The post Net Worth Report #6 – “Half a Dozen!” appeared first on Budgets Are Sexy.

My wife and I made a pretty big investment change last month … We withdrew $35,000 from our brokerage account, took another $15,000 in cash, and invested it all into a new real estate project.

You’re probably thinking we’ve lost our marbles, since I just wrote a whole saga about how rental properties are weighing me down and why we’re moving AWAY from them … But, this new investment is not another physical house that we have to manage directly — it’s a private partnership to fund a much bigger (and professionally managed) apartment complex. It’s a purely passive investment for us.

Up until now, I’ve kept our real estate partnerships separate from these net worth reports. But I’d like to track the numbers on this particular project publicly so you can observe how it grows from the beginning. I promise to write more about the ins and outs of private syndications another time, but for now I just wanted to explain why there’s a big chunk of money missing from our brokerage account, and how the new line item “R/E partnership” for $50k popped up below.

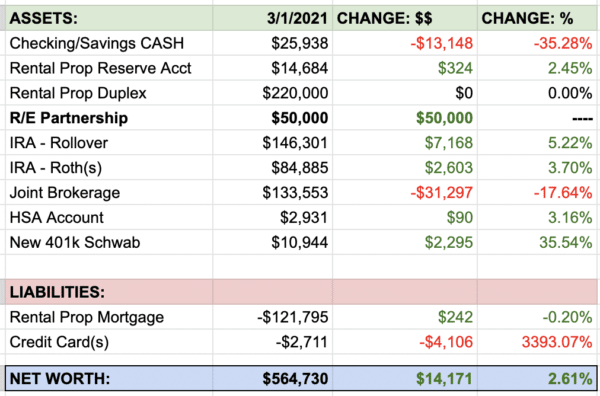

March 1, 2021, Net Worth: $564,730 (+$14,171)

Here’s the asset summary for everything we’re tracking. In February all these assets grew by a combined $14k:

Before getting into the individual account breakdowns, here are some fun money wins for Feb!

February money wins…

We got a $200 bank bonus!: PNC Bank is offering a $200 cash bonus to anyone who opens a new account and has qualifying direct deposits. I opened an account on Jan 22, transferred $2k into it, and got paid the bonus on Feb 25. An easy (and free) $200 bonus for about 1 hour of work! (See here how Bank Account Churning works if you’re interested.)

Selling crap online: One of my friends found out I like to turn trash into treasure, so he asked if I could help him clear some stuff out of his storage. He’s giving me a generous cut of the sale proceeds, and I’ve already made over $200 the past week from selling his stuff!

Check out these Lladro figurines… Each one sells for $50 – $300 on eBay depending on the piece. Crazy!

Work, work, and more work: I picked up a new side contract gig, helping with SEO on another blogger’s website! Although it’s only a few hundred dollars each week, this should add up to over $10k throughout the year (providing the work continues to be available).

Mammoth expenses last month…

Big travel expenses: Valentine’s Day set us back about $400 due to a weekend away in wine country. We also just dropped $1,500 on a Hawaii getaway that we’ll embark on later this month. As expensive as that sounds, we actually got free flights with SW points + companion pass, and we are staying with friends for a portion of the trip.

Feels good to spend money on travel after a whole year of cancelled covid trips!

New $950 laptop: The last time I bought a new computer was in 2009, so it was time for a technology upgrade! And I’m thinking this one might be tax-deductible now that I’m a stay at home blogging nerd. Here is my new best friend, a 2021 MacBook Air:

Yes, that’s a wine stain on the table cloth. We had a little too much fun last weekend and I haven’t run the laundry yet.

Detailed Asset Breakdown:

CASH Accounts: $25,934 (-$13,148): Now that my wife and I are both working, we’re happy having a little less cash in our personal emergency fund. $15k was deducted and applied to the new real estate project. We will slowly build this cash pile back up to $30k, I think before summer break.

Rental Property + Reserve Account: $234,684 (+$324): Not a great month for our duplex. We had a stove, dishwasher, and washing machine break. The repairs totalled about $900. But, I’m looking on the bright side because we didn’t have any frozen/busted pipes or water issues like many other properties in the Texas storm.

Another thing I’m grateful for here is that this duplex cost me zero *man hours* this past month. I sometimes complain that owning physical rental properties isn’t “passive” income, because there’s management work involved. But, my awesome property manager handled all problems on my behalf this past month, so no work was needed on my end.

IRA – Rollover: $146,301 (+$7,168): A portion of this IRA is invested in a Small Cap Value index fund, which is why it grew faster than the overall total stock market index.

IRA – Roths: $84,885 (+2,603): Woohoo! Tax-free growth! This is why I try to fund Roth IRAs as early as possible within the year (even if it means robbing from my after-tax brokerage account). The earlier money is invested into Roth accounts, the longer it can generate tax-free gains.

Joint Brokerage Account: $133,553 (-$31,297): Usually selling stocks is a big no-no while building wealth. The more you pull money in/out of the market, the worse off you do. For the $35k that we sold last month, we’ll be returning that shortly whenever we sell our first physical rental this year.

HSA: $2,931 (+$90): Just realized I should have funded this sucker in January, like we did the Roth accounts. Hmmm, something to add to my list this month.

New 401(k) at work: $10,944 (+$2,295): Woohoo, we crossed the $10k mark for this new 401(k) account! Not bad considering it was only opened last October.

Breakdown of Liabilities

Rental Property Mortgage: -$121,795 (+$242): Slow and steady wins the race. I just did an annual review of this rental property, which I’ll publish as a full post shortly and share the calculated ROI for 2020.

Credit Card Balances: -$2,711 (-$4,106): Some pretty hefty spending last month! But this was mostly irregular expenses, and we have the cash to pay this card off before any interest is due.

Wife and I have no other consumer debt at this time.

Questions? Comments? How were your updates the past month?

Have a great freaking weekend!

– Joel

The post Net Worth Report #6 – “Half a Dozen!” appeared first on Budgets Are Sexy.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment