Three *New* Financial Apps & Services You Might Like (Plus Some You Might Not? ;))

Heyo!

Got a few new financial apps to pass by you this fine beautiful hump day (HUMP DAY!!!!).

Some of these I recently took on as new consulting clients because I love what they’re about, and others I have no relationship with but just think are dope.

Take a look and see if any of them might help you!

I’ll add some other companies we’ve featured in recent months as well in case you missed them… I don’t tend to do many FinTech roundups, but trying to be better about it as I know many of you like ’em :)

********

#1. HoneyMoney –> honeymoney.io

[ 30-day free trial, then either $5/mo or $50/year ]

This is one of my favorite “new” products on the market, mainly because of the guy’s story who built it and his passion for helping others out. It’s founded by a guy named Ildar who built it for *himself* back in Russia 7+ years ago, and it helped him and his wife to save so much that he opened it up to others to use in his home country (they’re now at a 70% savings rate!). He’s trying now to bring it to the U.S. and I think it’s a really cool way of looking at things.

In a nutshell, HoneyMoney uses a calendar based system to help you better manage your money, focusing on cash flow instead of “budgeting.” You track things manually for better awareness, and then it’ll help you know how much is safe to spend, how much needs to be reserved, and then ultimately how much you can go and save.

Here’s a link to the demo which will give you a good idea of it right away –> demo.honeymoney.io (And then you can find more info on their homepage as well: honeymoney.io)

#2. DebX –> debx.co // Free

Debx is another client of mine, and a new competitor to Debitize if you recall us mentioning them a couple of years ago?

It’s founded by the guy who started the Allpoint surcharge free ATM network back in the day, and Debx allows you to use your credit cards as if they were debit cards, thereby giving you the perks of credit but the peace of mind of debit.

You sign up and link your cards once, and then each day Debx will add up all your transactions and pay off your credit card(s) for you similar to how debit cards work. This not only keeps your c/c balances at $0.00 every day, but also helps improve your credit score since it helps you to maintain a low “utilization ratio” throughout the month.

And unlike Debitize (which is also great!) it’s completely free ;)

There’s also a bunch of rules and barriers you can set so it only pays off what you want it to pay off. More info on them can be found here –> debx.co

#3. Onist–> onist.com // Free

Now these guys I don’t have a relationship with, but I think they’re up to something really cool and I’m interested in watching how they do over time.

A mixture of Mint, Dropbox and Messenger all in one, Onist lets you sync your credit cards, bank, investment accounts, and even upload important financial documents like insurance policies, wills, executor letters, etc. – allowing all your $$$ stuff to be contained in one centralized spot.

But instead of focusing on individuals which most apps/services do, they are geared towards *family* management of finances. Which is great since many of us manage our entire household’s money! And they also give you the ability to share only parts of your account with others too which is a nice option, like if you want to share one or two things with your grown children or financial professionals, but not the entire shebang.

Really cool idea that I hope others jump into or add to their current services as well! You can learn more about them here –> Onist.com

Now here are two newer apps that may or may not be good, haha…

I’m not the targeted market, but maybe you are and you want to give them a shot and report back? ;)

RentTrack.com — RentTrack allows you to pay your rent online, but then to have it *reported* so it better helps you build up your credit over time. They charge 2.95% if you pay rent through credit cards, or $6.95/month if you go with eCheck. And say that landlords apparently love it because they know they’ll get their money on time saving them hassle, so they’re apt to even cover the monthly costs for you if you tell them about it? Not sure how much I believe that, haha, but again – haven’t tested anything out here personally so who knows…

WinWinSave.com — This one was forwarded to me by my friend Amanda Steinberg – founder of mega site DailyWorth.com (one that’s def. worth checking out!) – and comes from one of the co-founders of the popular $$$ app, Stash. With WinWinSave, the more you save the more chances of being entered into a grand prize drawing of $1,000 each week. With each $1.00 banked giving you an entry (plus a chance to win more by playing games in their app). It’s kinda like a reverse lotto system where instead of *paying* a dollar for a long shot of winning anything, you *save* a dollar for a long shot of winning anything, haha… So I guess it’s kind cool? There is a $2.00/mo cost though after the first month (which is free).

And then here’s a handful of other great apps we’ve covered in recent memory in case you missed them…

Pickpocket.me (FREE) — Similar to Qoins, Pickpocket will automatically help you save money every month, and then redirect that $$$ right to paying off your student loan debt for you. Allowing others to also pitch in and match (family/friends/grandparents) as well to help you kill them off faster. They’re currently in beta mode where you have to get on a waiting list, but if you sign up through that link up there it’ll put you to the top of it as it’s linked to my info here (and they promised me to let you have first dibs at it! :))

Blooom.com ($10/mo) — Another cool service we’ve featured recently is Blooom, who will not only analyze all your 401(k)s/403(b)s/etc, but also manage it all for you if you want them to which is a relatively new concept (and definitely not around 10 years ago when I could have used them before I wised up!!). You won’t like them if you enjoy hand-picking and researching your funds yourself, but for the majority of people who don’t know what they’re doing with it, it could be an enormous help :) And you can also have them just analyze things but not make any changes as well if you prefer, so just really depends how comfortable you are in that area… They do charge $10/mo for the service though.

OnTrajectory.com (FREE for basic, $5/mo for upgrade) — You might recall these guys from Gwen’s review of them earlier on our site, but her passage here from it sums it up nicely –> “I’m pretty sure this beautiful piece of software is a love child from Excel having a one-night stand with the cFIREsim calculator.” Haha… You can read the entire review here if you’d like, or click here to go directly to the site, but in a nut shell it’s a super powerful graphing tool that let’s you forecast your $$$ by entering a handful of data. And similar to HoneyMoney up top, it’s a small startup just trying to do their part in the financial world.

brightpeak financial (FREE) — Lastly, if you’re looking for a new savings account and particularly are just starting out, these guys could be a great option for you! A division of Thrivent Federal Credit Union, brightpeak (lowercase on purpose – hah), will reward you for saving money into their “emergency savings account” if you can hit certain milestones. Like basically putting in $50/mo for 2 years straight. Do that, and they will give you an extra $100 for pulling it off, while you set yourself up with a nice little emergency fund in the process!

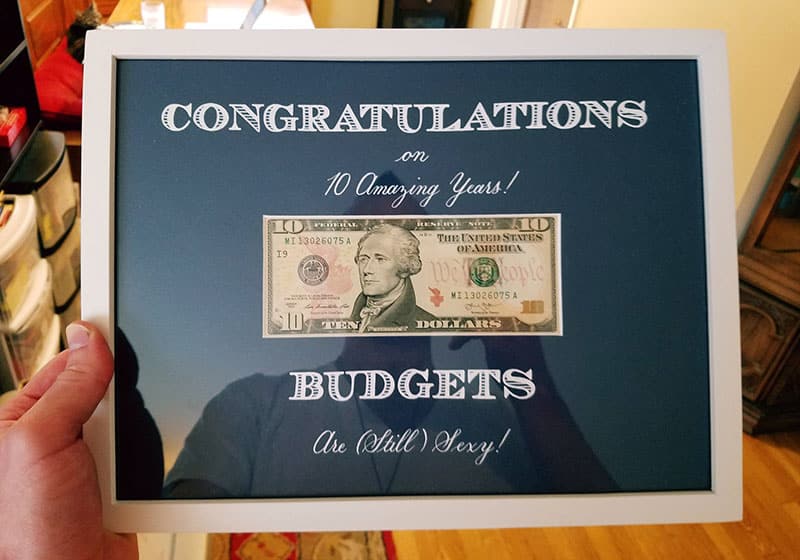

And I have to say, financial products aside, these guys are just super genuine and NICE. I recently got a package from them in the mail totally out of the blue, and when I opened it look what I saw:

How sweet is that??? One of the most thoughtful gifts I’ve ever received before, and from a company no less! Haha….

Anyways, there you have it – a bunch of new financial products on the scene :) You might not like all of them, but hopefully one or two of them at least catch your eye and are worth some investigation.

If you end up giving any a shot, come back and let us know how it goes! Especially if you really love – or hate – them, haha… You know we appreciate the realness up in here!

See ya in the comments… :)

*******

For more info on some of these, as well as other apps not featured, check out these past roundups:

- 4 Hot New Financial Apps & Services On The Scene

- 10 New Fintech Companies To Watch Out For!

- 12 New Financial Companies to Watch For!

FYI: Some of these companies above I have affiliate relationships with, some of them I have consulting relationships with, and others I have absolutely no relationships with – meaning I don’t get paid squat if you sign up and use or not. But outside of the “iffy” ones up there, I can back the awesomeness of those I’m connected with ;)

********

[For more $$$ nuggets, head over to Budgets Are Sexy!]

No comments:

Post a Comment