How I Appealed My Ridiculous Property Taxes

Last week I got my property tax bill. $5,185. Booooooo.

Many counties across Texas decided that 2020 was a good time to increase everyone’s assessed property value, raising bills by a whopping 10 – 20% for the tax year. It’s a kick in the groin… Because not only are many people under a financial squeeze this year, Texas was already ranked #3 for states with the highest property taxes!

For me, the tax rate is worse than most. While the average county in Texas charges 1.81% of a property’s value, the lovely little county where my rental duplex sits has a tax rate of 2.357%. Ouch! Tax is by far my biggest annual expense. Actually, it’s bigger than ALL other house maintenance, insurance, prop management fees and repairs combined. :(

What can I do? Property taxes are mostly unavoidable, right?

After I got that bummer assessment notice, this year I tried filing my first tax appeal. I was kind of successful, reducing my bill about $200. But I recently learned some other things that might have gotten me a better deal. Stuff I’ll maybe try next year.

Yes, You Can Protest and Appeal Your Property Taxes

Apparently, only 1 property owner out of 10 protests his property tax bills in Texas each year. The other 9 just accept whatever is given to them, or pay without even looking. Most years I’m fine with just paying, but this year the increased property tax assessment was too big to ignore.

Appealing was also free, all done online, and took less than 20 minutes.

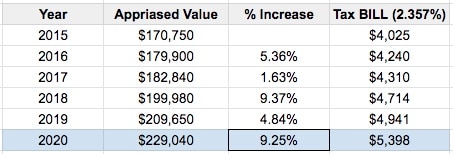

My 2020 Appraised Value Notice came by mail in late April. It said my duplex’s current assessed valuation was now $229,040 compared with 209,650 last year. An increase of $19,390, or 9.25%! The value has been increasing every year since I bought the place in 2015. Here’s the tax values and history of increases…

Since I got the first notice in April, mid global pandemic, home sales had stopped, and the stock market was down 30% at the time, I thought there is no way a $229k valuation was fair.

Here’s How I Appealed My Property Taxes (Warning: Amateur Hour)

The notice listed a county website for property tax appeals, so I created a login and filed a formal appeal online.

There were only 2 fields to fill in for the online appeal form… A number field where I could input what I thought the property value should be, and an explanation box to provide evidence or background information on why I was seeking a revaluation.

Since this was my first time and I didn’t know what I was doing, I just entered $200,000 as an approximate value, and then wrote a long angry rant in the explanation box. In hindsight, this was a poor choice because I’ve since learned a few other tricks that could have possibly made my assessment appeal better (which I’ll get into below).

Anyway, 4 days later I got a response that said a manual re-assessment had been completed, and the appeals board dropped the value to $220,047. Not a huge reduction, but lower by $8,993.

This reduction saved me $212 on my bill. Woohoo! Not bad for 20 minutes of work (which really isn’t much effort for any kind of appeal process)!

Ways I Could Have Make a Better Case to Appeal My Property Taxes

After I accepted the reduction in my duplex’s assessed value, I realized there might have been a better way to petition for a lower property assessment. I started googling and seeing how other taxpayers have protested their property taxes. Here’s some tips I found:

Check property records, tax cards, and house dimensions filed with the city. One of the ways county assessors come up with your valuation is based on a taxpayer’s home size, room dimensions, amount of fixtures, and other “features” listed. Mistakes in county records are more common than you might think, especially for older homes. If I found a discrepancy, a feature issue, or something that made my home less desirable, it could lower my taxable value.

Expose known property faults. If I could prove that my property is run down, needed major repairs, or had structural issues, I could include this in the appeal for a lower valuation. Since the ground in Texas moves very slowly over time, almost every house older than 10 years has “evidence of foundation movement” or “irregular soil levels.” Although these aren’t dangerous, I could take a bunch of bad photos and try to sell these property issues as worse than they really are.

This is a photo of “irregular soil level” that the inspector spotted when I bought the property in 2015. Sounds silly, but any evidence I can produce that the property is worse than the neighbors’ will get me a lower valuation.

Another common (but not critical) issue that could be pointed out is roof wear and tear. Proving that the property roof is getting old and showing unappealing photos could lower the assessment value.

Research the neighbors, and be more exact with numbers: Instead of me submitting my request for a $200k round number with no real justification, I should have researched the area and provided my own property comparisons. Using Zillow, Realtor.com, or other home value sites I could have found nearby houses that gave me a lower average fair market value. The county assessor uses this same “comp” method to do their evaluations, but I have to assume they use the higher available comps. I would try to use the lowest.

Be nicer with my request: Instead of ranting and complaining in my property tax appeal, I think it’s a better strategy to leave emotion out of negotiations and just stick to facts. And I’m sure the assessment appeals board appreciates this strategy!

There’s no perfect way to submit an appeal or guarantee that any of this will work. But it’s worth a try I think!? Before any of you property owners out there submit an appeal I urge you to check out your local laws and rights for appealing taxes!

We’ll See What Happens With My Property Value and Taxes Next Year…

While I love owning a property that rises in value, if I can’t increase the rents to match the rising tax bills, the investment slowly gets less and less profitable for me.

Not sure what the rest of 2020 or 2021 will mean for property values, we’ll just have to wait and see!

TLDR; & Summary About Appealing Your Property Taxes

- Appealing my property taxes online took about 20 mins, and saved me $212. It was my first time.

- In hindsight, I could have submitted a stronger appeal by projecting my house as less desirable or more run down.

- Apparently only 1 in 10 people protest their property taxes, at least in Texas. Since it’s free and easy in most counties, why don’t more people do it?

- I just realized I am an idiot… I live in a state with the highest income tax (CA), and own properties in a state with the highest property tax (TX). I should be doing the opposite!

No comments:

Post a Comment