10 Ways to Stop Impulse Spending

Do you know how easy it is to blow $10,000 in 1 year on useless crap? Easy! Just do $27.40 of mindless impulse spending each day for a year.

Everyone falls victim to some type of impulse buying. For me, it’s usually at the brewery right before I pay the bill and leave. I see those fancy branded pint glasses with the brewery logo on it… Suddenly I convince myself that it’s important to “support the brewery” (as if paying $9 per beer wasn’t already enough!) so I add a few little mementos to my purchase.

Then when I get home I realize I’ve somehow been tricked! My cabinet is already full of ~80 other impulse purchase beer glasses that are just sitting there collecting dust.

Why do I keep doing this!!? How can I stop?

Some surveys show almost 90% of us make impulse purchases somewhere, somehow. And not just cheap stuff. Most people admit to buying things in the $100+ range for impulsive buying! Covid seems to have both helped and harmed our spending habits. While some people have become more frugal, others are increasing their online retail therapy. In the USA we are buying more video games, toys, home improvement stuff, and electronics.

What triggers impulse spending?

I always thought impulse spending was something you can control internally. But just when you think you’ve got your emotions under control, retailers come out with new marketing tricks, tactics, and methods that beat your internal programming. Those crafty buggers!

We have to be aware of both our own emotional spending habits as well as watch out for retailer trickery.

Personal triggers for impulse purchases

Our mood: Impulse spending mostly happens when we are extremely excited (~50%) or bored (~30%). Shopping while intoxicated doesn’t help!  And shopping while hungry doesn’t help either!

And shopping while hungry doesn’t help either!

Our age: The younger you are, the more likely you are to make an unplanned purchase.

“Status awareness”: Those who notice what other people own or are doing tend to buy things quickly to feel included.

Instant gratification: This happens when you mix wants and needs with “right now!”

Subconscious habits: Grabbing a candy bar at the grocery store checkout is a common spending habit people do without realizing.

E-commerce vs. retail environment: Most impulse shopping used to happen in-person when the shopper was holding the physical product in their hands. However, our online buying is growing so the “thought of owning” is one of our spending triggers.

Retail trickery that encourages impulse buying

Store design or walking path: Physical shops are designed to make you walk near, past, through, under and over high demand items! They’re placed in areas easy to see and pick up. Things placed near the check-out lines are put there to trigger impulse buying. Online stores do this too, via a “virtual click path” while you are checking out!

Music, fragrance, and sexy signage: Stores will do anything to put you in a happy, relaxed and buying mood.

Time limits & urgency: When we read “promo ends in 12 hours” this triggers our fear of missing out on a deal. Also things like “Only 1 left in stock” makes us want it even more.

30-day money back guarantee: These offers make us think there’s no harm in buying, because we can easily return it if we decide later we don’t want it. Usually, we are too lazy to return things, even if we don’t need them.

“FREE shipping” or “Buy one get one FREE”: Everyone likes the word FREE, even if we have to pay for it!

Personalized and targeted ads: Almost all online advertisements are personalized via your location, internet search history, things you “like,” your demographics and more. It’s scary how much information is collected on you over time and used against you to encourage you to impulse buy. Don’t even get me started The Social Dilemma!

Tips on how to stop impulse spending (or at least reduce it!)

- Limit social media use! I’m not sure if you’ve heard of Facebook or Instagram… They are cool apps you can download on your phone that let you look at ads whenever you feel like it.

But seriously, social media is designed to excite you, then sell you stuff. Limiting usage limits your impulse buying.

But seriously, social media is designed to excite you, then sell you stuff. Limiting usage limits your impulse buying. - Log out of Amazon, or whatever online stores you regularly buy from. When you are forced to enter your Username and PW manually, it becomes less convenient to buy things and gives you time to second guess your purchases. The “1-click-buy” buttons encourage impulsive spending!

- Carry cash or a debit card instead of credit cards. I know, this seems so inconvenient! But, a bunch of research proves credit cards make you spend more, and makes unplanned spending less painful. Using cash or a debit card makes you think of the immediate impact on your savings account.

- Use apps and plugins to help limit spending! Icebox by Finder.com is a Chrome extension that changes the “Buy” button to a “Put it on Ice” button. This gives you time to re-think your purchase and stops impulse shopping. Another cool chrome extension is Amazon Contemplate that ads a 30-second wait time before you can go through with a purchase. In this wait time you can think about if you really need it!

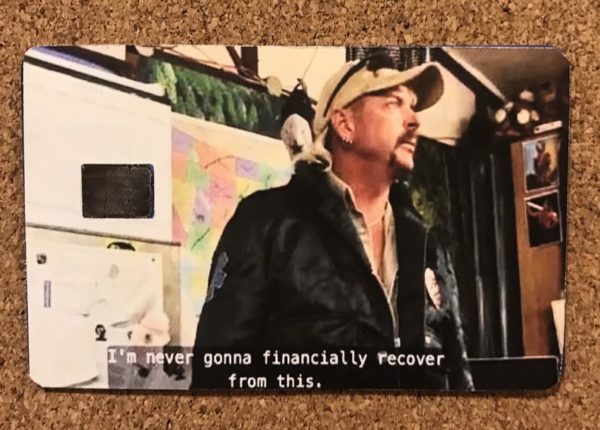

- Get a credit card sticker or decal. When you pull out your cc to make a purchase, you’ll be reminded by Joe Exotic, Terry Crews, or other fun messages that impulsive shopping is bad, and saving instead is good! You can also just write reminder messages with a sharpie all over your cards.

Joe Exotic Credit Card Decal on Etsy! - Get an accountability partner. You can share your budget with a friend, make commitments, and hold each other accountable. People do less spending when they are being watched. :) (My wife and I share a Mint.com login – we see each other’s transactions and keep one another in check).

- For holiday shopping, go in with a list! Impulse purchases happen when you have no particular item in mind. Start a “gift ideas” list and keep it on your phone. Throughout the year when you see cool stuff that you want to buy others, jot it down in your list. When the holidays come around you will be more prepared for specific spending vs. unplanned spending.

- Calculate the cost of things in time or work-hours, instead of dollars. For example, if you earn $20 an hour and you see a $40 t-shirt you want to grab, that would cost you 2 hours at work to buy. Is it worth it? This method applies more logic to your decisions vs. emotional spending.

- Return stuff! Over half of people who do impulse shopping admit they feel regret or remorse when they get home. If you fall in this category, make yourself return the items. Many people feel embarrassed or are too lazy to go through the return process… Don’t be one of them! Return policies exist if you change your mind – take advantage of them.

- Start a good ol’ fashioned no-spending challenge. If these seem boring and hard to do – that’s because they are supposed to be! When I do a 60 day no alcohol challenge, my chances of buying excess crap at the brewery drop to zero. No spending challenges can be done with specific categories like clothes, fast food, or guilty pleasures, or try not spending anything at all!

How do you resist temptation and cut back on impulse buying?

Via Finance http://www.rssmix.com/

No comments:

Post a Comment