The post Why My FIRE Number Keeps Changing appeared first on Budgets Are Sexy.

My wife and I discovered the FIRE movement about three years ago. We’ve always been decent budgeters, savers, etc., but three years ago was when it really clicked for us… “We can retire early!”

It all came down to us figuring out our “FI number” and realizing it was reachable in our 40s.

Why the 4% Rule for Retirement Doesn’t Always Work

Most FIRE enthusiasts follow the 4% rule of thumb to figure out how much money they will need for retirement. It’s pretty simple, you just take your annual expenses, multiply them by 25, and there you have it — that’s your FI number.

That’s a great rule when you’re first starting out, but as you grow older and life throws you more changes, you realize that your FI number is actually a moving target. It changes as your future expenses change.

The reason my wife and I don’t have an exact FI number is because we don’t know what our exact future expenses are gonna be. There are too many variables. And not just small variables, BIG ones, like:

- We currently don’t own a home. We’ve accounted for rent, but this number could change drastically.

- We don’t know which city we’ll live in. Heck, we don’t even know which country we’ll live in.

- Health care costs are a huge unknown.

- We don’t have kids yet. No clue how much they will cost.

Each of these expense variables has a 25x impact on how much we need to save for comfortable retirement. So, instead of shooting for an exact magic number, my wife and I are mostly shooting for a “range.”

Here are our thoughts and some rough calculations…

Figuring Out Our FI Number: Constants and Variables

Before jumping into what we don’t know, here’s some of our living expenses we kinda do know. These are annual expenses based on what we reckon will be a fairly comfortable lifestyle for us.

Food: $6,000

Booze: $3,000

Internet: $840

Phones: $1,200

Cars: $2,400

Gifts/Charity: $5,000

Pets: $2,000

Amusement: $1,200

Travel: $5,000

Miscellaneous: $2,400

TOTAL: $29,040

I’m a round numbers guy, so let’s just call this $30,000 per year in fixed and constant living expenses. (Yes, this number will increase with inflation year after year. At this point, all I care about is Year 1 numbers in retirement.)

$30k x 25 = $750k needed in retirement funds to cover these expenses.

OK, so now we have to add in 3 x variables… Housing, health care, kids.

Housing and Future Rent Guesstimates

Since my wife and I aren’t ready to buy a house, we’ll include monthly rent in our living expenses. This is where ranges come in, depending on the city we want to live in and size of our house.

Low estimate: In Los Angeles, we can happily rent a 1 bedroom apartment in a good area for ~$2,500 per month. (We pay less than this now thanks to a sweetheart deal, but that won’t last forever.) So, total annual would be $30,000 as a safe bet.

High estimate: I don’t think we’ll ever live in a McMansion, but if we need an extra bedroom and wanna be in a good school district or something, let’s say it’ll be $4,000 per month to rent a place. That’s $48,000 annual in rent on the high end.

Low rent: $30k x 25 = $750k needed in retirement

High rent: $48k x 25 = $1.2 million needed

If we get the warm and fuzzies and want to purchase a home somewhere, as long as the monthly payments and expenses are less than $4k for housing, we’re covered.

Health Insurance and Health Care Variables

This one is the toughest for early retirees to figure out. Last year we had an awesome post from the Dragons On FIRE about healthcare in early retirement, which is a pretty thorough guide to trying to work out future healthcare costs.

Free option: For my wife and I, if we end up moving back to Australia, we could potentially get by paying $0 for healthcare. 100% of Australian full time residents have Medicare, and pay nothing for hospitals and doctors appointments. (Private health insurance is also an option, and apparently the average cost is only $2000 per year per person!)

“Cheap” Healthcare: Last year I spent some time evaluating health insurance vs. having no insurance and paying out of pocket for care. My wife and I skated by for almost 3 years without insurance, only paying ~$4k during that entire time ($3k of which was government fines). Per the “national average” for us, our costs apparently would be about $4,000 per year (including fines).

Anyway, I know many of you are going to disagree with this, but I’m gonna use $10k per year as our low annual estimate. This would cover either a basic high deductible health plan (HDHP) premium with low care use, or living without insurance and paying $10k out of pocket per year for fixes.

High healthcare budget: Also in last year’s post I calculated a HDHP insurance plan for my wife and I and worked out that it would cost a max of $20,400 per year. This covers all premiums for the policy as well as maxing out the family deductible every single year.

Low healthcare: $10k x 25 = $250,000 needed in retirement

High healthcare: $20.4k = $510,000 needed in retirement

Future Kids Cost

Quick update on our foster/adopt process: We’ve completed all the pre-approval Zoom classes and most of the onboarding homework. A social worker came and did 1 home inspection so far, and we’ve got a few more inspections, as well as interviews and more qualifying stuff to get through. All in all, I’d say we’re 50% of the way through the county approval process.

If we decide not to have kids: Then our cost is $0 and it doesn’t really affect our FIRE number at all.

Average cost of raising a child in the U.S.: Based on 2019 numbers, the average total cost that middle-income parents will spend on a child from age 0 – 18 is $284,570. If my wife and I adopt a child, I can safely say our expenses will be lower than this, because the state provides free healthcare, a small monthly stipend per child, a TON of support for education services and stuff like that. For our estimate purposes, I’m gonna go with an annual cost of $12,000 per child.

Cost for 1 kid: $12k x 25 = $300k

Cost for 2 kids: $24k x 25 = $600k

Alright, let’s add this all up…

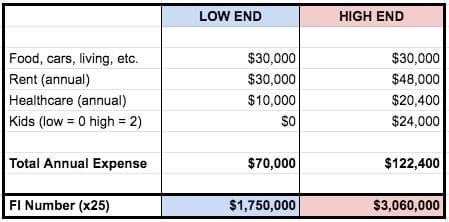

Annual Expense Totals and FI Number Range:

On the low end, it looks like we would need $1.75 million in assets for retirement. We’d live in a modest rental, have no kids, 1 dog, have subsidized or cheap health care, and do all the regular living stuff we enjoy doing today.

On the high end, we would need just over $3 million invested. We’d rent an upscale or bigger home, have a couple kids, a dog, max out our healthcare plans every year, and still enjoy the modest lifestyle we have today.

That’s a pretty huge difference in FI numbers!

Kind of scary to think about… the life decisions my wife and I haven’t figured out yet could have a $1.3 million impact on how much we need to save. And it might be 5, 10, or more years before we are even ready to make these decisions.

Coast FIRE: Options, Flexibility and the Messy Middle

I know a couple in their early 20s who have their entire life mapped out already. They have a dream house picked out, know exactly how many kids they want, plan to vacation in the same spot each year, etc.

On the flip side, I know some people in their 60s who still haven’t figured out what they want to be when they grow up! Having “plans” makes them feel boxed in, so they never commit to anything.

My wife and I are somewhere in the messy middle. We like planning, but we’re also open to change.

Adopting the Coast FIRE mentality means not only is our retirement timeline up in the air, but our magic FI savings number is uncertain, too. As uncomfortable as that may seem, my wife and I are confident that if we aim high and keep trying our best, we can handle both deliberate and unexpected changes as they come along.

Anyway I’ve been asked a lot recently, “What is your FI number?”… And this is why I don’t have a great answer. Somewhere between $2-3 Million?  As life goes on and things get clearer, you’ll all be the first to know.

As life goes on and things get clearer, you’ll all be the first to know.

Do you all have a specific target mapped out? Or are you within a wide range, too?

The post Why My FIRE Number Keeps Changing appeared first on Budgets Are Sexy.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment