we’ll slowly add money into the new 401k account. We’ll probably fund the HSA before year end ($3.5k), and then think about maxing our Roths in January ($12k). To do all this, we’ll need to take cash directly from our reserves. I don’t anticipate a huge increase in overall net worth, just a shuffle of money between accounts.

Our longer term goals are still shaping, and much of these depend on market performance, offloading some of our rentals, and possibly increasing our income a bit next year. More to come on all this stuff — things are a bit wonky right now!

As far as milestones, looks like we’re in sight of a $500k report pretty soon! J$ hit the Half Millie mark back in May 2016, then it only took 3 years from him to double it to $1M!  I can’t promise my assets will grow as fast, but it’ll be an interesting journey nonetheless!

I can’t promise my assets will grow as fast, but it’ll be an interesting journey nonetheless!

How are your net worth updates for the end of September? Any news or milestones to share?!

Have a great weekend!

– Joel

Via Finance http://www.rssmix.com/

No comments:

Post a Comment