Is Health Insurance Worth the Cost? Because Daaaaaang, It’s Expensive!

When I mentioned a few months back that my wife and I haven’t had health insurance for the past couple years, some of you thought I had lost my marbles. Thank you to everyone who emailed me their thoughts and were concerned about my family’s well-being.

Some good news — starting October 1, I am now eligible for employer sponsored health insurance. As a new employee, I don’t even have to wait for open enrollment.

But, it’s not all roses … health insurance is expensive!

Is health insurance worth the cost?

Hard question, because everyone values health insurance differently.

Some people with chronic health issues absolutely depend on insurance to cover medical expenses. Others haven’t visited a doctor in decades and see little value in insurance. Some people enroll in health insurance only because they get a hefty discount (or get it free) from their employer. And sadly, many people out there simply can’t afford health insurance.

It’s a crazy landscape. Everyone’s health situation is different. Everyone’s risk tolerance and attitude toward insurance is different.

Let’s take a look at my new health insurance options and run some medical issues and cost scenarios. You might see how hard and crappy it is for young and healthy couples to make a decision on health insurance. I’ll also share some of my experiences paying for health care out of pocket the past few years.

My New Health Insurance Benefits — Plan Options

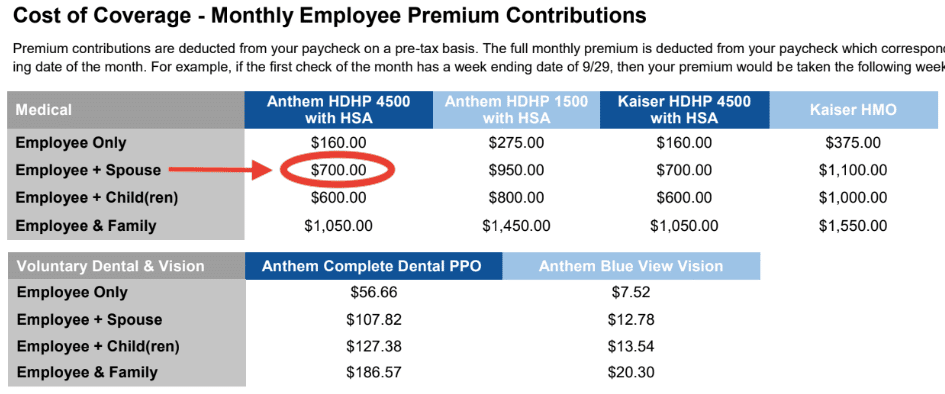

As a California resident, I get to choose between Kaiser or Anthem insurance. Both providers offer only 2 plans each through my employer. Here are the monthly costs …

The Anthem HDHP 4500 plan is recommended to me and my wife based on our health profile. It’s also the cheapest monthly cost to cover us both. Circled in red, this is $700 per month, or $8,400 per year. Ouch.

HDHP stands for High Deductible Health Plan. The reason the deductible is “high” is because this $700 monthly premium is considered “low”.

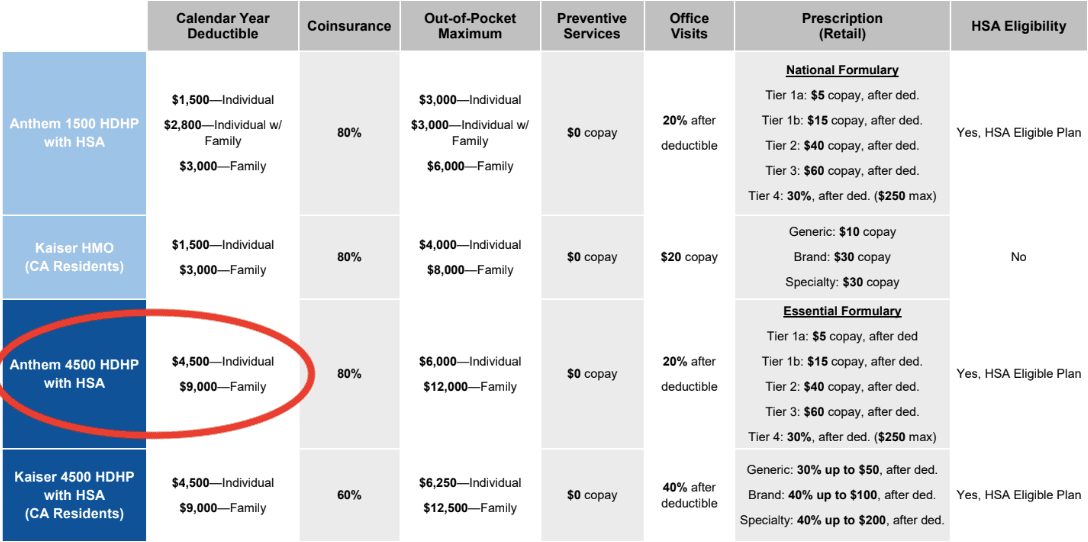

Now let’s take a look at the deductible and what health coverage these plans include…

Looks like this Anthem plan has a $4,500 deductible. The deductible is the amount paid out of pocket by the policyholder before an insurance provider will pay ANY expenses.

So on top of the $8,400 annual plan cost, I am responsible for paying the first $4,500 (Or $9,000 for me AND my wife) in care costs before I see any financial benefit from this insurance plan. Actually, that’s not completely true … This plan will throw me a few free preventive care visits or “check-ups” each year. Apart from that, it’s $12,900 in total before the insurance company chips in a single cent.

So Is Health Insurance Worth the Cost?

Well, everyone defines “worth it” differently. Let’s just look simply at the financial calculations for a moment …

For me to realize any financial value from this health insurance policy, I would need to spend $12,900 in care in a single year (either me OR my wife). Or, $17,400 if we both wanted to see value from the plan.

Will I need more than ~$13k in medical service in the next 12 months? I have no clue! (and I certainly hope not!). It depends on what goes wrong throughout the year. Let’s run 3 different health care scenarios for the upcoming year and compare my out of pocket costs of having insurance vs not having insurance.

*Quick note: In the great state of California, they issue a fine for people without a health insurance policy for 2020. This fine is a maximum of $750 per person, so I’ll be including $1,500 in annual fees in calculations for the non-insurance examples.

Scenario #1: A “National Average Year” (Not Much Health Care Needed)

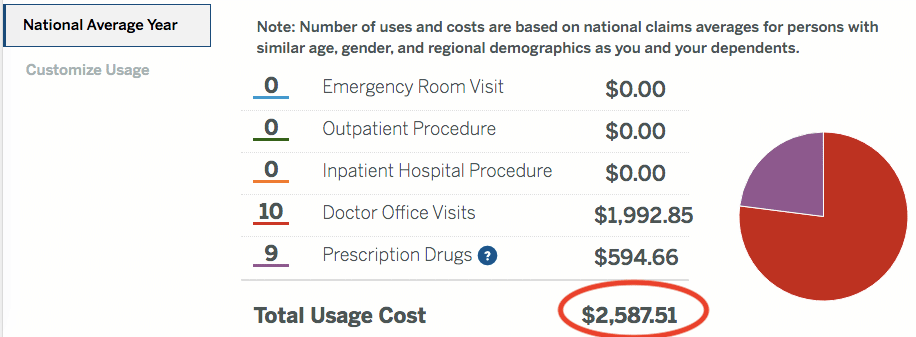

According to the calculator on my benefits website, the national average for a married couple like me and my wife would come to 10 x doctors visits, 9 prescriptions, 0 emergency room visits and 0 surgeries.

The total cost would be $2,588 in medical costs for the year.

Now because this is less than the $4,500 plan deductible, I would be responsible for paying this cost out of pocket whether I had insurance or not.

Annual Cost with insurance: $10,988 ($8,400 annual premium + $2,588 in care)

Annual Cost NO insurance: $4,088 ($2,588 in care + $1,500 no-insurance fines)

In an average low-health-issue year like this, my wife and I would be better off without family coverage, even if we took on a $1,500 fine. This is how we have gotten by the past couple of years, which I’ll explain more below.

Scenario #2: An “Unusually High Year” (Getting Sick and Hurt A LOT)

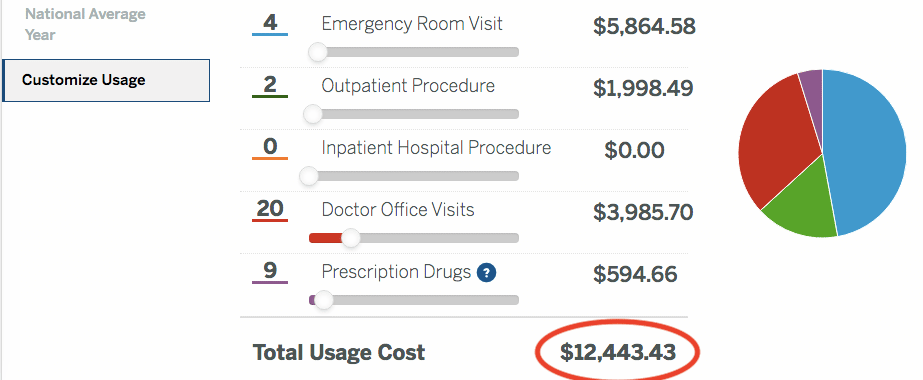

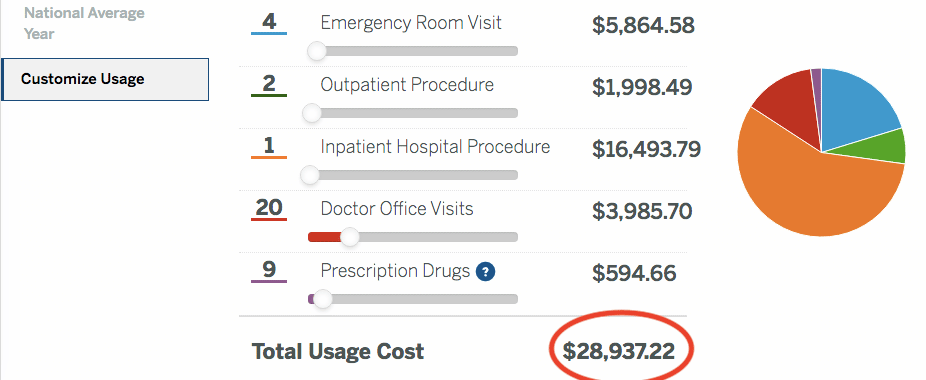

In this scenario, I added 4 x trips to the emergency room, 2 same-day surgeries, and doubled the amount of doctor visits to 20.

Even though a year like this has low probability, it could happen. Disaster strikes at any time and health problems affect everyone.

Annual Cost with insurance: $14,400 ($8,400 annual premium + $4,500 deductible, + $1500 in additional 20% of co-pay. $6k is the plan max out-of pocket)**

Annual Cost NO insurance: $13,943 ($12,443 in care + $1,500 no insurance fines)

Hmmm … I didn’t expect this outcome. Looks like having no insurance still works out financially better in this scenario.

**This calc is based on either myself OR my wife having all the health issues. If we split these doctor and emergency room visits between us, we’d have to cover our family deductible ($9k), so the cost would actually be just over to $18,000 total.

OK, now let’s add a horrible in-patient surgery to the mix …

Scenario #3: “Horrible Year” (Major Surgery Needed)

Here I’ve added an in-patient surgery or major event staying overnight at the hospital. This is on top of the unusually high year scenario we just reviewed…

I wouldn’t wish this scenario on anyone. But unfortunately, it happens every year to people around the world. Insurance not only provides financial coverage, but also peace of mind in traumatic times.

Annual Cost with insurance: $20,400 ($8,400 annual premium + $12,000 out of pocket family max)

Annual Cost NO insurance: $30,437 ($28,937 in care + $1,500 no insurance fines)

For a horrible year like this, insurance would save us an additional $10,000 medical bill. It would still be an expensive year out of pocket ($20k) but we could rest well knowing that this is the worst it would get financially. Insurance pays off financially when extensive care is needed.

Covered California Options

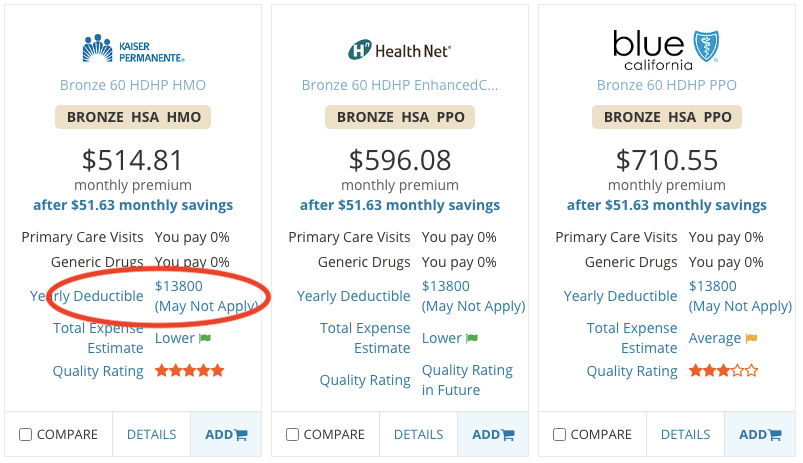

Another option I have is to decline medical coverage through my employer and look for a cheaper health plan elsewhere. Covered California is a program under the Patient Protection and Affordable Care Act. It provides tax credits to offset private health insurance costs depending on your income level. My household size (2) is eligible for some credits, as long as our income is under ~$100k.

Using their quote tool and an example income of $70k per year, here are the HDHP options available for my family coverage …

Although two of these plans have a lower monthly health insurance premium than my new work options, the deductible is much higher… $6,900 per person, or $13,800 for our family max. Saving a few thousand in one area seems to just cost us more in the other.

Surviving Without a Health Insurance Plan

Health care is a sensitive subject. So before going on I want to acknowledge how lucky and blessed my wife and I are to have not had any major health or financial problems the past few years. It’s unfair that some people are born healthy, while others have continuous medical problems. Our decision to be uninsured was one based on our personal risk tolerance and financial situation, not because we think we are immune to health issues. Our chances of unexpected health disasters are the same as everyone else our age/sex/race etc.

When I quit my corporate job in March 2018, I got a letter shortly afterwards explaining my options for COBRA (Consolidated Omnibus Budget Reconciliation Act). This was basically an option to continue paying for coverage at my old employer’s insurance rates for up to 18 months. The problem was, this rate was $1,600 per month and had more coverage than what we needed! I never realized how much my employer covered while I was working there — something I will pay attention to next time for sure!

My wife and I declined the expensive COBRA option and planned to look at cheaper alternatives, and possibly short term health insurance to cover us for a few months in case we started work again. After searching around a little bit, it became a lower and lower priority. Weeks turned into months, and we realized we could probably stay without insurance for another year. Paying out of pocket was just easier and proved to be cheaper.

Out of Pocket Costs

Since mid-2018, we’ve paid a total of $1,190 for medical services and care. (We’ll also pay an additional $2,890 total in fines for having no health insurance in 2018 and 2020). So about $4k total so far.

Believe it or not, the $1,190 in care included a 1-day out-patient surgery for my wife, about 10 clinic and doctor visits, and a few physical therapy sessions. While traveling in Africa I got pretty sick with a fever, but thankfully recovered naturally by staying in bed for 2 days. My wife and I also both got bad bronchitis while traveling in Australia — but thanks to the awesome clinics down there we recovered with antibiotics that cost less than $20, and a lot of rest. We’ve been extremely lucky.

Local clinics and student medical facilities were pretty easy to find in Los Angeles. We didn’t qualify for Medicaid … Even though we were unemployed most of 2018-19, our income exceeded the Medicaid limit (Max of ~$22k for household of 2). But, since our income was still considered “low”, we qualified for other financial discounts and programs. I didn’t know these even existed. This is how we got my wife’s surgery so cheap. Our local clinic referred us to a hospital that had crazy cheap financial plans and offered discounts to lower income households and people without insurance.

I was a little skeptical at first about the level of care at small clinics but quickly found that the services were on par, or better, than regular physician offices I’ve been to in the past.

Healthcare Blue Book is an awesome website that shows typical and “fair” medical costs for all types of procedures, lab tests, and medicines. Check it out if you find yourself wanting to estimate your out of pocket costs, or want information to negotiate a ridiculous medical bill.

Health Care and Retiring Early: What Should We Budget for the Future?

Our lack of insurance can’t go on forever. As my wife and I get older, our health risks increase, and insurance will become more and more valuable. Having no insurance was always a temporary decision. Same with dental insurance, and vision insurance (and maybe pet insurance for Cooper!)

What will the costs be in the future? What do I put in my future budget and how do I calculate my FIRE number to cover my future needs?

Health care is my biggest unknown. As a placeholder, I put in $10,000 per year for health care just so I could have a line item in the budget. Now I’m thinking this number is horribly low. Even if we do get cheap or subsidized care during retirement via Medicare or Medicaid, there’s still a lot of costs involved and potential disasters.

I haven’t figured it all out yet. I’m no expert. My wife and I will be working for at least the next 5 years, so we have time to make changes and adjust the budget as needed. Our FIRE number is a work in progress.

Important Considerations I Didn’t Cover Fully in This Post

- HDHP plans allow you to contribute to an HSA account (Health Savings Account). HSAs are probably the most tax efficient investment vehicle, available only to those with HDHP plans. So if I utilized an HSA, my overall “costs” for insurance could be lower.

- If I went with my employer-sponsored health insurance, the premium would come out of my paycheck on a pre-tax basis. So in my comparisons above, the annual premium would be slightly lower because it’s not counted in my taxable income. Actual savings depend on your tax rate, and ours will be probably pretty small in 2020.

- No matter if you have insurance or not, a large emergency fund<span style=”font-weight: 400;”> is necessary to cover out of pocket costs and deductibles. I’m calling this out because even if you have insurance, you can still have huge medical bills just meeting the deductible.

- Care costs included in my examples were all estimates provided by my benefits website. In reality, prices are different from doctor to doctor, provider to provider, and sometimes “cash” prices are cheaper or more expensive vs. pre negotiated insurance rates. Many costs are even negotiable. Healthcare Blue Book is a wicked resource for specific cost estimates!

TLDR & Summary

- Woohoo, I qualify for health insurance through my work!

- But it’s still expensive … family coverage will cost $8,400 per year, with a $4,500 deductible each. Boooo.

- Medical insurance might not be worth the cost if you are young, healthy, or have low income.

- Wife and I survived on no insurance for a few years for ~$4k. We are lucky.

- Health care is tough to figure out for early retirees. More to come one this!!!

No comments:

Post a Comment