The post Net Worth Report #5 – “Man Alive!” appeared first on Budgets Are Sexy.

“Most millionaires measure their success by their net worth, not by their realized income. For the purposes of wealth building, income doesn’t matter that much. Once you’re in a high-income bracket, say $100,000 or $ 200,000 or more, it matters less how much more you make than what you do with what you already have.”

This snip is from one of my all time fav books, The Millionaire Next Door.

For those of you who are not tracking your net worth on a regular basis, I encourage you to START TODAY. Growing wealth isn’t about how much you make, it’s about how much money you keep.

Tracking ensures you’re moving in the right direction! Please let me know if I can help you in any way.

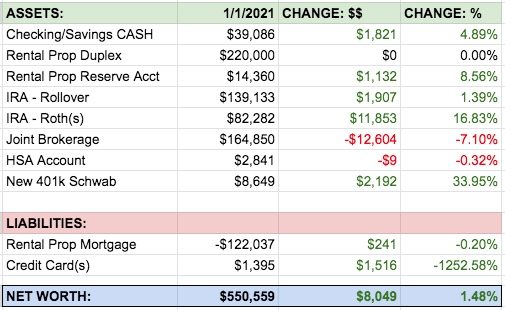

Feb 1, 2021, Net Worth: $550,559 (+$8,049)

Woot woot! Another month in the positive :)

Account summary below, as well as growth shown in dollars and percentages for each asset we’re tracking:

Here’s what went down in January…

Investment changes: We pulled $12k from our brokerage account and funded our Roth IRAs for 2021. Not really a *new* investment, more of a money shuffle for tax efficiency. Other than that, the only new money invested was ~$2k into my work 401(k) plan.

Travel refund: Over a year ago we pre-paid for an all-inclusive trip to Mexico for a friend’s wedding, but never got to travel due to covid… So the travel company finally just decided to give everyone their money back. Our credit card was refunded ~$2,500 which is why we didn’t have to pay it this month and we carry a positive balance!

Abnormal expenses: None. I guess this is a good thing?  Boring months are sometimes the best months! It’s kind of nice taking a break from spending after the holiday season.

Boring months are sometimes the best months! It’s kind of nice taking a break from spending after the holiday season.

Small money wins and fun stories!

I love celebrating the small stuff. It all adds up. :)

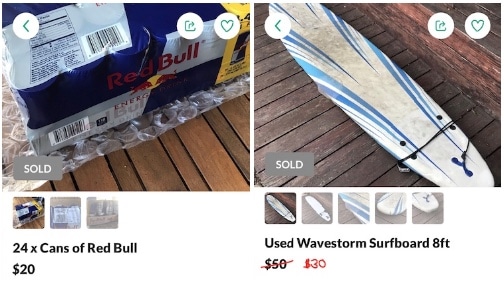

Last month, 6 boxes of Redbull accidentally got delivered to my neighbor’s house. It turns out a guy down the street from us is sponsored by Redbull, and they were sending him a care package but got his address wrong.

Anyway, after tracking the guy down and giving his Redbull to him, he gave us 3 x cases to say thanks. (We tried to refuse — we don’t drink energy drinks — but he insisted). My wife and I ended up with 1 of the cases, so I sold it for $20.

Also, I found a beaten up surfboard for free on Craigslist. I like having spare boards laying around for my beginner friends, but this was a little too broken, so I posted it online and sold it for $30!

One of my fun goals for 2021 was to make $1,000 from turning trash –> treasure. So I’m +$50 towards that goal so far! Maybe I’ll strike some luck and find some resellable stuff at Priscilla Presley’s estate sale next weekend!

Detailed Asset Breakdown:

CASH Accounts: $39,086 (+$1,821): Although we received our stimulus checks on Dec 31, ($1,200) I somehow didn’t include them in last month’s NW report. This as well as not having to pay a credit card bill this month means we have a higher cash balance heading into February!

Rental Property + Reserve Account: $234,360 (+$1,132): We had an absolute perfect month for rent collection and zero expenses outside property management. A great way to start the year! I  this duplex.

this duplex.

IRA – Rollover: $139,133 (+$1,907): Back in December, I did some rebalancing and shuffled my index fund allocation a little bit. This IRA now has about $40k of FISVX (Small Cap Value Fund) and the rest is still total stock market index.

IRA – Roths: $82,282 (+11,853): We funded these Roths on January 4, moving money from our after-tax brokerage account. The reason I like funding Roth accounts as early as possible in the year is to take advantage of the tax free gains as soon as possible. All in all it looks like the funds actually lost money, because we moved $12k in and only have an ~$11k increase.

Joint Brokerage Account: $164,850 (-$12,604): Apart from the $12k we moved to the Roths, this brokerage account was also shuffled a tiny bit… In December, we reallocated $25k to VXUS (Total international index, minus US stocks) to give us some international exposure. Also we allocated $35k to BND (total bond market).

HSA: $2,841 (-$9): A tiny decrease as this account is invested in the total stock market index.

New 401(k) at work: $8,649 (+$2,192): Slow and steady wins the race. Although I probably can’t max this sucker out in 2021, I’m trying to frontload as much as I can into this 401(k) at the beginning of the year.

Breakdown of Liabilities

Rental Property Mortgage: -$122,037 (+$241): I’ve always considered this mortgage “good debt,” but for the first time in my life I thought about pre-paying this down a little bit. With the *hopeful* sale of some of my other rentals this year, I need to figure out a good place to put the cash proceeds. Paying down this mortgage is one of those options.

Credit Card Balances: +$1395 (+$1,516): Most people owe money to the credit card companies. This month, the credit card company owes ME money! This positive balance is due to the refund we got from our pre-paid vacation. :)

Overall, not a bad start to 2021! Considering the total stock market was pretty flat, or maybe negative a tiny bit, somehow we walked away with an $8k net worth increase.

Questions? Comments? How were your updates the past month? Any of you nerds part of this r/wallstreetbets group and wanna brag about the mcmillions you made?

Have a great weekend, my friends!

– Joel

The post Net Worth Report #5 – “Man Alive!” appeared first on Budgets Are Sexy.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment