Coast Financial Independence: Building Wealth, Even If You’re Not Saving Any Money

The concept of “coast financial independence” can be tricky to understand. Here are some fun comments and questions I’ve received recently…

“So, let me get this straight… if you are spending the exact same amount that you’re earning each year, it sounds like you’re living paycheck to paycheck! How do you grow wealth when you’re not putting anything into your retirement accounts?”

“What happens if you accidentally lose your job or don’t earn enough each year. You’ll need to withdraw from your retirement accounts and you’ll be going backwards!”

“Don’t you want to retire early and stop working?”

“When the stock market bubble pops, your plans will be screwed.”

“I’d love to quit my job and slow down, I just don’t have the cajones to do it haha.”

I’m gonna talk about each of these from my perspective, but I’d also love to hear thoughts and feedback from you other Coast FI or Slow FI peeps out there!

An Important Baseline Is Needed for Coast Financial Independence

First and foremost, Coast FI isn’t the right strategy for everyone. Nor is it even an available option for some people. Intentionally slowing down your path to financial independence or stopping your retirement contributions requires three important things:

- Time: The younger you are, the more flexibility you have in your path to financial independence. Because Coast FI depends on compound interest, a longer time horizon is necessary.

- Existing assets: There has to be at least some amount of money or wealth already sitting in a retirement account that will grow over time. If you’re gonna leave your campfire unattended, you better first stack some large logs on that sucker before walking away!

- You still gotta work!: Coast FIRE lets you reap the benefits of financial freedom early, but it’s important to remember that without actually hitting your full FI number, you can’t stop work completely. Sabbaticals and breaks are OK, but “work” is still a big part of the strategy.

Everyone’s blend of these three necessities is different. If you have more of one, you can afford to have less of the others. It’s flexible. This is what makes Coast FIRE such a unique and personal life plan.

Having a 0% Savings Rate: How Does That Even Work?

I’ll admit, it’s a little scary earning only as much as I spend each year. Living paycheck to paycheck is something I’ve avoided my entire life!

But what allows me to sleep at night is my confidence in compound interest. Sounds nerdy, and it definitely is! It’s also a little risky, which I’ll talk about, too. Simply put, the reason I don’t have to keep contributing to my retirement accounts each year is because the growth of my existing assets does it for me.

Let’s take a look at a Coast FI scenario using this FIRE Calculator from the awesome dudes over at Playing With FIRE.  For this scenario, I’ve used the following inputs:

For this scenario, I’ve used the following inputs:

- Age: 35

- Annual expense: $40k per year

- Annual Income: $40k per year (0% savings rate)

- Number needed to hit FI: $1 million

- Current net worth: $500k

Based on a 7% assumed growth rate, someone who is about halfway to their financial independence number can retire in 10 years without contributing anything new to their portfolio.

Some people would call this model conservative, and others would say it’s risky … let’s take a look at what happens when things don’t go quite according to plan.

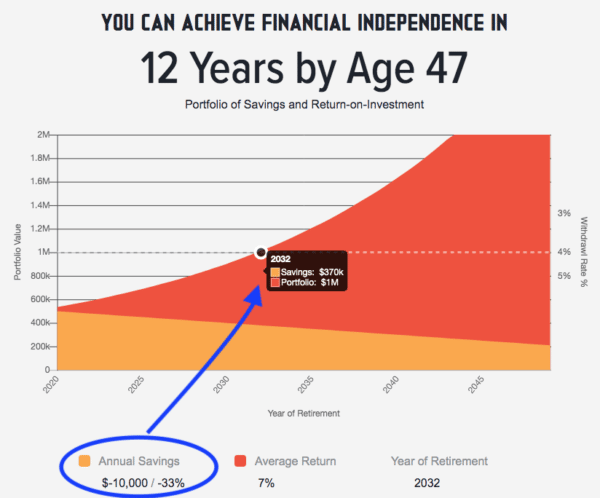

Scenario: What If We Make Less Than We Spend? (Negative Savings Rate)

Let’s now assume that we have trouble keeping steady employment and only earn $30,000 per year instead of $40,000. Unfortunately, this would mean pulling out $10,000 per year from our retirement savings to cover annual expenses.

- Age: 35

- Annual expense: $40k per year

- Annual Income: $30k per year (-33% savings rate)

- Number needed to hit FI: $1 million

- Current net worth: $500k

Looks like even if our savings rate goes into the negative every single year, it only adds two more years to the FIRE timeline. Even though we’re withdrawing $10,000 from the portfolio each year, the compounding growth more than makes up for it.

Retiring at 47 instead of 45 is not a huge deal, is it?

Let’s now take a look at if/when the stock market shits the bed.

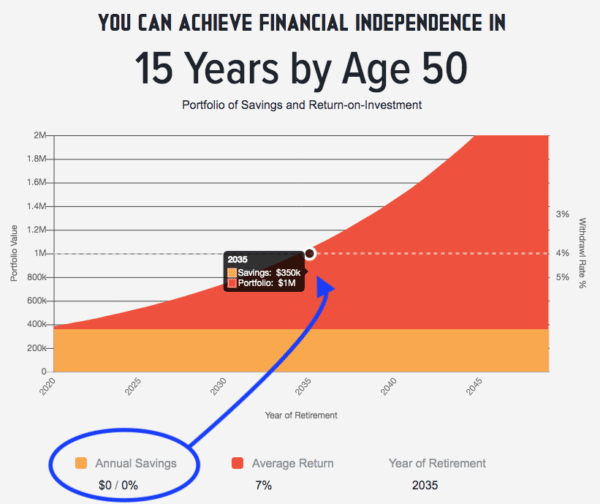

Scenario: What If the Stock Market Crashes 30% Right Now?

Let’s say the stock market crashed 30% next month, which brings the portfolio value down to $350,000. What does it mean for the growth timeline?

- Age: 35

- Annual expense: $40k per year

- Annual Income: $40k per year (0% savings rate)

- Number needed to hit FI: $1 million

- Current net worth: $350k (Down 30% from $500k)

If there was no immediate recovery after a crash, and we still assumed a 7% annual portfolio growth, the timeline now extends out to age 50 to achieve financial independence.

Now let’s look at one last scenario … with both the poop hitting the fan and a lower income vs annual spending.

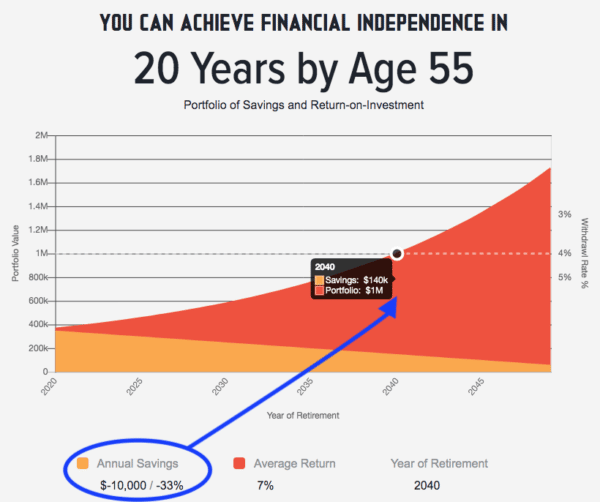

Scenario: What If the Market Crashes 30%, AND There’s a Negative Savings Rate?

- Age: 35

- Annual expense: $40k per year

- Annual Income: $30k per year (-33% savings rate)

- Number needed to hit FI: $1 million

- Current net worth: $350k (Down 30% from $500k)

Wow — looks like even with these factors, financial independence can still be achieved before traditional retirement age. You can see why a long time horizon is necessary when pursuing Coast FI. If your situation changes or things start to go wrong, time can correct things naturally, as long as you have enough runway.

Work, Work, and More Work Is Part of Coast FI

Three years ago, I would have probably looked at the charts above and thought, “There’s no way I want to work for another 10 years, let alone 20!” Many people feel the same when they first discover the FIRE movement. “Retirement” is the ultimate goal for those who don’t want to depend on work.

But my view toward work and early retirement has changed over time (and is still changing). I envision work being a big part of my future, no matter how old or how much money I have. If I’m going to be working anyway, I might as well discover or create positions that I really enjoy. This takes time to figure out, and possibly means starting from scratch in some industries. Coast FI gives me the flexibility to earn a low income for a while — maybe even many years — and still have a comfortable retirement nest egg later.

A fun thing to think about … In 20 years, I’ll probably be working on a project or doing a job that isn’t even invented yet. Just like ~20 years ago, blogging wasn’t even really a career. The unknown used to scare me, but now it kinda excites me.

The Opportunity Costs and Flexibility in Coast Financial Independence

There’s a bunch of opportunity costs that come with slowing down retirement savings and pursuing coast FIRE at a young age. I’m experiencing some of these costs right now, and let me tell you — it doesn’t feel great :(

First, I’m choosing to work part-time through some of my “higher potential income” work years in life. This isn’t a huge deal, because I’m still confident in the math that I don’t need a massive income to achieve early retirement. But, it hurts thinking about lost opportunity, regardless.

Another opportunity cost is not being able to take full advantage of buying more stocks during market dips. Earlier this year when the stock market tanked, my friends were all socking away excess income into their 401(k)s, Roth IRAs and other investments. I didn’t get that opportunity because I had no excess earnings. We’ll inevitably have crashes and dips in the future that I can’t take advantage of, either.

That said, Coast FI is flexible. If we wanted to get back onto a more traditional FIRE path, that’s always an option. I envision some big income years for me and my wife and some zero income years in our future. Time will tell how it all plays out!

Coast FI Takes Confidence!

One of the last comments I heard was “I’d love to quit my job and slow down, I just don’t have the cajones to do it haha.” After digging deeper, I found out this person is actually already past their FI number. They could stop working anytime, and have enough money to live the rest of their life. All the math and FIRE spreadsheets in the world couldn’t convince this person to quit their job, and that’s totally OK!

Everyone has different levels of comfort and confidence. At the end of the day, we need to follow the FI journey that makes most sense for us individually. Whatever keeps you stress-free and sleeping well at night!

Any fellow Coast FI peeps out there with 0% or negative savings rate? Am I the only idiot trying this?

Via Finance http://www.rssmix.com/

No comments:

Post a Comment