Net Worth Report #2 – “One Little Duck”

Before getting to the net worth update, 2 quick things to share… The first is a comment I received last month from a reader, Max S.:

“Good Morning Joel.. I finally did my first net worth report. After all that time hearing JMoney telling us readers to track our net worth I just never got around to it. Seeing your first net worth report motivated me to do my first report. Thanks for the push.

Can you tell JMoney I finally got started tracking my net worth so he can stop all that nagging about it now. jk :)”

Although J Money may have transformed the financial lives of millions of people out there, it’s nice to know that I at least motivated 1 person he didn’t reach! Haha. Jokes aside, the reason I’m sharing Max’s note is because maybe it’ll encourage any other net worth virgins out there to track for the very first time.

. It truly only takes a few minutes to do and it’s one of the best tools along your journey to FI!

. It truly only takes a few minutes to do and it’s one of the best tools along your journey to FI!

The other thing worth mentioning is getting an “accountabilibuddy.” If you are finding it hard to stay on track each month, I recommend finding a buddy or a partner you know and trust to help! You don’t have to share every specific detail, it’s more to make sure each other is doing their FIRE homework regularly!

Net Worth Update November 1, 2020:

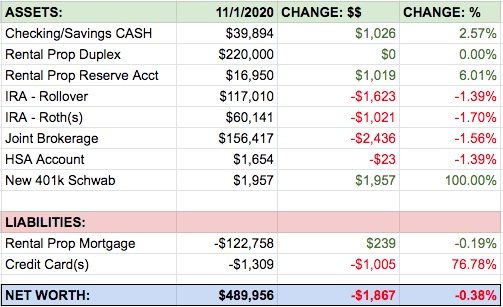

Here’s the account summary for me and my wife, as well as growth shown in dollars and percentages for each asset:

Well, shit.

Our net worth went down a few grand. Not the greatest start to tracking this stuff publicly, but we have to show both the goods and the bads in the wealth building process!

Here’s What Happened in October…

First off, there was a crap ton of volatility. The stock market does weird stuff leading up to a presidential election (and will continue to do weird stuff afterwards!) – more on that below.

For the first ~23 days of October we had some pretty killer growth. In fact, all our assets listed above topped the $500k mark for a little while! Woohoo! But then, things started to tank pretty quickly. The worst day was October 28th where our beloved VTI fund dropped a full 3.31%. :(

As the saying goes, “the market giveth, and the market taketh away.”

This doesn’t bother me all too much, though. The larger an investment portfolio, the less overall control we have on performance.

Asset Growth (and Shrinkage):

Checking & Savings Accounts: $39,894 (+$1,026): A little increase here, but we have about $1k in new debt added to our credit cards that is due in November. Our goal with this cash balance is to reduce it slowly over time and siphon some pre-tax income into my new 401k plan. This balance acts as our emergency fund, and includes the random churning bank accounts we currently have open.

Rental Property, and Reserve Account: $236,950 (+$1,019): This past month we collected $1975 in total rent, and had -$956 in expenses ($294 prop mgmt & maintenance + $662 mortgage pmt). Keep in mind taxes/insurance are *not* included in my mtg payment, I pay them annually in a lump sum. So although it seems like this rental might make $1000 in cash flow each month, it takes a massive drop when my ridiculous taxes are due in January. This year the tax bill is $5,185, even after my appeal.

IRA – Rollover: $117,010 (-$1,623): Kind of sucks when things are in the red, but that’s just the way it is sometimes. Back in July I pegged this IRA against the rental property to track which one will grow at a faster rate (they were both worth $109k at the time). This account is still ahead by about $3k, but if it has another negative month like this the rental asset will catch up and be worth more! :)

IRA – Roths: $60,141 (-$1,021): Same story as above… account value dropping a bit with the overall stock market. Since these are both long term retirement accounts, I’m just trusting that over the long haul we will have more green months than red months!

Joint Brokerage Account: $156,417 (-$2,436): The reason this account is moving at a slightly different rate than the IRAs is because a) we have some bonds in here which grow at a slower but more steady rate, and also a few individual stocks. However the majority is all in broad, low cost index funds. VTI mostly!

HSA: $1,654 (-$23): My plan *was* to increase this account immediately with $3,550 (the max contribution for 2020), but, I just learned that my employer will likely be changing my benefits, again! (and not in a good way  ). Since I’m only enrolled in a HDHP for 3 months this year (Oct-Dec 2020), a max contribution would require me to stay in a HDHP for the entirety of next year also. To play it safe I may just prorate my contribution for 2020, and there’s still a few months to figure this out before year end. If prorated, I think I can put in $887 safely ($3,550 / 12 x 3), right?

). Since I’m only enrolled in a HDHP for 3 months this year (Oct-Dec 2020), a max contribution would require me to stay in a HDHP for the entirety of next year also. To play it safe I may just prorate my contribution for 2020, and there’s still a few months to figure this out before year end. If prorated, I think I can put in $887 safely ($3,550 / 12 x 3), right?

New 401(k) at work: $1,957 (+$1,957): Woohoo, this is the first month adding to my new 401k plan! But, there are 2 sucky things to mention: 1) My contributions to this account in October were actually $2,044, so I lost about $87 having this money invested. Not horrible though, because I saved more than that probably on income tax. And 2) I mentioned above that my company benefits will likely change, or be taken away – and this 401k plan is part of what will be killed. Oh well, anything contributed here can always be rolled over to an IRA, converted to Roth, or put into another plan down the line if one is offered to me.

Breakdown of Liabilities:

Rental Property Mortgage: -$122,758 (+$239): There’s nothing sweeter than watching tenants pay down your property loan each month. It’s a very slow process — 30 years to be exact! — but the speed doesn’t matter… Progress is progress!

Credit Card Balances: -$1,309 (-$1,005): We have all of our credit cards set to auto-pay the full balance on the due date. This means we typically have a rolling credit debt of a couple thousand dollars at any given time.

My wife and I have no other consumer debt at this time!

Other Happenings This Past Month:

My wife got a new exercise bike! She says it’s her early Christmas present, but I feel like by the time Christmas rolls around she’ll “forget” she said that and will want another present then also. (Totally fine with me, because I plan to pull the same trick!). She picked up this bad boy off Craigslist for $200 – it was only used once by someone who bought it last month and is moving to a smaller apartment.

Another money win… We switched to AT&T Fiber internet! Not only do we get 960Mbps download speed for $20 less per month than our old Spectrum service, they also gave us a $200 Visa Gift Card signup bonus for switching! That’s a $440 difference this next 12 months. Woohoo!

Another little unexpected bonus… We got a $72 check from Apple as part of a class action settlement for some power button issue on the iphone 4 about 9 years ago. Were any of you guys a part of this claim and did you get the payout check too??

Future Volatility & Unknowns

I’ve seen a bunch of news articles lately about how the stock market behaves strangely before, during, and after presidential elections. Experts have their opinions, predictions, forecasts, prophecies, prognostics, indices, and some people even use the Big Mac Index to guess future stock market growth!

Although rollercoaster markets concern me, they don’t worry me. They don’t change my overall gameplan. Emotions aside, my wife and I will keep our money invested through thick and thin.

We are in it for the long haul – and I hope you guys are too!

How were your updates the past month? Share your milestones and juicy details in the comments — which as a reminder is a judgement free zone!

Have a great weekend! (And for you hopeless romantics out there – Today is exactly 100 days until Valentine’s Day!)

– Joel

Via Finance http://www.rssmix.com/

No comments:

Post a Comment