The post How Covid Is Changing Americans’ Retirement Plans appeared first on Budgets Are Sexy.

Happy Monday! Who’s ready for kick-ass week?

I’ve been reading a survey conducted by our friends over at Personal Capital that reveals some interesting info about how covid has affected people’s retirement plans.

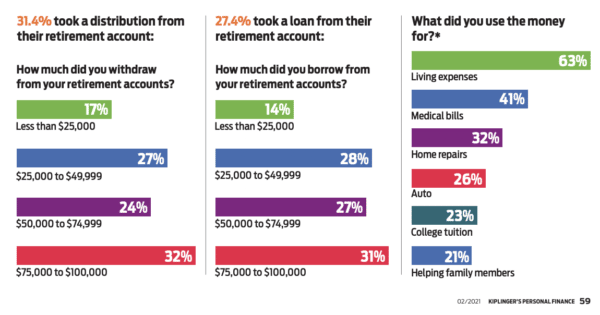

Some of the results are a little scary (like ~30% of people tapped into their IRAs and 401(k)s to fund living expenses last year), but most stats seem apt given that 2020 threw everyone for a loop. I’ll list and discuss the main takeaways below, and if you want to check out the entire dataset, you can do so here.

Also keep in mind that statistics can be interpreted many ways. So take everything with a grain of salt!

Quick Stats About the Survey Participants

This data was collected Nov. 4 to Nov. 10 — right after election day. All respondents were Americans with at least $50k in retirement assets and were “not retired yet.”

Respondents were between 40 to 74 years old, with the biggest concentration (32%) in the 40 to 44 range. They were split equally by gender. Most (86%) were employed (full-time, part-time or self-employed). Seventy-six percent were married.

Enough of that! Here are the interesting finds …

About One-Third of Americans Withdrew Money From an IRA or 401(k)

Part of the CARES Act let people affected by the coronavirus take a distribution of up to $100k from their IRA, 401(k), or similar account without paying the regular penalty.

Looks like about 1/3rd of people withdrew from their retirement accounts, and not just small amounts … more than 30% of them pulled out $75k – $100k. Most funds went to pay regular living expenses.

Regarding the people who “took a loan”… Sometimes taking a *short-term* loan from your retirement account isn’t actually such a bad thing. It’s a tax-free loan, quick process, has no impact on your credit report, and you pay yourself the interest vs. borrowing elsewhere. As long as you pay back the loan within the right time frame, it can be a good fix to a short-term problem.

That being said, I think we can all agree that having an emergency fund is the best way to cover emergencies. This is one of the main survey takeaways I’ll get to at the end.

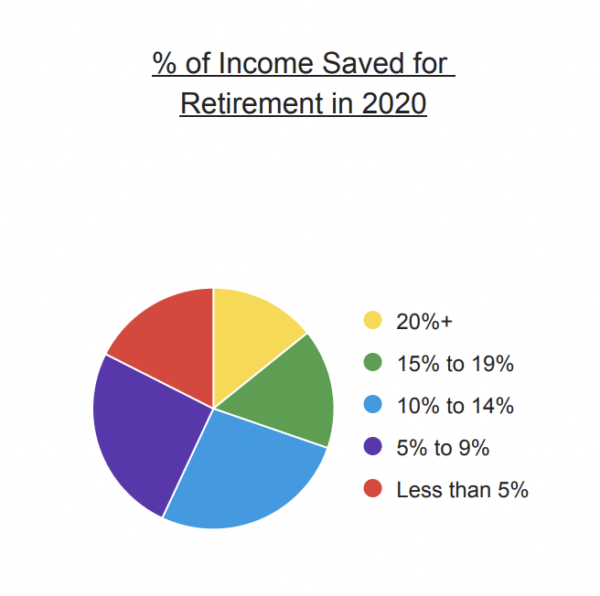

How Saving Rates Changed During the Pandemic

The median savings in 2020 was 12% of income for all respondents. Data showed about 66% of people contributed to their workplace retirement accounts, 37% to a traditional IRA, and 29% to a Roth IRA.

Honestly, this isn’t as bad as I was picturing. And another interesting thing is that almost 80% of people saved the same or more in 2020 compared with what they saved pre-pandemic.

- 53% said there was no change in savings rate pre-pandemic

- 25% said they saved MORE in 2020 than before

- 21% said they saved less than before

- 1% weren’t sure

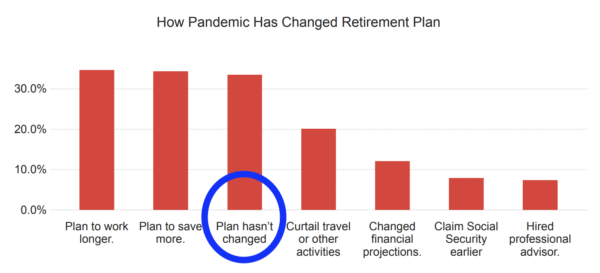

How the Pandemic Is Changing People’s Plans for Retirement

This one is really interesting…

Thirty-four percent of respondents said their retirement plans haven’t changed, and the other 66% of people are mostly planning to work longer and/or save more money.

But, why I find this interesting is because in the section above, nearly 80% of people said they saved the same amount or more than pre-pandemic. This tells me that the pandemic itself didn’t harm their ability to save in 2020, it was more of a wake-up call alerting them to the fact they may not have been saving enough in the first place.

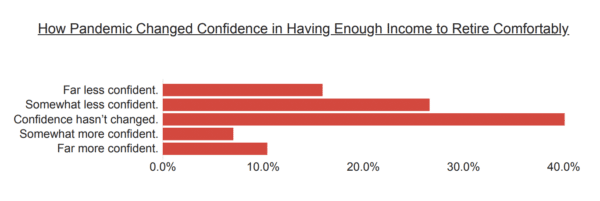

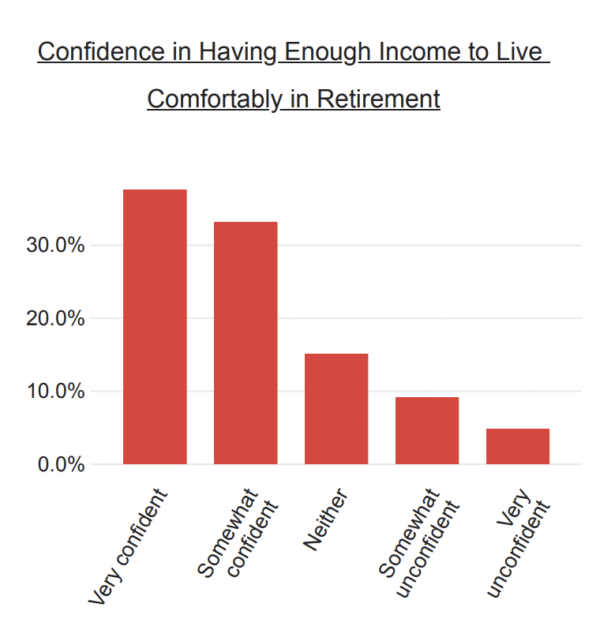

Confidence About Retirement Is Taking a Hit

About 43% of people said they are less confident that they’ll have enough to retire comfortably as a result of the pandemic.

But, although confidence was shaken, still 7 in 10 (71%) respondents said they were confident they’ll have enough income to live comfortably in retirement.

Social Security is a big part of this expected future income. In fact, 1 in 5 people said they expect Social Security will cover >50% of their needed retirement income.

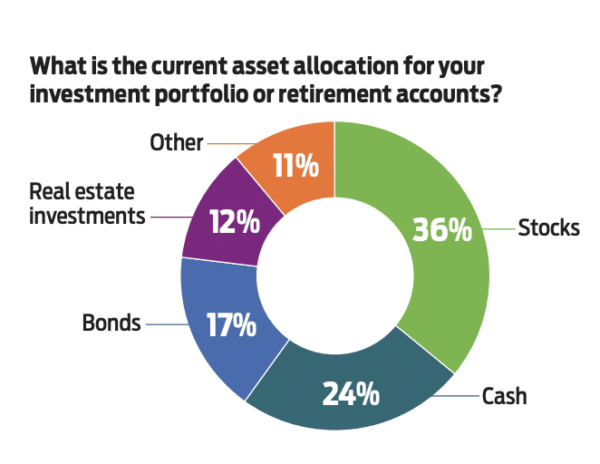

How Americans Are Investing Now — Includes 24% Cash!

Here’s the breakdown of assets in the respondents’ investment portfolios as of November 2020:

I thought I was nuts holding ~10% of my net worth in cash, but these respondents have a huge collective cash allocation at 24%! (They are older than me, so having a less aggressive allocation makes sense I guess). I’m kind of surprised there’s not a larger stock allocation — just 36% here.

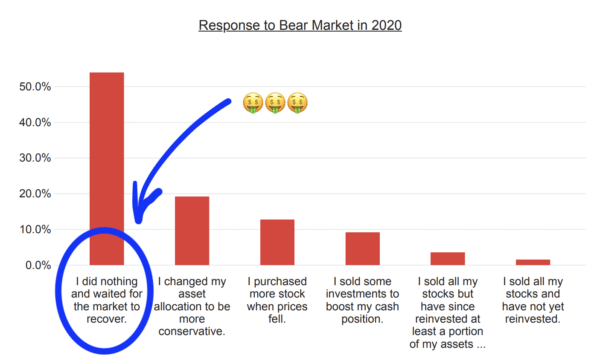

How Americans Reacted to the Market Downturn in 2020:

I’m most proud of the 54% of people who said they did nothing about the stock market and simply waited for it to recover …

This is waaaay easier said than done. When markets drop and everything turns red, it takes a really strong mind-set to think long term and not do any panic selling.

Personally, I sold $40k worth of stocks in a panic in March (mostly to boost my cash position and add to my real estate emergency fund) but ended up re-purchasing those same $40k of stocks about 10 days later. Thankfully, the market declined during that 10-day period, but it could have easily gone the other way.

Two percent of people said they withdrew from the stock market completely and haven’t re-invested any money since.

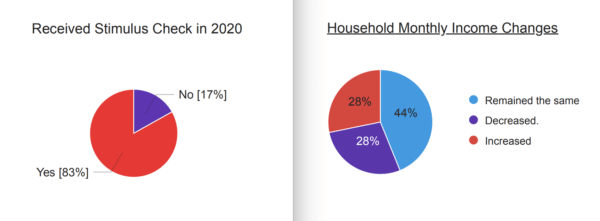

Who Got a Stimulus Check? (and Did They Even Need It?)

This is a little disheartening … 83% of survey respondents received a stimulus check. But only 28% percent of them actually stated that their income decreased…

I think it’s safe to say that a lot of money got sent to people who didn’t really need it (myself included). That’s probably why most people collectively said they saved it, invested it, or gave it to charity.

Keep in mind, this survey was done in November. Income situations may have changed since then (many cities went into more lockdowns for holidays), and another round of stimulus checks went out in late December and January.

What Americans Predict About Economic Recovery

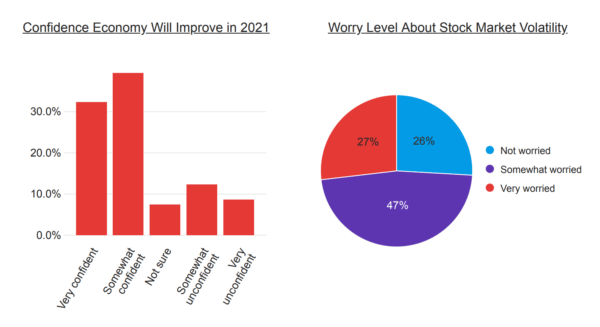

The majority (72%) of respondents are confident the economy will improve in 2021. But 3 out 4 (74%) are still “worried” about stock market volatility.

It’s difficult to interpret this because the questions are quite broad. But I think in general, most people expect 2021 to be much better than 2020 as far as economic improvement. However, they seem very aware that the stock market is detached from the underlying economy and has a mind of its own. (Could also explain why many people are hoarding cash?)

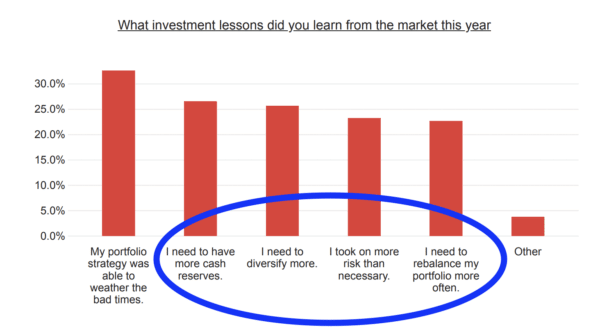

What Investors Learned in 2020

The biggest realization for everyone was that their portfolio strategy was able to weather bad times. Good to know when the next “bad time” comes!

We all need reminders of the other lessons learned, too:

- Check your cash reserves and emergency fund from time to time. Adjust it accordingly when your life situation changes.

- Check your diversification and asset allocation. Diversifying reduces risk by spreading your eggs across multiple baskets.

- Rebalance occasionally as your goals and risk tolerance shifts over time.

- Don’t take on more risk than necessary!

There’s a bunch more facts and general poll data here and here if you’re interested.

******

So, what do you reckon? Do these survey findings align with your experience last year? Have your retirement plans changed? What about you FIRE folks?

Have a great week!

– Joel

PS: Cheers to Personal Capital and to Kiplinger for conducting the survey and giving us permission to use the data and graph images. Personal Capital is a paid affiliate partner of ours, but there are no affiliate links in this post, nor did we get paid to write this.

The post How Covid Is Changing Americans’ Retirement Plans appeared first on Budgets Are Sexy.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment