Sequence Of Returns Risk – Why You Should Care

Sequence of returns risk? Sounds like something only old, rich, retired people have to worry about… As long as I save up 25X my annual expenses and hit my FI number, I never have to worry about money ever again, right?

Wrong.

Sequence of returns risk is the No. 1 risk that can cause early retirees to run out of money. So pay attention my young FIRE friends… this stuff is important.

Some of the math can be confusing (it took me a while to wrap my puny brain around it), so I’m gonna try to explain things as simply as I can, using round figure examples. In this post I’m going to cover:

- What is this so-called “sequence risk” that retired people are yapping about?

- Why you might not care right now, but the second you reach FI it will be concerning.

- Why sequence risk worries the FIRE crowd more than traditional retirees.

- How you can lower your risk for when you hit FI!

Let’s get started…

What Is Sequence of Returns?

Sequence of returns is basically the order (sequence) in which positive or negative returns come year after year for your investment portfolio.

We all know the stock market will have its ups and downs, and market volatility is mostly out of our control…

Sometimes the market will go up, up, up, then down.

Sometimes it will go down, down, down, then up.

And sometimes it will go up, down, sideways, up, up, down, down, up, etc. etc.

We usually don’t care about what order the ups and downs are in, because we know in the long run, the stock market will mostly trend upwards. We usually only care about the average investment return over a long period of time.

The average annual return is what we use in our FIRE calculators, our retirement projections, and almost every long-term investment analysis.

This might be OK when you are building wealth, (in fact, we are told never to worry about when the market crashes – just keep investing and stay the course!)… but the sequence of returns has a huge impact when you actually hit FI and start taking withdrawals for retirement income.

Let’s look at some sequence math…

Sequence Example: $100k invested, left untouched…

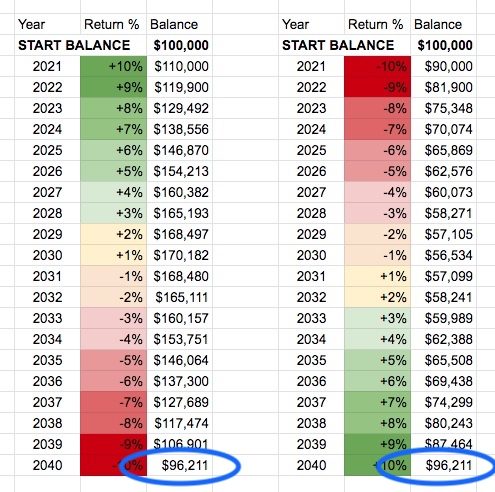

Here are 2 scenarios showing a different sequence of returns over a 20 year period. The left example shows a 10% return in year 1, then a 9% in year 2, slowly losing returns year after year. The right example shows the exact opposite sequence of returns, starting with -10%, then -9%, and gaining a better investment return each year.

Each example starts with $100,000 invested with compounding interest.

As you can see, no matter how the sequence goes (from bad → good, or good → bad), both of these scenarios end up with the same amount of money. They both have $96,211 at the end of the 20 year period.

In fact, you can mix/match these investment return percentages in whatever order you want. The average return will always add up to 0, and the retirement portfolio outcome will always be $96,211 after 20 years.

Now, let’s see what happens when we start to subtract money year over year…

Sequencing Risk: Withdrawing $4k Each Year…

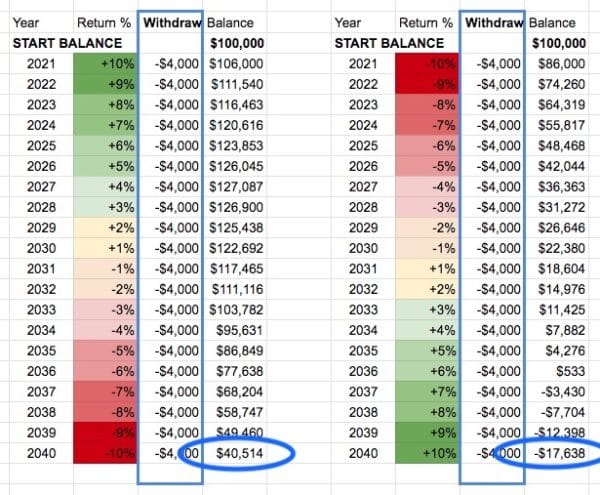

In these examples, we’re using the same sequences as above. We’re also starting with the same $100k initial nest egg, and the only difference is we’ll be taking out $4,000 each year from the investment portfolio.

Wow, this is a pretty staggering difference. Starting in a good market with things slowly getting worse each year for 20 years, the portfolio value on the left ended up with about $40k.

But starting in a bad market, and things slowly getting better and better over time, this investment portfolio on the right would run out of money in year 15!

This is sequence risk. Bad return years at the beginning of retirement throws the portfolio way off course. Even if things constantly improve afterwards, the good years later can’t make up for the severe damage that was done in early years.

Note: My examples are obviously fake return numbers I made up for simplicity. If you want some sequence examples using real stock market returns, check out this calculator here! Different numbers, but proving the same point :)

Sequence of Returns Risk in FIRE vs. Traditional Retirement

Now let’s talk about why the sequence of returns risk feels higher for the early retirement and FIRE community, vs. the common traditional retiree.

Typically, people from the FIRE community retire when the market is “high.” This is because their investment portfolio has grown at a faster pace than usual, and because investment gains are significantly more powerful than their personal contributions.

I’ll illustrate this with some graphs below. **Fair warning: This is by no means a technical analysis, this is just a rough sketch to illustrate a perspective**

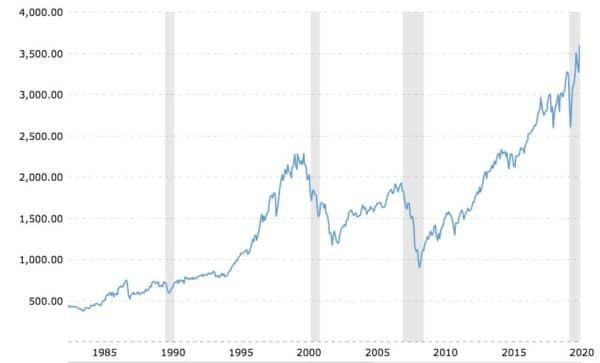

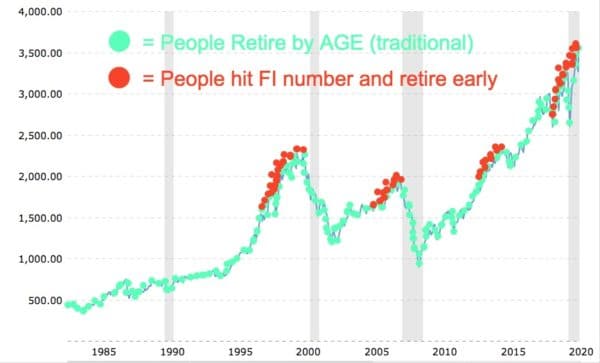

Here is a graph showing the S&P 500 growth over the last ~40 years…

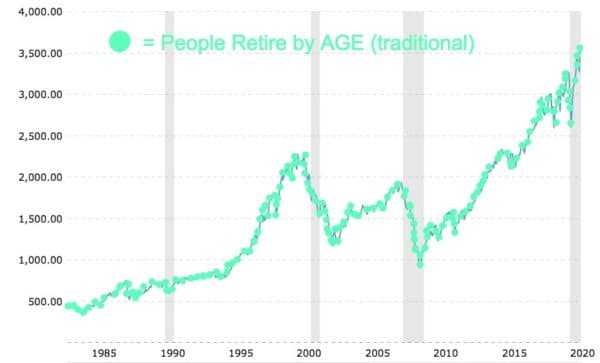

And here, shown in light green dots, is when people retire traditionally. For the most part, people retire when they turn a specific age. Somewhere around 65 – 70 years old… which happens every single year.

Now, let’s look at when people hit FI and retire early, shown with orange dots below… People usually retire early when they hit their FIRE number, no matter their age. And most people hit their FIRE number during excellent economies, when their portfolio has had killer growth.

Again, this is a very oversimplified and highly exaggerated illustration… It would appear that anyone retiring at the top of a bull market is doomed! That’s not necessarily the case.

Just because you have a series of positive returns, it doesn’t mean it will be followed by big negative returns. But, looking at the orange dots, can you see why people retiring early might be feeling a bit more exposed to sequence risk?

The other factor that compounds this issue is longevity risk. Early retirees need their retirement savings to last them many more years than traditional retirees.

The fact is, no matter when you retire, everyone has to plan ahead for sequence risk. Here’s a few tricks we can learn to lower the impact of bad early investment returns.

First, a quick note on safe withdrawal rates…

The 4% Rule and Safe Withdrawal Rates in Retirement

It’s important to note that the 4% rule has a lot of sequence of return risk mitigation already built-in.

The dude who invented the 4% safe withdrawal rate studied all of the past sequences and market returns data from 1925 to 1995. His study concluded “If history is any guide for the future, then withdrawal rates of 3% and 4% are extremely unlikely to exhaust any portfolio of stocks and bonds during any of the payout periods”

This makes me feel pretty good, but not 100% confident. History is a decent guide for the future, but it’s not always accurate. (2020 has proven this true – we’ve experienced many historic firsts this year).

So although the 4% rule was built to withstand bad sequencing risk, most people call it a “guideline,” or “rule of thumb.” It shouldn’t be taken as gospel.

Managing Sequence of Returns Risk

The quickest way to be in a more comfortable position in retirement is to build a slightly bigger nest egg. This sounds like a no-brainer, but if you’re young and in the wealth accumulation phase, why not stay there a little longer and build yourself a buffer?

- Consider saving 33x your annual spend, instead of 25x. This lowers your withdrawal rate to 3%, instead of 4%.

- Consider inflating your future budget numbers a tiny bit, so that in the event you have an immediate market crash you can simply spend less than you were planning for, without impacting your lifestyle.

- When calculating future projections, use conservative growth numbers and account for higher than usual inflation.

You don’t want to enter retirement with the absolute bare minimum saved. You’ll sleep better knowing you have over-prepared and have less risk.

Another way to plan ahead is to keep a large cash reserve bucket when you retire. 1, 2, or even 3 years of living expenses held in cash can be used for spending instead of withdrawing from your portfolio in down years. This may sound dumb, because holding money in cash means it’s not working for you, so your portfolio is growing at a lower average return. But, the goal in retirement is not to accumulate wealth as fast as possible anymore, it’s to preserve capital so it can keep feeding you – forever. Trading a lower return for lower risk is worth it.

Fixed income assets are another tool you can use to lower the impact of sequence risk. This is more preferable than the cash bucket idea, because it has a better risk-adjusted return. You can purchase bonds or annuities that provide a fixed retirement income amount no matter what the market performance is. Again, these types of investment vehicles have a lower return, but could be worth it to lower the risk.

Lastly, a broader asset allocation can help in managing sequence of returns risk. Using rental properties, for example, you could depend on positive rental cash flow to provide a portion of your retirement income, in which case you’re relying a little less on market portfolio withdrawals.

Plan Ahead for Less Risk in Retirement!

It’s funny… As we are accumulating wealth we are taught never to try and “time the market.” It doesn’t matter if the market is overvalued or undervalued, we are encouraged to keep dollar cost averaging with every leftover cent we can afford. Full steam ahead!

But, this attitude needs to change and mature as we get closer to reaching our FIRE number. Lowering risk and preserving our hard earned capital is important – especially in the first few years of retirement.

Other great reads I found while digging around:

- ”Buffer Asset” by PhysicianOnFIRE

- Ultimate Guide to Safe Withdrawal Rates by Big ERN

PS” It’s never a bad idea to consult a financial advisor and have them double check your retirement plan and help in managing sequence of returns risk. Their tools and retirement calculators are very extensive!

Happy Monday, y’all. Have a killer week!

– Joel

Via Finance http://www.rssmix.com/

No comments:

Post a Comment