We Ditched Our Big City Life for a Small Town, and Our Finances Thanked Us

Ever think about packing up all your stuff and moving your family to a small, less expensive town? That’s exactly what Joe DiSanto and his wife did. In today’s post Joe shares their transition across the country, cutting their budget by 60% (!!!), and all the good and bad stuff along the way.

Quick note: Joe’s budget numbers might be much higher than yours! (They’re certainly higher than mine!!) But what I love about stories like this is that freedom and time are what we strive for and value most, no matter what our numbers look like.

*****

Due to the Covid-19 pandemic, many Americans are exiting big cities and heading for the safety and tranquility of smaller towns. Although my family and I moved from the city to a small town almost two years ago (under normal circumstances), it felt like a good time to share the details of our transition.

I’ll show you how we were able to save so much money (60% of our previous budget!) so that we could work less and enjoy life more. Like me, you might even benefit from a total rehabilitation of your previous workaholic life-style! In small town America, you and your family may just end up happier.

A Little Preamble…

So why did we leave Los Angeles for a small town? Simple…we wanted to spend less time working and needed a cheaper location in order to accomplish that. Easily done? Not exactly. Here’s the gist of it.

I’m a former executive producer/business owner and spent many years and LOTS of hours climbing to success in the advertising and entertainment industries. My wife (a former film/tv editor) and I created multiple successful businesses (with our close friends and business partners), which provided an “enviable” big city lifestyle. We even won a couple Emmys, which pleasantly validated all our hard work!

(The Sonic Highways billboard on Sunset Blvd. And our audio team with their Emmys for Sound Editing and Sound Mixing!)

THEN….we kissed it all goodbye to start a new life. At the ages of 38 (Kristin) and 43 (Joe), we left our stressful big city careers and (eventually) relocated to a charming Florida beach town where we knew no one, but were able to raise our 3-year-old son full time.

We traded in time spent on work, for time spent together (such a cute tagline. I literally tear up every time I read that. Ok, not every time). Now we refer to ourselves as “semi-retired”, and living “Act 3 of a 4 Act Life.”

The (Hot) Financial Details….

Being that this website thinks budgets are sexy, I’m going to just get to the sexy part, and save the rest of the story for pillow talk (creepy yes, but funny).

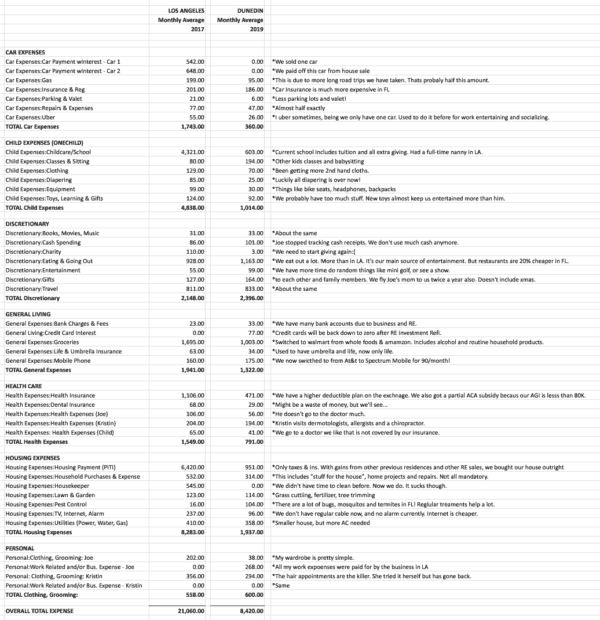

For those of you who fantasize about a good “belt-tightening,” you’ll be happy to know that moving to Florida has reduced our overall monthly expenses by about 60%. Really. It went from an average of $21,060 per month to $8,420!

A little background on the data: These numbers are not a “guesstimate,” they are actual expenditures. For LA we used a monthly average of 2017, and for FL we used a monthly average of 2019. We didn’t use 2018 because we moved three times and lived in LA, Austin and FL. It was not a consistent comparison.

Most every area of our life is cheaper here, but not all by 60%. And we do spend more on discretionary because we have more free time..yah! The biggest reductions in spending are our housing payment and child care costs. Plus we also have tried to corral our spending a bit.

Here’s Some Info on the Main Areas Where We Are Saving…

Child care costs are way less because we went from a full-time nanny to a full-time mom with some preschool. We would have eventually switched to school in LA, but not as soon. With Kristin working full-time, we would not have been able to do that until kindergarten, and then still would have needed after school care. It’s also likely that our son’s amazing Waldorf school here would cost 2x more in LA.

The other major reduction is housing. With the sale of our LA home and some other real estate, we are able to own our house outright here, so the out-of-pocket expense is only taxes and insurance.

Taxes are higher here, on a percentage basis, but house prices are significantly lower. Insurance is also higher here because hurricane coverage is mandatory and you really need flood insurance as well. In LA, earthquake was not mandatory, but we had it…so insurance is about the same.

We switched to getting groceries at Walmart instead of Whole Foods and Amazon. Walmart has nearly every organic item we want and it’s all cheaper…and they deliver. There is the moral dilemma of Walmart having low-paid employees and using a deplorable amount of plastic bags (among other things I’m sure), but it’s definitely cheaper.

We don’t have a housekeeper anymore (which sucks). We really liked having a housekeeper, and we needed it in LA because of our schedules. But it cost us over $500 a month. Now we clean our house and do our own laundry (it’s tough…hahaha). Honestly, we may get a housekeeper again, but it would only be once a month.

We only have one car now. This is possible because I work from home and Kristin is mostly with our son or blogging while he’s at school (three half-days per week). When we end up in the rare car bind, I just Uber. With the invention of ride services, many people could go down to one car and save money.

Other smaller ways we are saving a bit include buying less new clothing, ditching regular cable, switching to a cheaper mobile phone plan, buying fewer toys and skipping nail salons.

Take a Look at the Full Expense Comparison Below

(FYI…You can download this data (along with a budget version), and get a walk-thru video, by signing up for this Free Personal Budgeting Basics Course!)

Some Additional Thoughts Beyond the Numbers…

While we’re very diligent about tracking our spending, we’ll be the first to admit we are not the most frugal people. We (luckily) made enough money in LA to prioritize convenience over extreme frugality (which will cost you a lot).

We often didn’t have too much choice however, with our demanding work schedules. Plus, when we had free time we didn’t always feel like employing “frugal restraint!” But now that we are living less hectic and excessive lives, it’s easier to save.

So How Did We Pull This Big Change Off?

A lot of financial planning, many good investments (mostly real estate), and a healthy fear of life passing us by before we actually got a chance to live it. But even with most of our financial ducks in a row, I will admit that it’s not an easy thing to do.

It’s also worth mentioning that it took about 1.5 years from when we fully committed to this idea, to the actual departure from the airport on July 31, 2018. Extracting yourself from your life of 20 years involves a lot of functional planning and “untangling” of yourself from the web you have built around you.

Additionally, I will admit that we really didn’t have groundbreaking ideas about how we were going to make money after we left LA. We had a vague plan to “start a blog.” (Hey…you have to tell yourself something.) Our hope was that whatever we did for work, it would at best be more passive and at least be mobile.

We did, however, have enough savings that we were comfortable kind of winging it for a year and figuring it out. I realize this may sound irresponsible, but because I keep detailed accounts of our finances, I knew exactly how much money we had to work with.

Forcing Change Can Create New Opportunities

Luckily, when I initially discussed my departure with my business partners, they were interested in having me continue to do financial management from afar, for a monthly consulting fee.

This was welcome news and something I was more than excited to keep doing (because it gave me a little income to start).

Then (more) luckily, after leaving, other friends (who owned similar companies) asked me if I would be interested in doing similar work for them. Now I have 5 businesses and 2 individual clients in this capacity.

Some Passive(ish) Income

We have a handful of rental properties which produce some cash flow. It’s been a crap shoot every year on how much cash that is, but it provides a bit. Around $1200/month.

Additionally, we have realized some revenue from real estate this past year selling existing properties, like one in Austin and another in Kansas City.

There is also the reality that the equity in our remaining real estate, and the money in our retirement accounts, is growing. So we figure if we’re only breaking even on our life in general, then we should be ok in the long run. Time will tell of course.

Throwing in a Little Long Game

Finally, while blogging (or what I prefer to call the “business of education by individuals”) on Play Louder may have great income possibilities, it seems to be a pretty serious long game.

Writing informed and valuable lessons takes time, and I’m not working 70 hours per week right now. But, I’m really enjoying working on some killer finance and real estate courses that will hopefully add knowledge and value to people’s lives. I believe, in time, the blog will definitely produce some additional income.

How Did We Choose Our Small Town?

In a very weird way…

Our initial plan for this life changing journey was to move to Austin TX. Here’s a funny (not really) story about how we initially moved to Austin…promptly had an existential meltdown…and “changed our life” again just 88 days later. Yep.

Part of the idea with going to Austin was that there was a market for our work experience there, if we needed it (but we were also hoping to make a work-from-home scenario happen). We also had a rental property there that we thought we could fix up and then live in.

Long story medium, WE PICKED THE WRONG TOWN! The live music scene in Austin was really the only thing we liked about it (and the cheap Lonestar beer.) So after we completed our renovation, we put the house up for sale, packed up the family and moved halfway across the country…AGAIN!

(By the way, I wouldn’t at ALL recommend moving across the country twice…in three months…WITH A TODDLER! But if you DO find this ever happens to you, I highly recommend the book “life’s purpose,” this insight timer course on “gratitude,” and this documentary about happiness.)

So where did we find our new small town dream? Well, that’s a very unusual story involving the internet. We really didn’t know where to go. When you’re not driven to a place by either family or work, it’s actually surprisingly hard to “know where to go.”

We knew we wanted to be near the water and that we wanted a town with a charming main street. Sooo…we googled “reasonably priced seaside towns with charming main streets?” Genius!

We made a list of six of the towns that looked really good in the pictures, and seemed to check off some or all of our boxes. Reasonably priced homes, lower property tax, hopefully no income tax, walkable, decent schools, etc etc. It’s hard to get all these things in one town!

Then we said to ourselves, “Well we need to go visit these places!” Problem was that at that time we only had about 1.5 months left on our Airbnb, and we still had a renovation to complete before that date arrived.

So, we picked the town that seemed the most promising, and went for 5 days…Dunedin, FL. It’s pretty hard to decide if you want to move somewhere in a few days, but we were not staying in Austin…and we didn’t have time to visit anywhere else on the list so… Dunedin it was.

Fortunately, Dunedin turned out to be a wonderful place to live. We really love living here (thanks be to the gods). Within a short time of being here, we also found a home we wanted to invest in and renovate! So we stayed in a temporary house for a year, then moved into this beauty!

How Our (Non-Financial) Lives Are Different Now

Lets see…now I work as a part-time CFO and small business consultant and a part-time blogger (my blogging itself doesn’t make me any money as of yet though…g-damn blog!). My wife is able to be a full-time mom and part-time blogger (sure…she’s a non-paid blogger too….why not!). We both spend most days at home now as well.

We don’t dress up for award shows and fancy parties anymore, but honestly that’s a huge relief.

We only have one car (a minivan!) because we no longer have a life-sucking commute!

We get out during the middle of the week for a round of golf, or to the beach when there are fewer crowds and even out for sailboat rides!

We walk four blocks to the ocean, three blocks to the park, or two blocks to get ice cream.

We actually know our neighbors and would consider them our friends!

We have time to volunteer at our son’s school and get to know his classmates’ parents!

We are officially living the small coastal town dream…and it turns out…we really like it!

Another great example of how different our life is now…

This summer (because I’m no longer tied to an office) we hit the road for six weeks and explored America…

We hiked to waterfalls, picked blueberries, climbed trees and even stayed in an Airbnb in Cincinnati that was so terrible we left early because we were getting eaten by spiders while we slept.

None of this would have been possible with the financial demands and hectic work schedules in LA!

What Has This Journey Taught Us?

In so many ways, we lost our family’s safety net. BUT, when you let go of everything and everyone you’ve been gathering around you for years to create your life, you’ll find that you DO eventually settle in. When you do, you begin to feel a weight lifted off your shoulders.

One of my favorite stories to tell is how back in LA, I didn’t have as much time to spend with my son. When I did get to be with him sometimes he wouldn’t want to be with me and he’d say, “I DON’T WANT TO DO THAT WITH DADDY. DADDY IS TOO WACKY.” (Kids say the darndest things. He would actually say it in all caps too.)

We didn’t really know what he meant by that, but we were pretty sure it wasn’t a good thing. Well, after our move to Florida, one day he looked at us and out of the blue said, “DADDY ISN’T WACKY ANYMORE!” We were like WTF…WOW!?! It brought tears to my eyes.

I think what he was saying was that I actually spent quality time with him now, and he was able to form a real relationship with me. Before, I was so scattered, and always thinking about work. Now I’m actually being present with my son, and we have a legit relationship. Go figure!

Another important thing we learned was that we could move away and survive! It’s quite the character building experience. We made new friends (although we still miss our old ones), and have amazing adventures.

When we first left LA, we weren’t confident about our decision, and had a lot of fear that we would just want to go back to the way things were. But now that we’re happy and doing well, we’re even more confident that we could try something crazier, like moving to a foreign country.

But we’re staying put for now!!! Plus Europe won’t let us in at the moment anyway!

Thinking About Doing Something Similar? Have Any Questions?

I hope I made you feel (kind of) excited about the idea of taking the plunge to move from the big city to a small town to save money. If you are thinking of doing something similar and want to talk about it, feel free to contact me!

Until Then…

Joe

Via Finance http://www.rssmix.com/

No comments:

Post a Comment