But a collective insanity has sprouted around the new field of ‘cryptocurrencies’, causing a totally irrational worldwide gold rush. It has reached the point that a big percentage of stories in the financial news and questions in Mr. Money Mustache’s email inbox are about whether or not we should all ‘invest’ in BitCoin.

We’ll start with the answer: No, you should not invest in Bitcoin. The reason is that it’s not an investment. Just like gold, tulip bulbs, Beanie Babies, 1999 dotcoms without any hope of a product plan, “pre-construction pricing” Toronto condominiums you have no intent to occupy or rent out, and rare baseball cards are not investments.

These are all things that people have bought in the past, and driven to completely irrational prices, not because they did anything useful or produced any money and value to society, but solely because they thought they would be able to sell them to someone else for more in the future.

When you make this kind of purchase, which you should never do, you are speculating, which is not a useful activity. You’re playing a psychological, win-lose battle against other humans with money as the only objective. Even if you win some money through dumb luck, you have lost some time and life energy, which means you have lost.

Noticed this ad on the corner of a website recently … because we ALL need daily updates on an obscure piece of niche software technology!

Investing means buying an asset that actually creates products and services and cashflow for an extended period of time. Like a piece of a profitable business or a rentable piece of real estate. An investment is something that has intrinsic value – that is, it would be worth owning from a financial perspective, even if you could never sell it.

Now, with that moral sermon out of the way, we might as well talk about why Bitcoin has become such a big thing, so we can separate the usefulness of the underlying technology called “Blockchain”, from the mania about how people have turned Bitcoin it into a big dumb lottery.

This separation is important because the usefulness of Blockchain is the primary justification people use for the big dumb Bitcoin lottery.

Once you make this separation in your mind, you can see that Blockchain is a simply a nifty new software invention (which is open-source and free for anyone to use), whereas Bitcoin is just one well-known way to use it.

Blockchain is just a computer protocol, which allows two people (or machines) to do transactions even if they don’t trust each other or the network between them. It can have applications in the monetary system, contracts, and even as a component in higher level protocols like sharing files. But it’s not some spectacular Instant Trillionaire piece of magic.

As a real world comparison, I quote this nifty piece from a reader named The Unassuming Banker:

Now imagine that the same person also created a product called Cancer-Pill using their own instructions, trade marked it, and started selling it to the highest bidders.

I think we can all agree a cure for cancer is immensely valuable to society (blockchain may or may not be, we still have to see), however, how much is a Cancer-Pill worth?

Our Banker friend goes on to explain that the first Cancer-Pill might initially see some great sales. Prices would rise, especially if the supply of these pills was limited (just as an artificial supply limit is built right into the Bitcoin algorithm.)

But since the formula is open and free, other companies would quickly come out with their own cancer pills. Cancer-Away, CancerBgone, CancEthereum, and any other number of competitors would spring up. Anybody can make a pill, and it costs only a few cents per dose.

And yet imagine everybody started bidding up Cancer-Pills, to the point that they cost $17,000 each and fluctuate widely in price, seemingly for no reason. Because of this, newspapers start reporting on prices daily, triggering so many tales of instant riches that you notice even your barber and your massage therapist are offering tips on how to invest in this new “asset class”.

But instead of seeing how ridiculous this is, even more people start piling in and bidding up every new variety of pills (cryptocurrency), over and over and on and on, until they are some of the most “valuable” things on the planet.

NO, right?

And yet this is exactly what’s happening with Bitcoin. And if you haven’t been digging into the cryptocurrency world much, it gets way weirder than this. Take a look at this shot from the website coinmarketcap.com, and observe the preposterous herd behavior in real life:

“Holy Shit!” is the only reasonable reaction. You’ve got Bitcoin with a market value of $234 Billion Dollars, then Ripple at $92 billion with Ethereum right behind at $85,792,800,592.

These are preposterous numbers. The imaginary value of these valueless bits of computer data represents enough money to change the course of the entire human race, for example eliminating all poverty or replacing the entire world’s 800 gigawatts of coal power plants with solar generation. Why? WHY???

I’m only a mediocre computer scientist. But coincidentally, after I got my computer engineering degree I ended up specializing in security and encryption technologies for most of my career. So I did learn a bit about locking and unlocking information, hacking, and ensuring that independent brains (whether they are two adjacent CPUs on a circuit board or two companies negotiating across the Pacific) can trust each other and coordinate their actions in lockstep. I even read about these things for fun, with Simon Singh’s The Code Book and the Neil Stephenson novel Cryptonomicon being particularly fun shortcuts to pick up some of the workings and the context of cryptography.

But that’s just the software side (Blockchain). Bitcoin (aka CancerPills) has become an investment bubble, with the complementary forces of Human herd behavior, greed, fear of missing out, and a lack of understanding of past financial bubbles amplifying it.

Mustachianism – the mental training that gets you to very early financial freedom – requires you to evaluate inefficiencies in our culture and call bullshit upon them. Even if you are the only one in the room willing to do it.

In the field of personal wealth, this means walking your children past the idling lineup of your neighbors’ Mercedes SUVs, over the snowy grass and up to the door of the school – and being confident that you are doing the right thing. Even if you’re the only one doing it.

When evaluating investment bubbles, it means looking at where everyone is throwing their money – no matter how many billions – and being willing to say “Bull. Shit. Guys. Not going to do this with you.”

So I also read a lot about investment bubbles and fundamentals and how to tell those apart. One book that I found very useful in understanding the greed-fear cycle (and Central Banking and the Federal Reserve system to boot) is the 2001 classic Towards Rational Exuberance by Mark Smith. For a shortcut to understanding good investing, you can also simply look up Warren Buffet’s thinking on almost any topic – he’s careful enough about offering opinions that by the time he makes a statement on something, you can be pretty sure it will be among the best answers out there.

And of course, the purpose of this whole aside is that I want to establish credibility with you, so you will give this article some consideration. I believe the current Cryptocurrency “investment” mania is a huge waste of human energy, and our rate of waste has been growing exponentially.

The sooner we debunk the myth and come to our senses, the richer our world will be. So we need more credible people to speak out against it. If you’re one of these credible people, please do so in the comments or in a blog post on Medium that we can all read.

Why was Bitcoin Even Invented?

Understanding the motivation is a big part of understanding Bitcoin. As the legend goes, an anonymous developer published this whitepaper in 2008 under the fake name Satoshi Nakamoto. It’s well written and pretty obviously by a real software and math person. But it also has some ideology built in – the assumption that giving national governments the ability to monitor flows of money in the financial system and use it as a form of law enforcement is wrong.

This financial libertarian streak is at the core of Bitcoin, and you’ll hear echoes of that sentiment in all the pro-crypto blogs and podcasts. The sensible-sounding ones will say, “Sure the G20 nations all have stable financial systems, but Bitcoin is a lifesaver in places like Venezuela where the government can vaporize your wealth when you sleep.”

The harder-core pundits say “Even the US Federal Reserve is a bunch ‘a’ CROOKS, stealing your money via INFLATION, and that nasty Fiat Currency they issue is nothing but TOILET PAPER!!”

It’s all the same stuff that people say about Gold, which is also a totally irrational waste of human investment energy.

Government-issued currencies have value because they represent human trust and cooperation. There is no wealth and no trade without these two things, so you might as well go all-in and trust people. There are no financial instruments that will protect you from a world where we no longer trust each other.

So, Bitcoin is a protocol invented to solve a money problem that simply does not exist in the rich countries, which is where most of the money is. Sure, an anonymous way to exchange money and escape the eyes of a corrupt government is a good thing for human rights. But at least 98% of MMM readers do not live in countries where this is an issue.

So just relax, lean into it, and grow rich with me.

OK, But What if Bitcoin Becomes the World Currency?

The other argument for Bitcoin’s “value” is that there will only ever be 21 million of them, and they will eventually replace all other world currencies, or at least become the “new gold”, so the fundamental value is either the entire world’s GDP or at least the total value of all gold, divided by 21 million.

People then go on to say, “If there’s even a ONE PERCENT CHANCE that this happens, Bitcoins are severely undervalued and they should really be worth, like, at least a quadrillion dollars each!!”

This is not going to happen. After all, you could make the same argument about Mr. Money Mustache’s fingernail clippings: they may have no intrinsic value, but at least they are in limited supply so let’s use them as the new world currency!

Why not somebody else’s fingernail clippings? Why not one of the other 1500 cryptocurrencies? Shut up, just send me $100 via PayPal and I’ll send you a bag of my fingernail clippings.

Let’s get this straight: in order for Bitcoin to be a real currency, it needs several things:

- easy and frictionless trading between people

- to be widely accepted as legal tender for all debts, public and private

- a stable value that does not fluctuate (otherwise it’s impossible to set prices)

Bitcoin has none of these things, and even safely storing it is difficult (see Mt. Gox, Bitfinex, and the various wallets and exchanges that have been hacked)

The second point is also critical: Bitcoin is only valuable if it truly becomes a critical world currency. In other words, if you truly need it to buy stuff, and thus you need to buy coins from some other person in order to conduct important bits of world commerce that you can’t do any other way. Right now, the only people driving up the price are other speculators. The bitcoin price isn’t rising because people are buying the coins to conduct real business. It’s rising because people are buying it up, hoping someone else will buy it at an even higher price later. It’s only valuable when you cash it out to a real currency again, like the US dollar, and use it to buy something useful like a nice house or a business. When the supply of foolish speculators dries up, the value evaporates – often very quickly.

Also, a currency should not be artificially sparse. It needs to expand with the supply of goods and services in the world, otherwise we end up with deflation and hoarding. It also helps to have wise, centralized humans (the Federal Reserve system and other central banks) guiding the system. In a world of human trust, putting the wisest and most respected people in a position of Adult Supervision is a useful tactic.

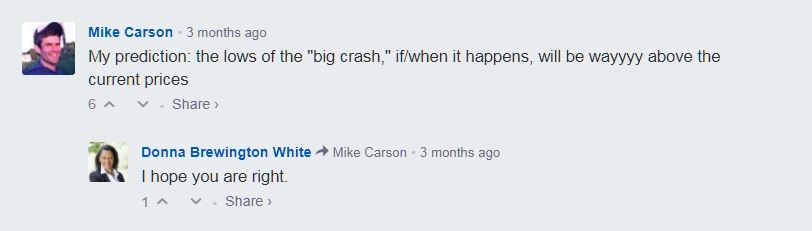

Finally, nothing becomes a good investment just because “it’s been going up in price lately.”

If you disagree with me on that point, the price of my fingernails has just increased by 70,000% and they are now $70,000 per bag. Quick, get me that money on PayPal before you miss out on any more of this incredible “performance!”

The world’s governments are not going to let everyone start trading money anonymously and evading taxes using Bitcoin. If cryptocurrency does take off, it will be in a government-backed form, like a new “Fedcoin” or “G20coin.” Full anonymity and government evasion will not be one of its features.

And you don’t want it for this purpose anyway – after all, do you currently hide your money in offshore tax havens and transact your business on black markets? Do you practice illegal tax evasion as your primary wealth strategy? Probably not, because life is better and wealthier when you aren’t living a life of crime.

The Cryptocurrency bubble is really a replay of the past: A good percentage of Humans are prone to mass delusions which lead to irrational behavior. This is a known bug in our operating system, and we have designed some parts of our society to protect us against it.

These days, stocks are regulated by the SEC, precisely because in the olden days, there were many, many stocks issued that were much like Bitcoin. Marketed to unsophisticated investors as a get-rich-quick scheme. The very definition of an unsophisticated investor is “Being more willing to buy something, the more its price goes up.”

Don’t be one of these fools.

Further Notes

This YouTube Video is one of the best shortcuts I found for explaining how Blockchain works.

This Vice article explains yet another ridiculous aspect of Cryptocurrency: running the transaction network (called “Mining”) involves a deliberate computer-intensive crypto challenge syetem called “proof of work”. This inefficient design is now wasting more electricity than many entire countries. Doing one transaction burns 215 kilowatt-hours of electricity, enough to run the entire MMM household for more than a full month, or to power an electric car for more than 800 miles of driving.

Another interesting side-effect of bitcoin mining: big sales of computer graphics cards, and theft of electricity and cloud computer services. One of my coworkers at MMM-HQ works for Nvidia, and part of his job is hunting down the mining thieves. Some of my conversations with him inspired the research in this article.

I enjoyed this analysis by Aswath Damodaran, a thoughtful investor and Professor at NYU school of business

Another intelligent case by highly experienced crypto business lawyer Preston Byrne. Favorite quote:

“Bitcoin’s growth is not based on its technology alone (which, while powerful, is open-source and therefore easily replicable) but rather on the strength of virality, encouraged by the vested interests who held early and invested in marketing it; with no genuine business underlying it, it acquires its (very substantial) memetic potency only from the evangelism of those who hodl and preach.”

Via Finance http://www.rssmix.com/

No comments:

Post a Comment