How The Pursuit of FIRE Got Me a Girlfriend

[Morning! Have a fun – and super adorable – story for you today by Erik of The Mastermind Within blog. The next time someone tells you you’re not going to find love being a financial nerd, you can just send them right to this post! ;) Happy Friday!]

********

Risk is a funny concept.

Many people talk about risk like it’s something tangible and concrete.

Heck, there are entire divisions in big corporations dedicated to identifying operational, credit, and reputational risks in order to estimate the dollar amount associated with these risks.

Some people are risk-adverse, and others are risk-seeking.

In the financial independence community, we hate risk and love stability.

“Invest in index funds!”

“Stay away from Bitcoin!”

“Bonds are your friend in retirement!”

Well, I’m here to tell a different story.

This story is about opportunity, risk, the pursuit of financial independence, and why I went on a second date in Vegas.

Pursuing Financial Independence

In 2013, I came across the world of financial independence.

Reading about how everyday people could become wealthy in a short amount of time and do what they wanted with their time sounded amazing.

I dove into learning about real estate investing, the stock market, getting out of debt and the impact of fees and taxes on your wealth over time.

All of this was theory at this point in my life as I was still in college.

2 years later, I was finishing up my Master’s degree and ready to start building wealth.

While I had a negative net worth in 2015, I was making $63,000 at age 22 and had all the tools and strategies to eliminate my student loan, make smart choices about my investments, and to start creating wealth for the future.

Dating and the Pursuit of Financial Independence

I’ll be blunt: dating is difficult when pursuing financial independence as a single person.

In 2015, the girl I was dating didn’t understand why I wanted to buy a house and have my 3 friends pay down my mortgage. She didn’t realize why it was so important for me to still live like a college student so I could crush my student debt.

Unfortunately, we didn’t work out.

Over the next few years, I went on a number of dates, dated a few women, but when money came up, we were always on a different page.

A pile of debts? I don’t know about that.

Shopping sprees and going out to eat 5 times a week? That probably won’t work.

Endless make-up and pedicures!?!? Ugh.

While it was tough, I stayed positive. No reason to stress! I was on the path to financial freedom!

The Real Reason You Need an Emergency Fund

Let’s fast forward to the summer of 2017.

In the past 3 years, I’d accomplished quite a bit on the financial front: I’d paid off my student loan, paid off my auto loan, bought a house at 22 and grown my net worth to over $100,000 through house hacking, and now was sitting with a fat bank account.

Last June, I hosted a BBQ at my house for like-minded individuals. I invited some bloggers, entrepreneurs and other people with the goal of financial freedom.

I met my girlfriend there – and it’s all because of my pursuit of FIRE!

But that’s not the end of the story.

That next Friday, 5 days later, I was at work texting my new special friend. She was off to Vegas to meet some of her friends for the weekend and mid-flight had just found out that her friends were not going to be there after all.

“I wish I was coming up to Minnesota to hang out with you instead of going to Vegas alone!” I read on my phone.

I’m not one to mess around: I bought the second house I looked at, bought the first car I test drove, and when I see something I like, I go for it.

I replied, “I could come to Vegas for the weekend….? How much is housing? Tickets are $648, is that good?”

“Housing is free, I was going to stay in my friend’s condo, but they aren’t going to be there. All you’ll have to do it pay for the plane ticket.”

Opportunity, Risk, and Taking Chances

I take chances. I’ve failed many times in my life, but I’m also one of the more successful 25 year olds out there. With a net worth approaching $200,000, a great job paying nearly 6 figures, and multiple lucrative side hustles, I’m doing okay.

With all decisions in life, there is risk. There was risk when I bought my house. There was risk when I joined a multi-level marketing company in college for a month. And, there was risk when I was considering buying a plane ticket to Vegas to meet a financially driven young lady for the second time.

I looked at my bank account: $11,260.73.

All I would have to do is pay the tickets to get there? Free lodging in Vegas? A weekend with an awesome girl?

I bought the tickets. (Don’t tell my mother!)

16 hours later, I was off to Vegas for my girlfriend and I’s second date.

The Couple That Spreadsheets Together Stays Together

I have a confession to make. Actually, two confessions.

First, I’m so cheap that before this trip, I didn’t have a line item in my personal finance tracking spreadsheet for travel.

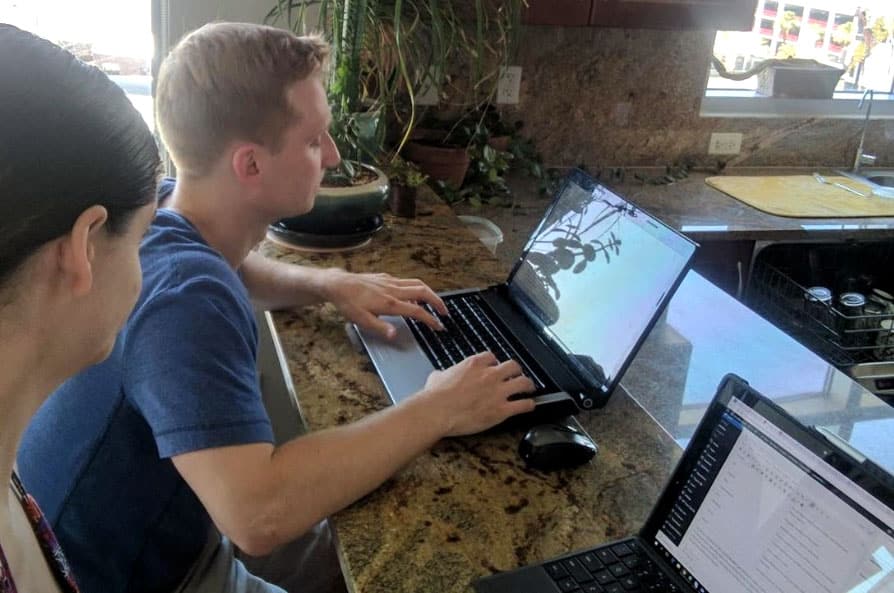

Second, since it was the beginning of July, and my girlfriend happens to be another personal finance blogger, we spent one afternoon of our 3 day second date updating our spreadsheets together :)

Other than that, it was a pretty low key Vegas vacation (as far as those go). As financially minded people, we kept our losses to $100 total throughout the few days we gambled, and even ate at home at the condo for a few meals!

I don’t think that second date will ever be topped… and it’s all because of my pursuit of financial freedom.

It All Starts With An Emergency Fund

What happens when the furnace or AC goes out in your house? What happens if your car breaks down, or you get sick? What happens if you need to go to Vegas last second??? There are so many unplanned emergencies to account for. Take it from me: it’s amazing the feeling of having some cash in the bank.

However, around 70% of Americans don’t have $1,000 in their bank account.

That has to change.

An emergency fund is so critical for financial success. Cash is king!

Here are 3 tips you can apply in your life to build your emergency fund and build a strong financial base.

#1. Look at your expenses and identify any areas of weakness you could work on

- Tracking your income and expenses is the first step to financial success. Even finding savings of $10 a day can add up over time. $10 a day is $3,650 a year. $3,650 a year for 30 years at 7% compounded is over $300,000!

- Get a budget! You are literally reading this article on the site, Budgets are $exy.

#2. Work on destroying your debt and eliminating this monthly burden

- Guess what – debt sucks. I’m sure you think this as well.

- It’s easier to save money if you don’t have a monthly debt payment

- Credit card debt is the worst. Paying 20% in interest every month is not something you want to do if wealth and stability is your goal. Destroy your debt!

#3. Invest in yourself and grow your income

- The best investment you can make is in yourself

- If you earn more, you will be able to save more. If you save more, the better chance you will have of being in a situation where if times get tough, you will be ready.

- Become more valuable for more responsibilities and higher pay

After building your emergency fund, you can use this as a launching pad on your way to saving money, building wealth, and reaching financial freedom!

I Met My Girlfriend Pursuing Financial Freedom, What Could You Do?

The path to FIRE isn’t as difficult as it may seem: live below your means, look to eliminate your debts over time, save some money each month, and BOOM, 5, 10, 20 years later, you are wealthy!

Here’s the thing:

I’m not any better than you.

I’m not any smarter than you.

I’m just an ordinary guy in Minnesota doing ordinary things. I wake up in the morning, get dressed, and head to my 9 to 5.

5 years ago, I decided I was going to be financially free and pursue FIRE. Along the way, I met an amazing girl, went on a second date in Vegas, and now am continuing to grow my wealth with the support of a loving partner.

I’m just an ordinary guy doing ordinary things. What could you do in your pursuit of FIRE? (And what are you willing to risk for it?)

*******

Erik runs The Mastermind Within, a blog and podcast geared towards helping you reach your full potential. Erik has way too many side hustles, loves talking about personal finance and self-improvement, and looks to inspire and help others grow and succeed in their career and life. He can also be found on Twitter at @MastermindWithi

EDITOR’S NOTE: This is not the first couple to come out of personal finance blogging :) A couple other bloggers (Romeo & Latisha) actually met at one of our conferences and then GOT MARRIED!! Maybe it’s time to start a blog if you’re having trouble finding “the one” too? Haha…

********

[For more $$$ nuggets, head over to Budgets Are Sexy!]

No comments:

Post a Comment