The post 2020 Review and ROI of My Rental Duplex appeared first on Budgets Are Sexy.

Hey there, money nerds!

How’s your 2020 tax return going? Who else out there besides me gets turned on by a long 1040 Form, multiple 1099-MISC’s, sexy AGI, and itemizing deductions for their MFJ status? (and who has no clue what the heck I’m even talking about? → don’t worry, that’s what H&R Block is for!)

Anyway, I just received my annual Profit and Loss Statement for my rental duplex for 2020, and I thought some of y’all might be interested in checking it out.

It’s basically a summary of all income and expenses that my property management company reported in 2020. They send me one of these for every property, every year, which I use for tax filing.

Also, it’s really handy for calculating the annual ROI for this investment, which I’ll do within this post.

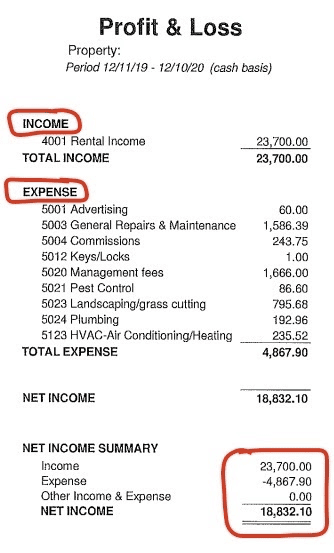

Example of a Profit and Loss Statement for a Rental Property

Here’s what my P&L for 2020 looked like:

INCOME: In 2020, we had 100% Occupancy and 100% rent collection. Woohoo! Every investor’s dream! Especially given the pandemic challenges last year.

There are two units in this duplex. One pays $1,000 per month and the other pays $975 per month, so $23,700 total for the year.

EXPENSES: These expenses listed are just the items that my property manager handles. So insurance, property taxes, and mortgage payments we’ll look at separately in the overall ROI in a bit.

- Property management: I pay my property management company 7% of all collected rent.

- Commissions are paid for renewing tenant leases. Last year there was only 1 renewal, and it’s calculated as ¼ of 1 month’s rent (Unit #2 renewed at $975/m. The other unit was on a 2-year lease.)

- General repairs: From my monthly detail reports, I can see this is mostly toilets, sinks, dishwashers and stove repairs here and there, etc.

- A/C & Plumbing: I’m not sure why plumbing is broken out separately, but I like how the HVAC has its own line item. From memory, this was preventative maintenance and cleaning. New A/C units cost about $5-6k when they blow up, so keeping them clean and up to date is important!

- Landscaping seems big, but it works out to about $15 per week. The lawn peeps come every 1-2 weeks depending on the season and do the front and back lawns.

All in all, total income minus expenses was $18,832 last year.

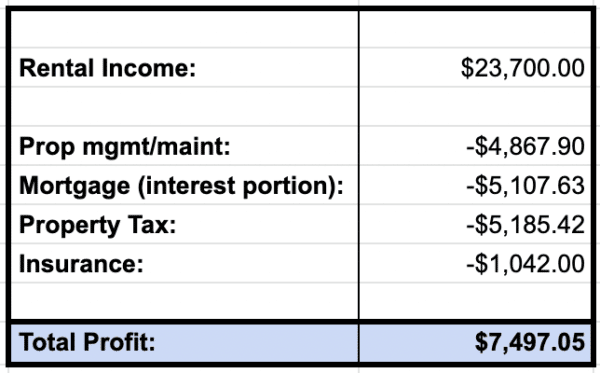

Now let’s add in the other 3 big things that I pay separately for this property. This helps calculate my actual profit in 2020…

PITI: Mortgage Payments, Insurance, and Property Taxes for a Rental Property

Investors sometimes call this “PITI,” which stands for principal, interest, tax and insurance. Here’s the PITI expenses we paid in 2020:

Mortgage Payments: $7,938.60 in total

- $2,830.97 was principal

- $5,107.63 was interest

Property Tax: $5,185.42

Insurance: $1,042

It’s important to note that mortgage principal isn’t technically an “expense” because this money is actually applied to paying down the loan balance. So the $2,830.97 in principal payments was paid to myself, and therefore we can remove it from our overall expense tally.

Total PITI (without principal paydown): $11,335.05

OK, now let’s add this all up and see what the real profit was for 2020…

This duplex made me and my wife $7,497.05 last year.

This was made up of $4,666.08 in positive cashflow and $2,830.97 in loan balance paydown. Not bad!

What About Property Value Appreciation?

Another thing we could calculate into our annual profit is appreciation. The value of the house could have risen in 2020, making us even more money.

But I have no idea if it’s really increased in value. There hasn’t been much buying/selling in my area this past year, particularly for duplexes and fourplexes, so we can only make a rough guess about changes in value.

I could pay for an appraisal or competitive market analysis, but unless I’m looking at selling, I don’t really need to know how much the place is worth currently.

So at this point, I’m gonna just use our actual *realized* profits of $7,497.05 to calculate the ROI for the past year.

Total Return on Investment for 2020

To work out the ROI, I’ll take the total 2020 year gains ($7,497) and divide it by the value of the investment at the start of 2020 ($102,973).**

($7,497 / $102,973) = 0.0728. So basically, that’s about a 7.3% ROI.

Not great, but definitely not bad. We didn’t include any appreciation or tax advantages, which would boost this number.

**For those of you wondering how I arrived at the investment value at the beginning of 2020… I used a $220k valuation, minus the outstanding mortgage on Jan 1 of last year, plus the balance of my emergency reserve account at the time. Happy to debate with you over a better way to do this – or if you have other ways you work out ROI within a single year, hit me up in the comments!

Other Good and Bad Notes for This Rental Property in 2020

Just for annual review purposes, I like to jot down a few goods and bads for the year. It’s mostly for my own records so I can remember back later in life. For other co-owned properties that I manage, these notes I usually send to my partner investors to keep them in the loop.

Good stuff from 2020:

- 100% occupancy

- 100% rent collected, no late payments

- No major repairs or emergencies

- Tenants happy and likely to renew

Bad stuff from 2020:

- property taxes took a ~9% price hike

- We didn’t increase rents at all

Is 7.3% a Good Return?

Well, in 2020, the total stock market index increased by 21%!!  My piddly little 7.3% doesn’t look so great standing next to a kickass stock market year.

My piddly little 7.3% doesn’t look so great standing next to a kickass stock market year.

That being said, this rental property serves a specific purpose within our long-term retirement plans. It’s a really flexible asset that will give my wife and I various income options later in life. It’s not always about chasing the highest return in a single year.

For a stable property that doesn’t take much of my mental energy to manage, I’m fairly happy with a ~7% return year over year. (Appreciation may add another 2-3% or so on average per year, which is great too). This isn’t a slam dunk investment, but it’s definitely not a loser.

How are your rentals doing? I know a lot of landlords are hurting right now – especially those who own vacation rentals. Do you other investors do annual reviews like this?

Cheers, and have a great week!

– Joel

PS: Seriously if you haven’t figured out your tax stuff yet and are looking for help filing online, HR Block has a FREE basic filing service, as well as they’re offering 20% off these packages for easy self filing!

The post 2020 Review and ROI of My Rental Duplex appeared first on Budgets Are Sexy.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment