Should you include your primary home in your net worth?

I got a question recently from a reader about my net worth tracking…

“I was curious why you’re not including your primary residence in your net worth equation? I know many people say it’s not an asset. It’s your home, you have to have a roof over your head, etc.

Just wondered the reason. I include ours in the equation but didn’t know if that’s the typical way. :)”

This question pops up a lot, and it sparks a pretty interesting debate. So I thought I’d share my reply and thoughts with y’all. I’ll also talk about why including your home equity in your net worth calculation could either help or harm your retirement expectations, along with some hypothetical examples!

Oh, and to answer that first question about my personal situation… The reason that I don’t include my residence is because my wife and I don’t own the house we live in. We are renters… and happy ones at the moment!

Is Your Primary Residence an “Asset”?

In general, yes. When you’re taking a snapshot of your net worth, your house can be included in the asset column (and corresponding mortgage in the liability column).

So why do so many people leave their residence out of their net worth calculation? All assets should be included, right?

Well, that’s where we reach a fun grey area…

Remember, Income Production Is a Big Part of Net Worth

A net worth report is just a wealth snapshot from a single point in time. It doesn’t actually explain someone’s true financial trajectory or readiness for financial independence.

Specifically for retirement planning, we need to try and look past an individual net worth snapshot, and try to envision a long-term stream of income. After all, that’s what we’re really saving up for … recurring cash flow we can live off of, not just a big pile of “assets.”

Most primary residences don’t provide income (unless they are sold, refinanced, or rented out). So this is why some people leave out home equity in their net worth reports, because they are more concerned with tracking and growing income-producing assets only.

Here are some examples to illustrate the impact of including (or not including) home equity as a part of your net worth calculation…

Net Worth Examples: *Including* Home Equity

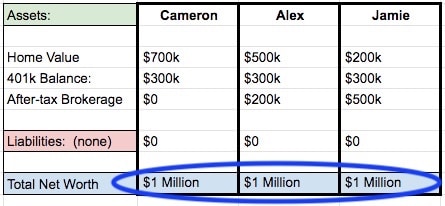

Cameron, Alex, and Jamie all have a personal net worth of $1 million dollars. They have been diligently saving, paying down debt, and investing for the past few decades.

They are all in their late 40’s, have paid off their mortgages, and own their primary residences free and clear. They have zero credit card debt. Woohoo!

Here are their current net worth reports side by side:

On the surface, it would appear that all three of these people are just as wealthy as one another, because their total assets and overall net worth values are all equal. All $1 million.

But, if we drill down into what type of assets they each own and start retirement planning, we uncover a totally different story. Each asset serves a different purpose, which affects how these people meet their financial goals.

Let’s drill down into each individual situation and discuss retirement savings…

Cameron Wants to Retire Early

Cameron’s FIRE buddy recently said, “With a $1M net worth, you can withdraw $40,000 each year (based on the 4% rule), and never run out of money again!”

Cameron loves this idea, because their expenses are about $40k per year. Retiring early would be awesome!

But, Cameron quickly finds 2 problems with their net worth…

- They can’t withdraw any money out of the primary residence. Even if they did a refinance or got a home equity loan, they couldn’t withdraw enough money to provide $40k consistently year over year. Cameron doesn’t want to sell the house or move out, so this $700k “asset” isn’t really useful for retirement.

- Cameron can’t pull any money out of their 401(k) retirement account either – until age 55. (Technically it’s possible to withdraw funds early and pay penalty fees/taxes). So this $300k “asset” isn’t very useful right now either, and wouldn’t last very long if they started withdrawing money from it anyway.

So, even though Cameron has a net worth of $1M, those underlying assets can’t help them retire.

Cameron needs more income-producing assets to make up their retirement savings.

BTW – this is why people sometimes call their primary residence a ‘liability’ instead of an ‘asset’. Cameron’s $700k in equity seems more like a burden than a help at this stage (based on the goal of retiring early). Cameron has a lot more saving/investing to do before they can use the 4% rule to retire.

Alex and Jamie are in a slightly different financial situation, which we’ll get into in a sec…

Net Worth Examples: *NOT Including* Home Equity

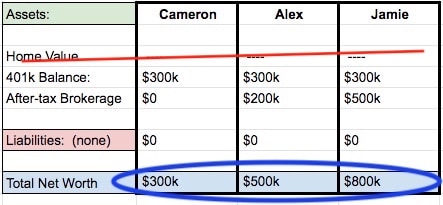

Now let’s look what happens if all three of these hypothetical people *didn’t* include their primary home in their net worth statement. It paints a different picture…

By removing the primary home equity, we now see a pretty huge difference in personal net worth. This gives us a bit of a better view into each of their individual paths to financial independence.

Let’s talk about Alex’s and Jamie’s financial goals…

Alex and Jamie Want to Retire Early, Too

Alex and Jamie also learn about the 4% rule, and both anticipate needing $40k per year in income for retirement.

They each take different routes to reach FI…

Alex realizes they have a $500k net worth and are exactly halfway to their FI number of $1M. Alex plans to knuckle down for another 5 years, putting all excess savings into their after-tax brokerage account. With compound interest on their existing retirement savings, it’s a quick journey to the $1M. Yeehaw!

Jamie has the highest net worth out of them all, at $800k (excluding primary residence). Being fairly close to achieving true financial independence, and still relatively young, Jamie decides to do something a little unconventional…

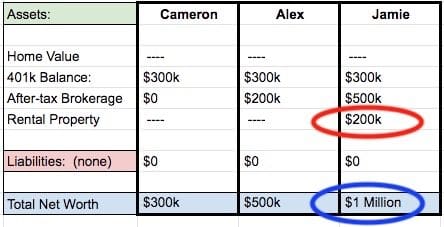

Jamie decides to rent out their primary residence, and travel abroad for 4-5 years. Jamie has always wanted to live in South America, volunteer, and already researched 5-6 cities there that offer a comfortable lifestyle for around $35,000 per year.

Jamie quits their 9-5 day job and buys a 1-way ticket to Panama.

Now that Jamie’s home is no longer a primary residence (it generates rental income and monthly cash flow), the house can be added back to their net worth statement as a “rental property” asset…

Since Jamie now has $1M in net worth made up of income-producing assets, and only needs ~$35k in retirement income the next 4-5 years, they have achieved temporary financial independence living within the 4% rule.

Sometimes Including Home Equity in Net Worth Is a Good Thing

From the scenarios above you might be thinking that adding your primary residence as an asset in your net worth is a bad thing. But, there are definitely benefits to tracking your home equity:

First, it helps track your mortgage paydown and progress, and overall debt to equity ratio. Over time, your house increases in value, and the mortgage slowly decreases in value. It’s fun to watch your equity grow organically, and it’s motivating to track constant progress!

Banks, lenders, and potential business partners like to see ALL your assets included in your financial statement. The more assets you include, the better financial health you appear to be in, and the more favorable you look to do business with. Tracking everything is a good thing in the banking world.

Lastly, even though your primary residence might not be income-producing right now, it might become part of your investable net worth later. Recall Jamie’s scenario above… assets can change in purpose over time, so it’s good to track everything and always consider your options.

Should You Include Your Primary Home in Your Net Worth?

All in all, this is something everyone can really decide for themselves. I think the answer strongly hinges on what you are using your net worth report for.

If you’re tracking your progress to financial independence, and retirement is your sole goal, be careful about including assets that you can’t rely on for retirement income. If you include too much dead equity, you could be artificially inflating your progress to FIRE.

I’m curious to hear what you readers do. Or maybe you keep multiple net worth tracking sheets? It really only takes a few minutes to update – why not do both!?

Via Finance http://www.rssmix.com/

No comments:

Post a Comment