How a Journal Completely Changed My Finances

[Oh do I have a good story for you guys today!! I hope you like long-form posts, because my man Ryland from TheHiddenGreen.com stops by the blog today to pour his heart out to us… Amazing how much your life can change when you find something that *clicks*! And shockingly, it wasn’t a budget that did it for him ;) Take it away, Ryland!]

********

I was 23 and crying.

I had just graduated college after working my tail off.

I had received $100k in scholarships to pay for school, founded a nonprofit while there and won numerous awards for my work.

I thought I had done everything right.

But I missed one piece of the puzzle – my finances. And there I was, in my black 2007 Nissan Xterra, with tears in my eyes because of it.

This is where my financial life started, and I owe it all to a little journaling.

Here’s the story of how I went from broke to over $100,000 in my accounts and completely changing my life in the process.

Zilch Financial Knowledge and $7k of Debt

In 2007 I had just walked out of an accounting office.

I had been told I owed almost $7,000 in taxes – of which $7,000 I did not have, nor with any income to pay it back.

That $7k may sound small to some, but I can tell you it’s enough to make you drop your head in your hands and wonder how the hell you got there.

It’s enough to feel scared.

I’ve always been someone who worked hard and tried to do the right things, but I’ve also always been someone (maybe behind the scenes) who struggled with money.

Let me give you one example.

In college I was up to get an award for my work and needed a suit. So I went to Nordstrom and tried on the $200, the $500 and the $800 suits.

Which did I get?

The $1,271 suit.

I’ve never wanted a luxurious life, but somehow I’d do stuff like that all the time.

And at that moment it was hitting me…

I sat there with tears rolling down my cheeks trying to figure out how I could pay it off.

When I got home I pulled up a Google Sheet (this exact one here) and gave my first petty attempt at building a budget.

To say the least, I hate budgets.

(Sorry, J. Money. I guess I’m just into other things…)

After a few hours of thinking it through, I decided to sell my car, most of my surfboards, as well as my professional trumpet to pay it off.

That sucked.

But it forced me into an uncomfortable place and brought about self-motivation to create a better life for myself.

Stop Budgeting, Start Journaling

About a month later I got my first job.

It was one of those jobs at a company that makes your mom proud.

Here look. She even took this picture of me on “Ryland’s first day of work.”

Cute, right?

To be honest, I was excited about it too, but I knew from day one that it wasn’t going to be my end-all-be-all.

I wanted to have more time to work on the things I was passionate about. I wanted to take a few trips a year without breaking the bank. And I wanted to make enough money to live a fun, yet simple life.

I remember thinking, “Is that really too much to ask for?”

No way.

But the biggest thing holding me back at that time was my money situation.

I didn’t know how to make it work for me.

I tried budgeting and that (obviously) didn’t work. I tried putting cash in categorized envelopes, but that didn’t work either.

Everything I tried just wasn’t for me.

But what was for me was writing lists.

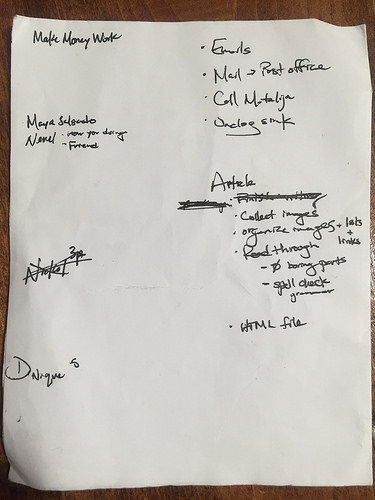

I wrote one almost every day. I still do. Here’s my list right now.

From doing that for years I had grown this belief that *what you write* becomes your life.

So back then, while stuck in my hard place, I decided to write a list.

I wrote out a few lines in my journal of what I wanted to accomplish just for that month.

Here’s exactly what it looked like:

Pretty basic, right?

A few weeks after, something interesting started to happen.

I noticed myself going back to look at the list every few days. In it I’d see the things that deep down I wanted to accomplish, and almost subconsciously my mind would refocus on how to bring them to fruition.

It was so helpful that at the end of that month I wanted to do it again.

But when my fingertips began writing the next list, my mind kept looking back at the old one.

I had unfinished business.

The old list was calling for an honest reflection, and so that’s what I did.

Yep, I failed on some items.

But that didn’t matter. The only thing that mattered was continuing to write – continuing to bring the life I wanted into reality.

So I wrote next month’s list and at the end of that month, I wrote about how I did.

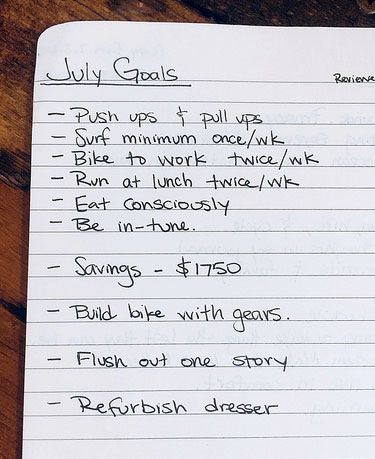

Here’s a look at that one too:

There wasn’t some special format, outline or directions to follow, and it felt great because of it.

This is my life. It doesn’t fit perfectly inside anyone else’s lines.

My goal became one thing: Write.

Every. Damn. Month.

And that’s what I did.

I wrote down things like “eating only nuts, fruits, veggies and fish,” and other things like “doing push ups, pulls ups and stretching” each morning.

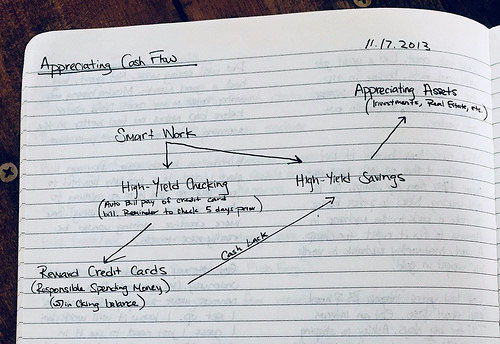

Along with those things I wrote down how to make money work.

I wrote out where I wanted my savings account balance to be at the end of each month.

I mapped out how my credit card worked with my paycheck and bank accounts.

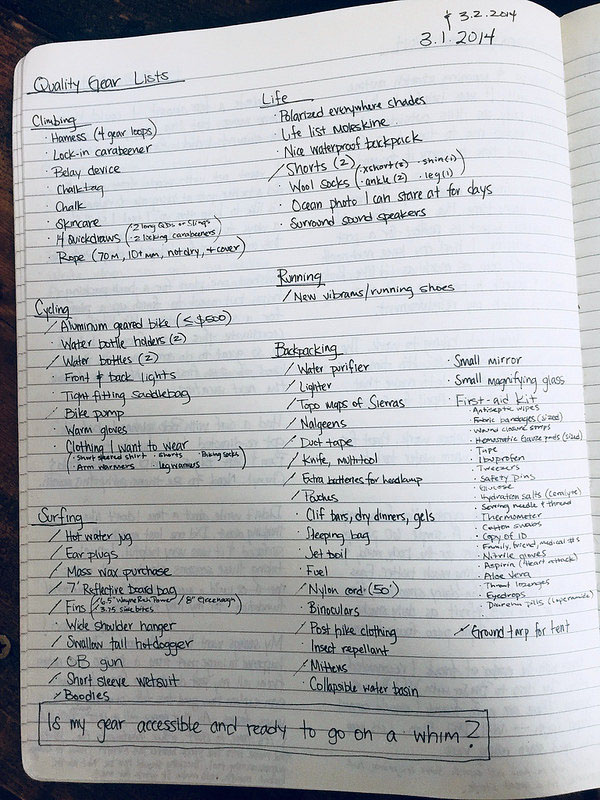

And I made a list of all the quality items I wanted to have in my life, so I could focus on buying things that really made me happy rather than $1,271 suits.

Did I hit every goal every month? Hell no.

Did I write like clockwork on first of every month? Hell no.

But I did it.

Slowly and surely things started to change. Here’s what happened.

Getting a Grip on My Money

While writing my goals, I began wanting to learn how other people accomplished the things I wanted.

I Googled everything I was interested in, and came across a whole underground movement of people that were designing their life for the things I was after.

It was magical.

I came across the legends: Mr. Money Mustache, J. Money and The Mad Fientist.

(I linked to my favorite article by each of them above, if you’re interested)

And I read everything. Seriously, everything.

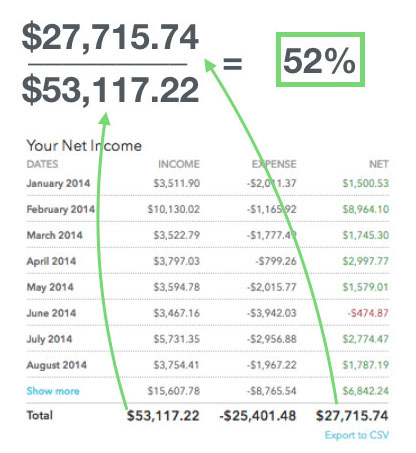

One of the most important things I learned was the importance of hitting this number called your “savings rate” every month and year.

By tracking that one number you can get a ballpark estimate of how long it’ll take for your investments (your passive income) to cover your lifestyle cost (your normal spending).

To me, that was perfect.

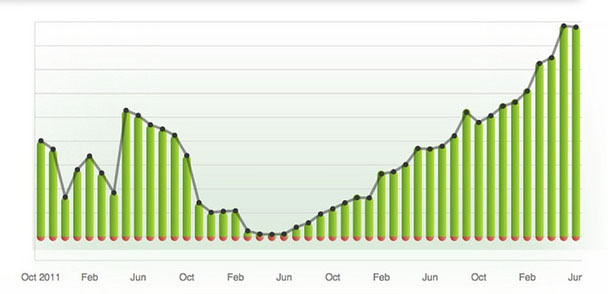

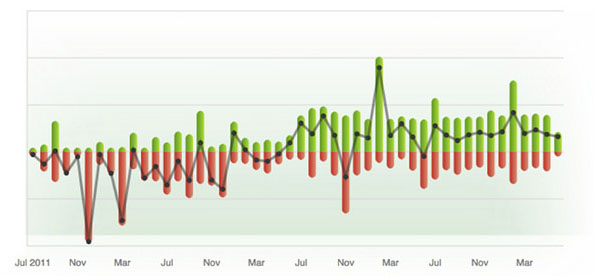

All I needed to do was hit that number and I’d know I was on track. I went off and built a whole automated system that became my personal financial dashboard.

From it I could see my net worth.

I could see my net income.

And I could track my savings rate too.

My net worth started going up month after month, and it felt awesome.

For the first six months, I just shoveled money into my savings account trying to hit the balance I wrote in my journal each month.

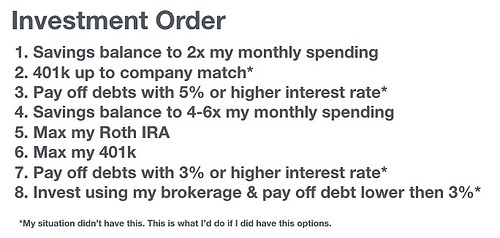

That worked great, but I began wondering when I should start investing, 401k-ing, Roth IRA-ing…

You know, all that adult-ing stuff.

That’s when I came across the godfather of this underground movement, Jim Collins.

I read his entire stock series and so much of his blog that I told my girlfriend I felt like he was my long lost Uncle while on a date one night.

(Even with a comment like that I still couldn’t get her to read his stuff!)

From him I learned 90% of everything I’d ever need to know about investing, and I figured out what to do with my money. [Editor’s Note: Jim was the catapult of my (J. Money’s) investing strategies as well. Great teacher!]

To jump four years ahead for one moment, here’s a look back at where I put my monthly net income (savings) each month.

I’d work on one step until I maxed it out, and then I’d move on to the next.

The only thing I might recommend you change from the list above is the investing related lines.

Why?

Because I’ve learned that once there you have three paths to choose from: Paper Assets (aka The Stock Market), Real Estate or Business.

By doing a little research you can choose the investment class (or combination of classes) that’s best for you. (I’ve linked to the three best resources I know in those links above to point you in the right direction)

So this is how my puzzle pieces began coming together.

But I want to make one thing clear.

My whole journey above didn’t go down smoothly. It was messy, hard and even disappointing at times.

It was life.

I just kept writing. I just kept going.

Here are a few real-life highlights from how it went down.

What You Write Becomes Your Life (And $10,000 Mistakes)

I really don’t believe my life was that different than my peers.

But there were differences.

I’d say the most helpful differences were how I handled these three parts of my life: Housing, Cars and Travel.

Let me tell you what I mean.

Housing

“I will never move back in with my parents.”

I said those 9 words hundreds of times to my friends in college. In my mind there was no way, no how that I’d move home after graduation.

Welp…

That was the first thing I did.

One unforeseen benefit of the job I had landed was that the office was about 15 miles from my parents’ house.

I remember driving home from college with my dad and all my stuff in the back of his truck. We pulled into the driveway and my neighbor came out to say, “hello.”

I was so embarrassed.

I couldn’t believe I was moving back home.

We met with a brotherly handshake, and one of the first things I said was “Yeah, man, I’m only going to be here for a month. I’m already looking for spots in the city.”

Wrong again…

I ended up staying for 11 whole months.

But this action made a huge difference for me, especially at the start.

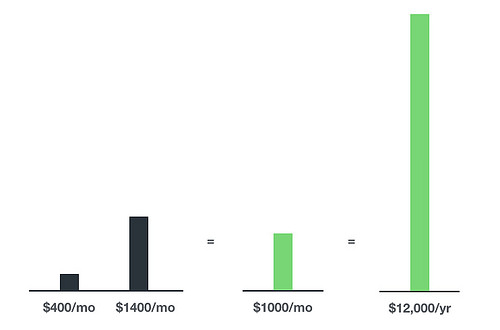

I was paying $400/mo in rent while my peers were paying $1,400/mo for rent in San Francisco. That put an extra $1,000 in my wallet every month ($12,000 over a year).

Beyond that, I loved that my rent went to people I knew and loved, and, by being more of an adult, I built a new relationship with my parents which was great.

I know this option isn’t available for everyone.

But if I could talk to my old self without the “move in with parents” option, I’d tell myself to reach out to family friends, extended family or whoever I could to see what is possible.

In the end though, my parents are my parents and I needed freedom.

I wanted to live in an awesome apartment in the city. For me, that was one near the beach, close enough to bike to work and shared with great people.

I started asking friends and coworkers if they’d want to move into a place like that if I found one.

Key point – “If I found one.”

I didn’t want anyone on a 14-day or 30-day time schedule to make the jump. I wanted to move only if the perfect apartment came up.

I ended up finding two great coworkers who loved the idea and hopped on board.

Together we hacked Craigslist to send us any new listings that matched our “perfect apartment” specifications.

Here’s how (link to video here if it doesn’t show up):

And in one month here’s what we found:

Epic.

I took the small office room that was connected to the living room by a sliding door for $1,000/mo.

It was a great price, but I’d be lying if I said that room was perfect.

There were definitely nights where people wanted to stay up many hours later than I preferred. But for the most part, I was respectful about hanging out with everyone late and my housemates were respectful about the noise.

(Pro tip for noisy rooms: Earplugs. They saved me numerous times.)

All in all this rent kept me well below the city’s average rent, giving me an extra $400/mo ($4,800/yr) to stash beyond my peers.

Living in that apartment with good housemates at that price was another huge help.

But not everything went that smoothly…

The Car. The F—in’ Car

Maybe I’m weird, but I’ve always had this love-hate relationship with cars.

I love the flexibility they provide for my life, but I hate how much they cost when things go wrong.

Let me tell you why.

Three months after starting my job I started searching for a car. I searched and searched and searched, and felt like I’d never find the right one.

One day I came across some ol’ Swedish wheels — a 2001 Volvo XC70 (a wagon) for $5,400.

My dad drove me about 45 minutes to test drive it.

I was so tired of searching for cars that I decided then and there that I’m just going to buy this thing.

Wrong decision.

After eight months, a Baja California surf trip (that ended with a tuna can lid duct taped over a missing piece of the engine) and $6,500 in unforeseen maintenance costs later, I sold that piece of junk for $1,900.

That’s a $10,000 loss. In 8 months.

I still facepalm when I think about that.

From that day forward I went into car-diac arrest for nearly a year.

I sold it a few days after I moved biking distance from work (5 miles), and began using my bike as my daily mobility for 3 months.

It was great. I listened to so many amazing podcasts, came in to work energized and my body never felt better.

After a few months of that I bought a 125cc Yamaha Vino Scooter for $1,800.

Getting the scooter was the perfect transition into getting a car (and the ladies totally love the goofy looking scooter vibes).

After about 8 months of my bike, scooter, car share program, it became time to get a car again.

This time I thought through what I needed the car to do.

I wanted something that I could pack up with gear, throw surfboards on top and drive to Big Sur for weekend adventures with a friend or two.

I then used these guidelines to help meet my money goals:

- Buy a car that’s at least five years old (here’s why)

- Find a car I like from this list of the top 10 cars for smart people

- Get a peer-recommended mechanic to look at the car before buying

- Toyota or Honda. Period.

What’d I get?

A 2005 Scion XA for $4,000 flat with insurance, registration and taxes.

(Scion is a less expensive brand of Toyota)

Compared to the average new car price, that purchase saved me about $26,000.

It’s taken my girlfriend and I on a 2,000 mile road trip through the Western US, has taken me on multiple surf adventures and, after 3 years, is still running strong!

Travel

For my first year back I didn’t do much “plane” traveling.

Instead, I did tons of weekend trips. My usual schedule looked like this:

I’d pack my surfboard, bike and running shoes in my car and take off at sunrise to Santa Cruz.

I’d surf in the morning, eat a little food and then do a run nearby. In the afternoon I’d meet up with family friends for lunch or tea or just write in my journal overlooking the sea.

Then on the way home I’d go for a small hike, walk or bike ride, sometimes with friends.

It was so much fun and gave me that sense of seeing the world even though it was only for a day and less than 100 miles away.

But as time went by I definitely wanted to go on more longer term, faraway trips.

Here’s how I handled that.

I’d always heard about people collecting hundreds of thousands of points from credit cards and using them to fly for free, but I never understood how they did it.

I thought they were wrecking their credit score or going into debt and just wrote it off as something that wouldn’t work for me.

Until this new phase of my life.

I did some Googling and ended up finding a way to safely travel hack.

I made this video to show you how:

I’d do this for 2-3 cards a year, which would give me enough miles for 2 or so free flights to places like Costa Rica to surf, or Colorado and Utah to snowboard.

All in all these little life-hacks probably helped me save an extra $10,000 a year. So over my near four years of work that was about an extra $40,000.

Not bad!

Once I saw how much money I was adding to my wallet with these type of acts, I started pushing my limits with it.

And consistent with “Ryland” fashion I pushed it a bit too far.

Girlfriend Ain’t Having It

What do I mean by too far?

Well, I got so into this “spend as little as possible” mindset that one day I became too paralyzed to even buy my girlfriend a birthday present.

To say the least, my girlfriend wasn’t having it (and rightly so).

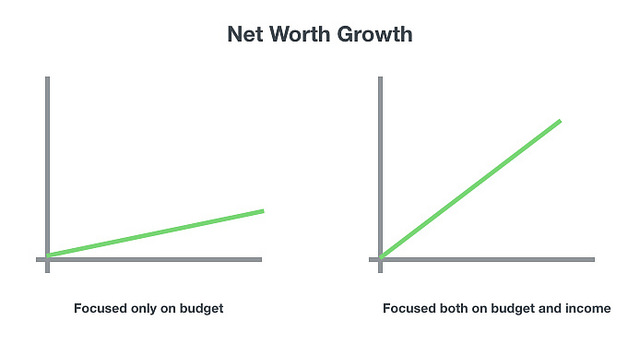

At this point, I had become overly focused on the “control my spending” side of the game.

I learned in that moment that the issue with only focusing on controlling my spending is it’s limited — I could only budget so far until I felt scarcity.

And scarcity isn’t happiness.

I was after freedom, not constriction.

So if I was to continue on my path, I had to turn my focus to the other side of the game — increasing my income.

The beauty here is that the income side is unlimited. And if you play it right, you can align the income to come in by doing something you love.

That’s the ultimate goal — making enough money doing something you love.

So off I went.

How I Handled My First Job (It Wasn’t Pretty)

I’ll never forget my first interview.

It was in this tiny, awkwardly quiet white-walled meeting room.

One of my future colleagues came in and it seemed like we had a good conversation. As we were wrapping things up he asked, “Are you willing to shovel shit?”

It was kind of a test to make sure I had grit.

Like any good interviewer, I said, “Give me the shovel.”

Horrible answer.

I got the shovel and my first job title became “Chargeback Support Representative” making $47,000/yr.

You know when you see a charge for $132 that a fraudster stole from you and you call your bank?

I was the person who picked up the phone.

The thing was, I loved the company I worked for and I really believed in its mission, but I couldn’t stand my position or my boss, and my work suffered because of it.

I wasn’t a team player, I did C grade work on my daily tasks and I just wasn’t myself.

For two years I felt as if I would show up, do a couple tasks and accept the normal small raises for being a warm body in a chair.

Then, right around that “birthday gift” incident, I finally switched positions to one I knew I’d enjoy more.

Immediately I started adding value.

I was excited to come into work, happy to go above and beyond and loved supporting my other teammates.

This newfound energy led me to two raises in 10 months from $55k to $70k with bonuses.

If I could summarize the top things I did to get those raises it’d be:

- Asking my boss what the #1 thing I could do to be successful in my position. (Then doing it)

- Asking my boss what’s the biggest thing she and the team needed help with outside my roles and responsibilities? (Then doing that also)

- And being kind, uplifting and helpful to everyone.

Seriously. That’s it.

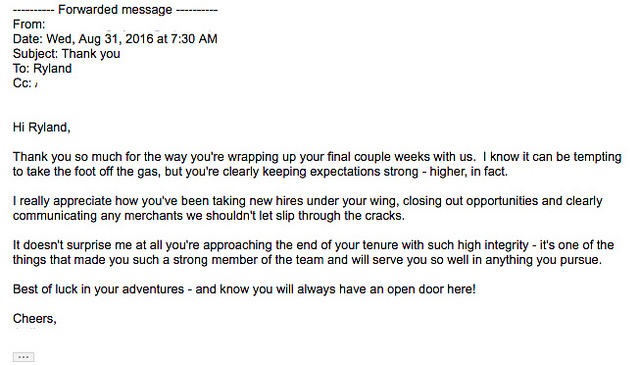

And when I decided it was time to transition away to work I enjoyed even more, I got notes like this:

That note is worth a starting salary of $70k/yr for me.

In other words, when I started adding value to the team I wasn’t just getting paid more, I was also building my personal capital.

Think of it like this.

Say I go to work each month to work on a house. Every two weeks rent comes in.

If I put in new carpets, upgrade the utilities and paint the rooms while at work I could charge more for rent (increase my income) and know that the value of my house was going up (my personal capital).

Everything was better with this new job.

But within a year, I was ready to move on again toward my financially independent life.

Living a Financially Independent Life (Before Financial Independence)

A financially independent life.

WTF is that anyway?

Three years ago I would have told you I’d be financially independent the moment my passive income covered my lifestyle cost.

The problem with that definition though is it has nothing to do with life. It only touches on money.

Today I believe it’s totally different.

Today I believe I can have a financially independent life as soon as I have enough money to have the confidence to walk away from any situation that doesn’t benefit me.

That moment comes at different times for different people.

For me, that moment hit about three years after my first journal entry when my girlfriend asked me this question, “Why not now?”

“Why not take off on your millennial adventure? Why not quit and start your own thing? You have the money.” She said.

She stumped me.

(That girl’s probably been my best financial advisor, haha)

I seriously didn’t have a good answer.

I had saved almost $100,000 (not including investment growth) and had a net worth that could cover 7 to 8 years of my lifestyle cost.

She was right — why not now?

I took it to heart.

I started writing my own blog about financial independence. I started helping my friends with their money situations just because I loved doing it. And I put up a page on my site about coaching other people in similar situations toward financial independence.

One day a friend I had helped posted about working with me on his Facebook page.

As life goes, one of his friends saw it, came across the coaching page on my site and became my first client.

I then offered my small list of 200 readers early access to a course I was building on financial independence.

In that course, I didn’t just sit back and send them the lessons. I engaged with them via email and live office hours on Facebook.

From that group, my next two clients signed up.

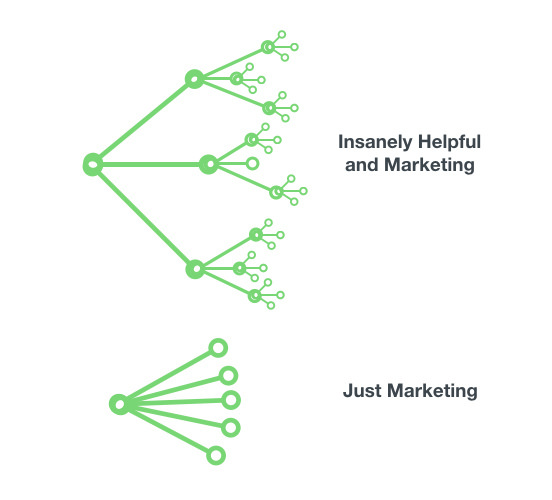

I gave my heart and soul to ensure every person I talked to kicked ass. Then when they became clients I continued with that kind of help which brought in new subscribers and new clients.

I’ve had almost 20 clients since then.

While all this was happening I took my girlfriend’s advice, amicably left my job and gave a full shot at aligning my income to what I love even further.

Today I’m still giving it that shot.

It can be tough at times, but I know as long as I continue helping people as best I can the income side will follow.

And beyond money, I’m now working on the things I’m passionate about. Like taking a few trips a year without breaking the bank. And I’m on my way to making enough money doing something I love to live a fun, yet simple life.

I got to this place not because of some rigid system.

I got here only because I kept going.

That’s it. That’s the secret — keep going.

I started this whole journey with tears rolling down my cheeks trying to build a budget that ended up looking like this:

I didn’t know how to make a budget (pretty obvious). I didn’t know where to put my money. I didn’t even know the difference between a savings and checking account.

I just started writing.

Goals. Reflect.

You can do that.

You can start right now.

It might make you a bit uncomfortable. Great! Embrace it.

Tell me the 4-6 things you want to accomplish deep down this month in the comments below.

Don’t think. Just write.

I’ll hang out here for the day, reading your comments and doing my best to help you out.

Thanks for reading,

– Ryland

**********

Ryland is a writer, outdoorsman and surfer. He’s also the founder of The Hidden Green, which helps young professionals (the ones who’d choose a mountain bike over a Maserati) do well with their finances. You’re invited to take The Hidden Green’s FREE mini-course — Do What You Love Finance or reach out to Ryland at ryland@thehiddengreen.com.

********

[For more $$$ nuggets, head over to Budgets Are Sexy!]

No comments:

Post a Comment