Taking a break from all the heart pouring lately, and moving on to some financial sexiness today… With special attention on the latter ;)

Check out this clip I was emailed from Sam over at Honeyfi (who you might remember from our FinTech competition and apps review the other month). The truth finally comes out!!

We just conducted a survey of 500 committed couples, and I thought you’d be particularly interested in the results. Among other things, we found that couples who regularly track and discuss a household budget are (i) 50% more likely to report being “extremely happy” in their relationship, and (ii) over 33% more likely to report having a great sex life. In other words, science has finally proven what you’ve known for a long time: budgets truly are sexy.

Thank you, thank you – *takes a bow*. But we can do better, folks. 33% is a great start, but I want to see us at 100% budgeting and having even greater sex!!! And then greater budgeting with greater-er-er sex, all at the same time! Haha… Wait, that doesn’t work…

But it is better than this other stat I recently came across, from Varo Money:

“35% of people say they would rather vomit than make a spreadsheet of their finances”

Come on!! No way that’s true… #FAKENEWS #FAKENEWS #FAKENEWS

The only thing you should be vomiting is all of your expenses to make room for those scrumptious savings! Mmm mmm….. Nothing tastes better than a hearty early retirement cake! And this blog here gots all the fixin’s for it – heyo!!

Okay, I’ll stop haha…. might have had one too many espressos this morning ;)

But true fact: Budgets are sexy. And also, apparently kangaroos…

(This was trending on Twitter yesterday, haha… “A surprised tourist was stopped from using a public toilet in a national park near Perth because a kangaroo was striking a pose in the entrance.”)

Here are more random, yet slightly nauseating and entertaining,

financial stats

I’ve been collecting them for quite a while now… Feel free to bring them up at all the Spreadsheet Parties tonight:

**********

“The average American racked up $998 of post-holiday credit card debt.” (survey)

Ugh… but wait for it…

“…which will take the average respondent 10.28 months to repay (!!!)”

If anything is vomit-worthy, it’s that. Because guess what’s coming around again in another 10.28 months??? Oh that’s right – HELLO HOLIDAYS!!! Thus becoming the never-ending circle of debtness! Ho Ho, NO.

“Over 50% of men and women said they would feel successful if they employed a housekeeper” (study)

I don’t even know how to respond to this one, haha… I mean, yeah – I guess if I had enough money to hire a housekeeper (or chauffeur, door man, professional driver, chef, bat cave, island) I’d feel pretty successful too. But any idiot can pay for that and still be on the brink of bankruptcy. Success ≠ how you spend your money. Success = how you SAVE it.

“74% of parents assist their adult children in paying for their living expenses including rent, cellphone bill, utilities and transportation.” (poll)

I’m shaking my head on this one too, but Lord knows I’ll probably be doing the same for my kids when that dreaded age comes along, haha… You always want to help your kids out, but how do you do it so they learn and don’t need you anymore later in life? What’s the best way to teach them?? I’m really asking – these are not rhetorical questions, haha… I don’t want to lose any of my street cred here! ;)

“27% plan to opt out of home ownership in the next 5-10 years, an 8% increase from 2016” (link)

Now that stat I can get down with! Not because I’m against home ownership in any way, but because it means people aren’t as afraid to do what’s in their best interest anymore for themselves! Because spoiler alert – owning a home is not for everyone. In fact, I’d be leery at any stat that was hovering around the 100% mark of what people were doing to be honest… Unless of course it was around budgeting and/or spreadsheet parties ;)

“Doctors make way more than we think. They are perceived to make $125,000/year, however they actually make $200,000/year.”

Nice! Go docs! I guess that’s why y’all are popping up all over the early retirement scene lately, eh? Checkin’ to see that everyone’s treating their money with as much respect as their patients? To make sure they’re all nice and financially healthy? That everyone’s wallets have a pulse? (One more, one more – That they all have emergency funds???? #NailedIt!)

“46% of married Americans die nearly broke, according to a recent study by the National Bureau of Economic Research” (GoBankingRates.com)

Damn. Though I don’t know why “married” had to be included in there? Shouldn’t that make the odds better that you wouldn’t die broke? Still, no bueno. Although, you wouldn’t be that different from many of our founding fathers back in the day… Both Thomas Jefferson and George Washington ended up dying deeply in debt! But at least they enjoyed their lifestyles going out at the end ;)

(I’m actually reading a pretty interesting book on G. Washington right now, and how one of his biggest expenses was entertaining the parade of guests that would stop by his home over his retirement years to pay their respects. Something he had a hard time turning down (also out of respect), but only added to his financial problems. This seemed to be the case for many notable figures in history which is kinda interesting… Do you think you’d be able to turn down all your adoring fans and colleagues?)

“D.C. metro area named worst city for earning six figures & still being broke” (link)

Yup, it’s bonkers out here… $500,000 will literally get you a door if you’re lucky, haha… No less an entire home with your own roof and bathroom! We pay $2,200 for a tiny 1,100 sq ft rambler, and that’s still 30 mins outside of the city… Two hours 30 minutes in rush hour.

“More than half (55%) of Americans think it is acceptable to purchase an engagement ring from a pawn shop.” (Ebates.com)

Hey – traditions gotta start somewhere? :) I’d personally prefer a family heirloom or handmade ring of some nature for anyone out there considering proposing to me anytime soon, however as the financially conscious guy I am, a pawn shop would certainly also do the trick. But only if it doesn’t come with a sad or creepy story as to why it’s there… I’m not about to score a bargain off of someone else’s loss. And I’m damn sure not playing around with any ghosts!

“32.6% have used Venmo to pay for drugs (marijuana, cocaine, adderall, etc.)” (poll)

I thought that was what Bitcoin was for? ;)

“21% of millennial respondents have used Venmo for betting or gambling.”

Oh wait, THAT’S what Bitcoin is for, bah-dum-ching… Although I’ll admit it – for the first time in 5 years I’m actually starting to get a little interested in it. Is that bad? Mainly just for experimental/learning purposes, but not a week goes by when someone doesn’t ask me my thoughts on it. And I’m getting tired of always responding with “I don’t know, go ask Mr. Money Mustache.” Haha… (Okay, I don’t actually do that, but his recent post I just linked to on it was pretty good…)

I’ll leave you with one more, just in case you were wondering…

Happy weekend everyone!

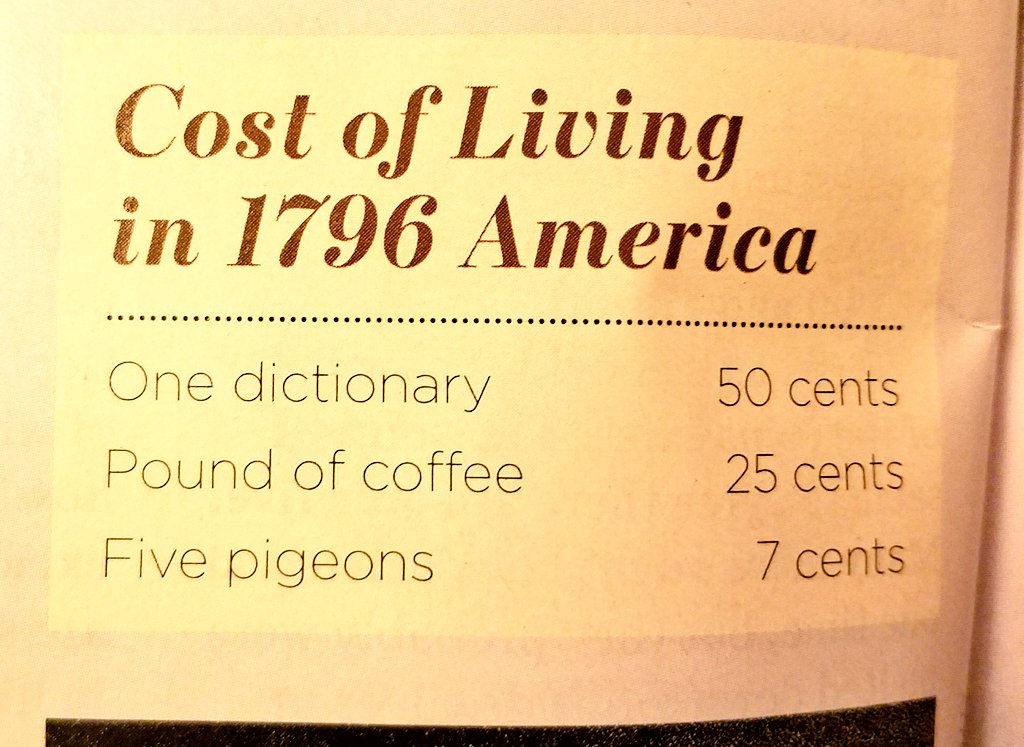

And to save you the look-up: “Homing pigeons can cost anywhere from approximately $50 up to several hundred dollars, depending on the pedigree and breeder. Keep in mind that in addition to the cost of the pigeons, you must also pay the cost of shipping.”

Via Finance http://www.rssmix.com/

No comments:

Post a Comment