You Don’t Have to Be Good at Math to Be Good at Personal Finance

Happy Friday! Who’s looking forward to an awesome weekend!?

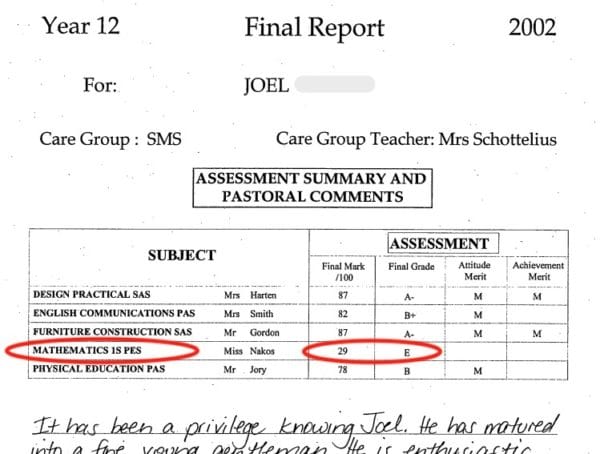

Today I’m gonna share something a little embarrassing… It’s the final report card from my graduating year at high school. Check this out:

As you can see, Math was my worst subject. 29 out of 100… I’ve never scored lower than 29% on anything in my entire life! This class was the rock bottom of my formal education.

But, before you label me a complete idiot, you should know a few things about Australian high school vs. American high school:

- Australia has wicked high standards for curriculum. For example, this high school Math class “1S PES” included Applied Calculus – stuff most Americans usually don’t get taught until later in college. No wonder I sucked at it, I was only 17!

- The grading system is wacky down under. For example, I received the highest Art Design score in the whole school (and still only got 87%). In the US, many schools give the highest person 100%, then grade the entire class based on a curve.

- In the USA you must pass every class to graduate from high school. For AUS they go based on weighted averages. You can suck really bad in 1 subject and make it up by overachieving in others. This is how I passed high school.

Anyway, no matter which way you look at it, I was labelled “bad at Math.” All my teachers, my peers, and my grades told me that I would never be a numbers expert. I received merits in every other subject.

This report card is from 18 years ago. Today, I have a job writing about finances, of which some stuff has a heavy math focus. How can a guy who barely scraped through high school get a job writing about numbers? How can a guy like that become financially independent and be able retire early in life?

Here are a few things I’ve realized about math and personal finance. I hope these insights encourage others who may have been (or currently are) a similar type of student as me.

1. You don’t have to be good at math to be good with money

Many people think becoming a millionaire is complicated and you have to have advanced knowledge in investing, economics and complex math. This simply isn’t true.

Kicking ass in personal finance is a simple and repeatable process, no matter your level of education. It’s based on proven principles and habits…

- Work as hard and smart as you can

- Earn as much money as you can

- Spend less than you earn

- Save and invest the difference

- Repeat this for many years

After high school I jumped straight into the workforce while my ‘smart’ friends went to college. I always felt bad about this, like they were getting smarter and smarter, and I had given up on education. I hate to admit it, but I let my high school report card define who I was for a long time. Big mistake.

Then somewhere around my late 20’s, I looked around and realized I had more money than most other people my age. I realized that my growing wealth wasn’t because of my academics, or lack thereof… It was due to my subtle daily habits and following the basic money principles.

You can be the smartest math genius in the world and still be flat broke later in life. And you can be a high school dropout and become financially independent in your 30s. Don’t ever let bad math grades convince you that you’re bad at money or will never be wealthy! If you’re not convinced, just read The Millionaire Next Door and learn what most true wealthy people are like. :)

2. Formal education vs. self education

School while you’re young is important. Your mind is a sponge, you have unlimited spare time, and education is packaged nicely into 1 hour classroom learning sessions.

Learning as an adult is much harder. And inconvenient! It requires self motivation, discipline, and time to acquire knowledge. Many young kids think that when college is over, the learning stops. This isn’t the case at all!

The reason I’m better at math today and can comprehend finance stuff is because I slowly built up knowledge over time. Books, podcasts, blogs, independent courses and asking good questions all contributed to my education. And, I’ve still got a loooong way to go!

If I could go back in time and give advice to my high school self, it would be:

- Just because you’re not great at something today, it doesn’t mean you will never be good at it. Learning never stops.

- If you didn’t learn something in school, or from your parents at home, that’s OK. There are a ton of places you can pick up knowledge and learn as an adult.

- In school, a report card tells you how well you’re doing. In personal finance, your net worth is your report card. It is the single best tool that tells you if you’re on the right track, or need to study harder! Your school report card goes away in your 20’s. Your net worth report card never goes away.

3. There’s a calculator for that!

My grandpa once sat me down and said, “Joel, if you ever don’t know how to do something in life, that’s OK. Because there’s someone else out there who knows how to do it – and you can always hire them to do it for you.”

As a kid I was self-conscious about my education (still am a bit I guess). But Grandpa helped me realize that it’s OK not knowing everything. As long as I know where or how to find the information when I need it, I’ll be fine.

- Don’t know how mortgages work? That’s what mortgage brokers are for! They do it all day, every day.

- Not good at spreadsheets or calculating formulas? There are a TON of free resources online where people have created stuff and simplified it down for beginners.

- Can’t calculate your effective tax rate based on your AGI or determine how much capital gains harvesting is best for your 2020 filing? Don’t stress! There are calculators to help you with all that stuff. CPAs, tax professionals, and random enthusiasts can point you in the right direction. It’s OK that you don’t know.

Giving up on improving your finances because “math is too confusing” is like slashing your other 3 tires because you have 1 flat. Just call in an expert for help and get back on the road :)

Have an awesome weekend, all! Stay safe out there!

– Joel

PS: I was a guest this week on a fun podcast called Friends on FIRE! We chat about habits, happiness, and hard work :) Check the show out here, or wherever you regularly get your podcasts from. Cheers to the hosts Maggie and Mike for having me!

PS: I was a guest this week on a fun podcast called Friends on FIRE! We chat about habits, happiness, and hard work :) Check the show out here, or wherever you regularly get your podcasts from. Cheers to the hosts Maggie and Mike for having me!

Via Finance http://www.rssmix.com/

No comments:

Post a Comment