Way back in the olden days, people used to be amazed at my life story. I was

“The Man Who Retired at 30”, and it was so unusual that it would show up in news headlines all over the place.

Thankfully, this is no longer such a surprising story. The idea of financial independence has spread far and wide with the rise of the FIRE movement, and people now realize it’s not such a big deal after all. And in fact, people are doing more innovative things than I did, and getting themselves to financial independence in less time.

My story was a nine-year working career, and retirement at 30. This was achieved by earning an engineer’s salary, not spending all of it, and investing the surplus in very standard index funds and fixing up my own house.

Today we will to learn about a guy who did it in about three years, and is now financially free at age 27. And this was accomplished on a lower salary, without the cooperation of the badass and high-earning partner that helped me, and without my own honey badger dedication to bike transportation and DIY home renovation.

His secret was simply buying houses in an area with solid demand and renting them out. But with an interesting twist: by partitioning larger houses into smaller, more affordable units, he was able to make a small initial investment go much further, and grow much more quickly.

This is an age-old business model, but it has come back in a newer, better form and today it sometimes goes by the name House Hacking. And my goal with this article is to get you to consider the practice, because it is often the highest hourly wage and most flexible job you can possibly create for yourself. And, if you do it right, you are improving your city by providing a useful service, making housing more affordable and increasing density in a place where it is needed.

What is House Hacking?

At its most basic level, this is just a trendy name for “renting out part of your house as an apartment.” You can go further and add layers of complexity (and profit), for example moving yourself into that apartment and renting out the bigger part of your house, a move which I call the “Mustachian Inversion.” Or go even further and live in a tinyhouse in your own back yard. But at the core, we are still talking about renting aparments.

While it may sound a bit daunting and/or inconvenient if you’ve never done it, the reality is that becoming a landlord is usually surprisingly easy, and also ridiculously profitable. Seriously – almost every one of my friends these days has some form of rental property, and is financially independent. And these two life conditions are usually related.

So if you currently live somewhere with extra space – or if you plan to shop for a house at any point in your future – and you have any use at all for more money, you should consider it seriously.

There are two fundamental reasons that house hacking works so well:

1 ) Rents are Non-linear. Or in plainer English, people pay a lot for their first bedroom, bathroom and kitchen. But they only pay a little bit more for each additional bedroom. So as the homeowner you can sacrifice just a little bit of your space, but get a larger portion of the rent that you would have collected from renting out your entire house.

2) Borrowed Money is Ridiculously Cheap. We are living in unprecedented times, where banks are willing to lend out huge amounts of money at just about zero cost after you adjust for inflation. This effectively makes houses cheaper to own, because you lock in the purchase price today, but pay it off super slowly with dollars that are worth a bit less with each passing year.

With those big puzzle pieces in hand, let’s put the rubber to the road with a real-world example.

In fact I can use myself as a case study because I currently own a house all to myself, with a bit more space than I need.

Dear Self,

I currently have a small house in Longmont, Colorado, which is a fairly expensive market because it is right next to the stratospheric wealth engine of Boulder. The current value is about $390,000 which includes some renovations I have done since I bought it.

The total house size is about 1800 square feet:

- 900 sf main floor

- 500 sf finished basement which includes bedroom, bathroom, and small kitchen/living area

- 400 SF finished 2-car garage which could become living space if I wanted.

I don’t have a mortgage on this place, because I am overly conservative and bought it with cash. But if I did, it would have the following monthly stats:

- Outstanding balance: $312,000 (assuming a 20% downpayment)

- Monthly payment: $1600 (includes principal, interest, taxes+insurance at local rates)

Note: This is assuming today’s 30-year interest rate* of about 3.08%

… a couple of additional details:

- Amount of this that is Principal Repayment (a form of savings): $520

- Actual carrying cost of the house after you account for that principal repayment: About $1080

First of all, wow, isn’t it amazing that you can own a $390,000 house for only a thousand bucks a month of actual cash outlay? That’s the cheap money at work.

But that’s just the beginning of the amazement. Because my house happens to be in a row of townhouse-like identical detached houses located along the side of a small hill. The fronts of these houses have a few steps down to the sidewalk, and street parking. The backs of the houses are accessed by an alley, where we each have a two car driveway, two-car garage, and a ground-level entrance which leads to the sorta-walk-out basement.

This setup is just ripe for creating a separate apartment, and indeed several of my neighbors have already done so. So what if I did it myself?

Scanning Craigsist and Zillow for smallish 1BR apartments in the better neighborhoods, I am surprised to see them in the $800-$1000 range. Especially with off-street parking and the fact that my house backs onto the main bike path and a beautiful greenway with a mountain stream running through it, I feel confident that I could be within this range so let’s say $900.

So where does this leave us?

- Monthly rental income: $900 per month ($10,800 per year)

- Portion of house carrying cost covered: 83%! (900/1080)

- Portion of total house payment covered: 56%

Wealth difference over the first ten years, if you conservatively reinvest the proceeds: about $150,000

Wow! So even in this very beginner situation, I cut my housing costs by 83% and increase my wealth by $150,000. Just by giving up a portion of my spare living space and putting up a Craigslist ad.

I wonder what would happen if we took this even further?

Meet Craig Curelop

(which you can join too)

Craig started with this strategy in a small way, but scaled it up rapidly. It went roughly like this:

2017: bought a house in a less-than-pristine but very central Denver neighborhood for $385,000 (with only $17k down). Lived there in one small room partition, rented out part as an apartment, and rented out the rest as an Airbnb.

Rental Income: $2850/month (plus free rent he values conservatively at $400)

Costs: About $2250 including expenses

Net cashflow benefit: $1000/month = $12,000 per year.

(including principal payoff, this is over a 100% return on that initial $17k downpayment!)

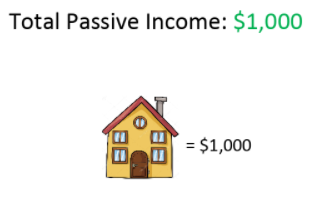

So at the end of year one, Curelop’s portfolio looked like this:

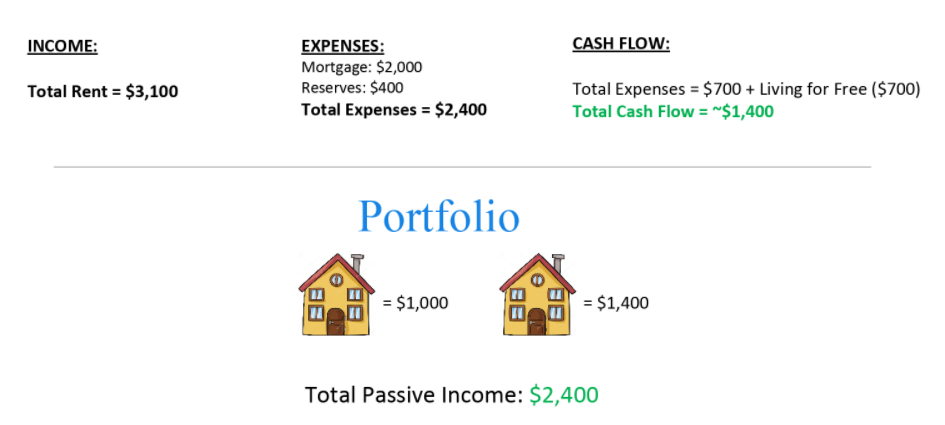

2018: Bought a second house for $343,000 ($27k down including some upgrades). Then immediately rented it out by the room for a total of $3100 per month. Carved out a little space for himself, and moved in. Raised the rent on the previous unit since he wasn’t living there any more. The end result was this:

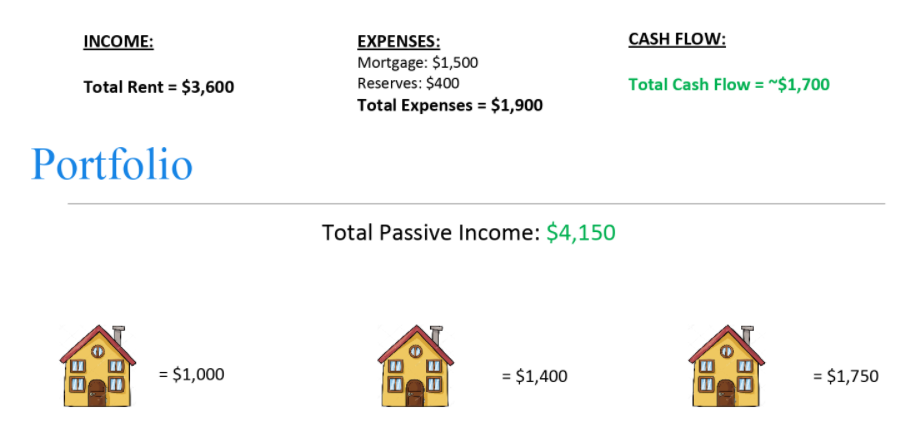

2019: With so much passive income already rolling in, Craig continued to save vigorously and bought another house for $380,000, this time with a 5% downpayment ($19k) plus $32k in repairs and other costs to make it a nice two-unit rental. This brought him to this situation:

And BOOM – at this point Craig was already set for life.

$4150 per month is more than enough to live on, which means he never has to work again – unless he chooses to do so. This happens to be my personal definition of “retirement”, because the old definition of ceasing to work is obsolete. Work is better when you don’t need the money.

And it gets even better. The $4150 number is before taking into account the fact that about $2000 of principal is being automatically paid off on these three loans per month, or that they are appreciating in value at an expected $3000 per month based on expected inflation alone. And thanks to US tax laws regarding property depreciation, a large portion of this cashflow arrives completely tax-free.

And as luck would have it, the Denver real estate market has gone up much faster than inflation in recent years, boosting his net worth by an additional $100,000+.

All of this wealth has been exploded out of an initial cash outlay of only about $100,000. With this amount invested in index funds, the 4% rule would suggest you rely on only about $4000 per year of passive income. Craig is getting about ten times higher returns, in exchange for some good brainpower, a moderate amount of work and some risk – all multiplied by the magical power of massive leverage with money from banks.

A Bit More on Risk

So far, everything sounds almost too good to be true. And indeed, this story is an unusually successful one. Things can and do go sometimes wrong when you use leverage, so it is important to know what could happen:

Interest rates on a fixed-rate mortgage are locked in, so this part is relatively safe.

But economic conditions can flip in a heartbeat. If you have multiple rental houses, you could end up in a situation where all of them are vacant for several months at a time. Or, rents could decline by 20-30% and stay there for a year or more, as may currently be the case in Pandemic-affected cities like San Francisco and New York. If your rentals are in a one-trick town and that industry happens to evaporate like typewriters or coal mining, you could be faced with dropping rents and property prices. The worst case could include defaulting on your mortgages and losing all accumulated equity.

There is no free lunch, but real estate is a fundamentally sound human need – people will always need housing. So as long as you keep your leverage reasonable, your profit margins high, and your lifestyle costs low and flexible, you decrease the chance of big financial stress. Which brings us to our next point: you don’t have to push the limits of leverage far in order to be very successful.

Because Craig has been so aggressive and efficient, it can seem a bit intimidating to hear his story. And in fact, I’m hesitant to even mention that in 2020 he has gone even further and bought seven additional homes, just because he is on a roll and enjoying the game (for now).

Oh, and while most wealthy people go out shopping for mountain houses, Craig is going the opposite way at the moment – experimenting with Van Life, having bought a nicely converted vehicle which is currently parked in the back yard of our HQ coworking space.

But fear not. You absolutely don’t have to go to these extremes in order to become financially independent. Because all you need is enough money, so that you no longer have to think about the stuff. House hacking is simply a very powerful tool to get you there much faster.

So if you do have a use for more money, you should definitely keep this in mind. Even the slightest bit of dabbling like renting out a basement or making sure your next house has a suitable rental space, can cut years off of your mandatory work career, and bring in an income equivalent to hundreds or thousands of dollars per hour that you to put into it.

It’s well worth the hassle, and you just might discover that you love it.

In the Comments: Have you tried house hacking or at least rental real estate? How has it been working out for you?

Do you have a question for Craig specifically? Feel free to ask him here, and I’ll invite him to participate in the discussion. You can also find him at his own website, where he has built a small team for continued real estate deals and other fun, at https://www.thefiteam.com/

Temporary Opportunity just to help a friend: If you are Colorado Curious, you should move here and rent my friends Mike and Kim’s house. It’s an awesome place in the best possible location!

* Indicates an affiliate link – MMM may earn a commission if you decide that Credible’s Mortgage rates or Student Loan Refi Rates are the best for you, see affiliates policy.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment