Welcome to the last official business day of 2017!! That went fast, huh?

As promised, here’s a list of my all-time favorite posts from the year, to compliment the most popular posts we just featured on Wednesday.

You read all of these and not only will your wealth grow exponentially, but your standing here on BudgtsAreSexy will rise to the tippy top too! And there will be a quiz at the end of this – so make sure to pay attention and take notes!!! (Okay, no there won’t, but still smart to take notes :))

Here are my favorite posts from the year, sprinkled in with a few extras…

(Instead of taking a couple of hours to summarize them all like I did the last one, I’m just going to copy & paste my favorite clips from them here :) Why re-work the brilliant words that got these posts on this list in the first place?? Also, I’m lazy. #SorryNotSorry)

#1. If You’re Smart Enough to Retire Early, You’re Smart Enough to Figure Out The Future — “Here’s the thing: if you’re smart enough to retire early, you’re smart enough to figure out how to live for the rest of your life. You’ve already done the hardest part! You hit your early retirement number! And we all know damn well that “retirement” really isn’t “retirement” for folks in our community anyways… What blogger, or early retiree, do you know who just lays around all day wasting away their lives? (Answer: no one) If you’ve figured out how to get – and keep! – millions of dollars for yourself, and certainly by your 20s/30s/40s, you’ve earned the right to do whatever the $hit you please in life. Whether that’s to keep working for more or just completely change your life.”

#2. The Ultimate List of What Belongs in Your Net Worth (And What Doesn’t) — “Do you include pensions in your net worth? How about art, insurance, homes, cats, baseball cards? These are some of the most popular questions I get asked, outside of “Is J. Money your real name?” (Yes) and “how did you get so damn sexy??” (I don’t know, it just comes natural! ;)) So today I thought I’d list out my personal feelings on it, and then everyone can chime in and let me know if they think I’m a big fat idiot or not. Although the reality is that we’d all be wrong, because: THERE IS NO WRONG WAY TO TRACK IT!””

#3. A Different Way of Looking at Spending — “I’ve been trying something new lately where every time I have to spend money on something – whether a need or a want – I try to look at it as I’m “supporting” the place my money’s going to vs. “I’m spending my hard earned money” there. The effect to my wallet usually remains the same, but what I’ve noticed is that I’m starting to appreciate these transactions a lot more, and not only that – but in some cases even enjoying it!”

#4. Let’s Bring The $2.00 Bill Back!! — “When it comes to cash, I’m an equal opportunity owner. I have $10 bills, $5 bills, $20 bills, and of course many many $1.00 bills. But the one bill that I secretly admire more than any other, and also the one that gets the least respect, is the lonely $2. Not only has it been forgotten for the past handful of decades (yes, they still print them!), but some even think they’re fake and have literally gotten arrested for using them. #AlternativeFacts So today’s goal for this post is quite simple: to get you to start using the $2.00 bill! I don’t care if you use it just once or a thousand times. I want these puppies circulating so fast that McDonald’s comes out with a $2.00 Item Menu! ;) “

#5. If You Can Afford to Spend It, You Can Afford to Save It. — “What I have been doing differently is that, if I decide I can afford it, and I don’t really need the items, I immediately transfer that amount into my savings account instead of spending it. Light bulb moment: if I can afford to spend it, I can afford to save it! WHOOOOA. This has revolutionized my savings life.”

#6. I’d Scoop up Poop if it Made Me Happy! — “Back when I quit got laid off of my job 7 years ago, I told the world I’d never go back to a 9-5 myself and thought I was pretty hot $hit for saying so.

“9-5? Those are for suckers! Blogging’s where it’s at, bitches!” – Said the guy who worked a 9-5 just days earlier…

But the truth is, I was a big fat idiot. And so are others who say they’ll “never” do something again. You may feel that way at the time, and maybe you never do end up going back to something again later, but I’ve since learned that the more limits you put on yourself the less opportunities you end up having later on in life. Why say “never” when “never” could actually make you happier one day?”

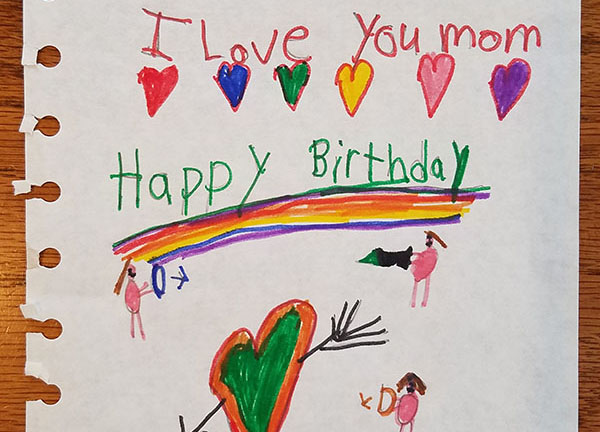

#7. A Beautiful Way to Save Money on Cards? — “Among the old notes and doodles from school, apparently my mother thought it would be nice to store some of the old cards I made for her and my father too – particularly around the holidays. And rather than throw them all out which I was about to do, I thought – what if I can reuse them? Instead of buying another Hallmark card each holiday, what if I actually gave these hand-made cards BACK to my parents as if I were still that same 10 or 13 year old boy? And pretend no time has passed at all? Wouldn’t their hearts just explode with memories and be so much more meaningful? And bonus win: it wouldn’t cost a thing!”

#8. The Real Reason We Buy Stuff — “Have you ever met anyone who buys stuff they hate? Who willingly goes out of their way to blow money just because they see someone else doing it? I haven’t, yet we’re always talking about these “Joneses” who we’re supposedly keeping up with as if we were robots without any capability to think for ourselves! We are influenced by them, but the real reason we buy stuff isn’t just to be like other people. No. IT’S BECAUSE WE LIKE $HIT!… Everything we’ve ever bought or spent money on (outside of bills and boring adult stuff) we’ve done so because we LIKED what we got in return for it at the time… There were no Joneses holding up guns to our heads.”

#9. “It’s Strange Going From Saving Money Your Whole Life to Spending it!” — “How do you get okay with spending money after decades of saving and skimping by? How do you break a habit that’s 20, 30 or in my father’s case – almost 50 years old in the making? It sounds like the opposite of everything we’ve been trained to do, right? I still haven’t come to terms with it if I’m being honest, but two years later I’m proud to report that my father has finally overcome it and officially had his last day of work just last week :) At 60-something years old he has stopped hustling for that almighty dollar, and is now on a mission to soak up what he hopes is an even almightier life of leisure.”

#10. “Maybe The Life You’ve Always Wanted is Buried Under Everything You Own” — “Similar to the book, Essentialism, I raved about the other month, this is another one that helps get your mind right and back focused on finding your MORE out of life by saying no/less to everything else that doesn’t match our priorities. Namely, our stuff… And if you’re fan of Joshua’s popular blog, Becoming Minimalist, you’ll enjoy his book even more – especially if you don’t know the story behind his epiphany which led him down this “less is more” track. You never know where inspiration will hit you!”

The beauty of minimalism isn’t in what it takes away, it’s in what it gives. – Joshua Becker

And that’s the Top 10 list!

Here are the runner-ups… mainly because I’ve already talked about half of these ad nauseum lately ;)

- Nothing’s Ever Permanent

- The Triad of Hustling

- What If You Just Don’t?

- $20 Does The Trick!

- Whatcha Know About Legacy Binders?

- “The Challenge Is Not To Touch It!” (And Other Things I Recently Overheard)

And here are some posts that just attack you with one tip after another after another… Good for when you’ve drunk massive amounts of coffee and are ready to speed-read!

- 10 #Money Tips For Ya

- 9 More Financial Hacks to Put In Your Pocket

- 8 Tips for Appreciating What You Have

- 6 Great $$$ Ideas To Steal

Lastly, here are a bunch of crazy and fascinating (and crazy fascinating!) stories from our recently created “Financial Confessional” series. Great for feeling better about your own “boring” lives.

- My Life (And Finances) After Escaping a Cult

- How I Survived Prison And Accidentally Found My Path to Wealth

- What My Ridiculous Parents Taught Me About Money

- Financial Confessional: I Used To Be An Escort

- Seeking Financial Stability as a Gay, Non-White, Man of Muslim Faith

So there you have it. 25 more articles to read when you’re in the mood to stalk the blog ;)

Who knows what will come out next? Or how many of us will go on to become millionaires in the new year??? Only time will tell, but if I’m doing my job right, you’ll grow that wealth faster and faster with each passing year… and hopefully not get put to sleep in the process.

Have a happy happy new year, everybody!! If any of these posts resonated with you above, please let me know in the comments so I can sleep knowing I won’t get fired! ;)

Via Finance http://www.rssmix.com/

No comments:

Post a Comment