The post How Big Should an Emergency Fund for a Rental Property Be? appeared first on Budgets Are Sexy.

I got the following note from a reader the other day…

“Joel, I noticed you keep a big emergency fund for your rental property. 2 questions for you…

1) It seems like you have too much cash because shouldn’t you only need 3-6 months of mortgage payments as a cash reserve?

2) Also why do you keep this emergency fund separate from your personal emergency fund?”

Great questions! It’s been a while since I calculated how much to keep in rental reserves, and admittedly I do probably have too much right now! So in this post I’m gonna run some math and figure out just how much I should really be stockpiling for emergencies.

Right now I’m sitting on $14,360 in my duplex emergency savings account. If it turns out I’m holding too much cash, then we have the fun problem of figuring out where to put the excess!

How Much Emergency Fund Do I need for a Rental Property?

A general rule of thumb is about 3-6 months of expenses. While some investors only account for “PITI,” which stands for Principal + Interest, Tax and Insurance, I like to add a few other expenses in there to be on the conservative side.

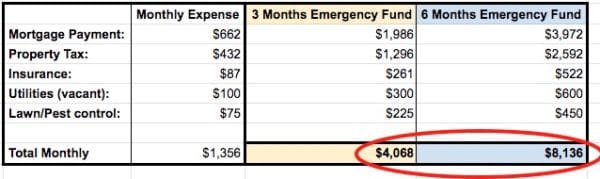

Here are the PITI expenses for my rental property in Texas:

- Mortgage payment: $662 per month. This covers principal and interest only.

- Property tax: $432 per month. This is based on my 2020 tax year bill of $5,185. It increases slightly each year.

- Property insurance: $87 per month, based on my 2021 policy of $1,042 for the year.

Total “PITI” expenses = $1,181 per month.

There are 2 other expenses I like to add, and I’ll explain why:

- Utilities when vacant: ~$100 per month. When a rental property is vacant, the utility companies charge the property owner instead of a tenant. Even though there’s nobody living in the unit, workers need power for tools to fix stuff, and in Texas we need to keep the air conditioner on to make sure no moisture builds up in the house during hot and muggy days.

- Lawn maintenance & pest control: ~$75 per month. These expenses are necessary for all housing, whether I’m receiving rental income or not.

Total monthly expenses: $1,356!

All in all, based on the 3-6 months of expenses rule, I should keep somewhere between $4,000 and $8,000 in emergency savings.

Will this be enough to get me through an emergency? Let’s go through some potential disasters and look at the potential costs in an emergency scenario.

Disasters That an Emergency Fund Should Cover

The point of having an emergency fund is to cover unexpected expenses when shizzle hits the fan. Here’s what my emergency fund is mostly protecting me against…

Once-off disasters with large, upfront costs:

- Wind, Hail & Fire Disasters are covered under my insurance policy. My deductible is $2,310.

- Large appliance disasters like an A/C blow-up ($5k), water heater replacement ($1-2k), fridge/stove/kitchen appliance breaking ($1k).

- A new roof would cost me about $6k.

- Trashed units happen sometimes when a tenant moves out. If there’s property damage, it could be covered by my insurance policy, or if I need a small renovation I wouldn’t expect more than $5k of fixes needed.

This tree came down during a big storm a few years ago. Luckily, it fell the way it did. If it fell the opposite way, it would have hit my building, caused major damage, and displaced 2 tenants!

Longer term disasters are scarier, because they bleed you dry over months/years:

- Vacancies: With no rental income, I’d be missing out on $1,950 per month (my hard expenses are less — $1,356 per month like we calculated above). The beauty of having a duplex, though, is that it’s kinda rare to have both units vacant simultaneously. With only one renter in place, my loss is only half.

- Squatters or rent not being paid: Again, this would cost me loss of rent ($1,950 for both units per month). Thankfully, Texas has pretty decent laws that side mostly with landlords when it comes to eviction. The most I’ve ever had a squatter stay for without rent payment was ~90 days (under the first eviction moratorium in 2020).

So it looks like a 3 month cash reserve of $4,000 isn’t quite enough to cover some of the larger potential disasters. Personally, the minimum emergency fund I would like to keep is 6 months of expenses, so $8,136.

How to Build Up an Emergency Fund for a Rental Property

Before we go back to my personal scenario, you might be wondering if you have enough cash reserves for your rental property (or a new rental you’re planning to buy soon).

It never hurts to run through the exercises I just did above to evaluate your rental risks and potential disaster costs. Even if your bank tells you that “a few months of mortgage payments is enough to keep in reserves,” you should save more if you think you’ll need it.

I always recommend people build and store a separate emergency fund for rental property in addition to their personal emergency fund. This way, your family and your assets can both survive separate disasters simultaneously. One is not dependent on the other for survival.

2020 was a great example of multiple disasters happening at the same time. As a landlord, I had a separate emergency fund for each rental property I own, as well as a personal emergency fund for me and my wife. It’s certainly a lot of cash to be holding, but boy were we resting well at night knowing we had plenty of runway should we be unemployed *while* have failing real estate at the same time.

Looks Like My Rental Savings Account Is Too Big :)

Well, we’ve determined that a safe 6-month emergency fund for my rental property would be around $8,136. I currently have $14,360 in cash reserves, so definitely more than necessary!

I like round numbers, so maybe I should drop this cash reserve account to an even $10k, and invest the excess $4,360 elsewhere. I could drop it into the stock market, pay down the mortgage a little, or see if there are any strategic upgrades to make to the property that could attract higher rental income?

I’d love to hear how other real estate investors store their emergency fund for rental property and any good practices we can all share!

Make it a great day,

– Joel

The post How Big Should an Emergency Fund for a Rental Property Be? appeared first on Budgets Are Sexy.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment