Should I Refinance My Rental Property?

With interest rates so low right now, a question on every homeowner’s mind is, “should I refinance my mortgage?” And what about doing a refinance on a rental property?

It takes a fair amount of effort to refi — it’s just like qualifying for a brand new loan. There’s also hefty closing costs and fees… Is all that money and time worth it for a lower interest rate?

Luckily, the internet has smart calculators to help figure all this stuff out!

Let’s run some numbers on my current Texas rental property and see what a hypothetical loan refinance would look like. Let’s also look at a cash out refi, just for the heck of it.

Current mortgage on rental property

- Original loan amount: $136,500 (today there’s $123,235 left to pay off)

- Current interest rate: 4.125%

- Loan term: 30 years (started in 2015, so 25 yrs remaining)

- Monthly payment: $662 per month

I sent all my property info to a mortgage broker, and they were able to send me back a quote for an updated interest rate and closing costs for a new 30 year fixed rate mortgage. This is under the assumption that I have excellent credit (I do!), and that my income could qualify for the loan (I actually don’t think it will). Regardless, here’s the quote I got on Aug 13th:

New refinance loan quote

- New interest rate: 3.65%

- Mortgage term: 30 years (starts a new 30 yrs all over again)

- Closing costs: $7000

- Loan amount: $130,235 (current outstanding balance + $7k closing costs)

- New monthly payment: $596 per month

Now, before you start grilling me and comparing my rate to the killer sub 3% rate you just got on your home refi, please understand that an investment property loan is treated differently than an FHA loan. Investment property loans have higher interest rates (typically 0.5 – 0.75% higher), and banks have a little higher closing costs, too.

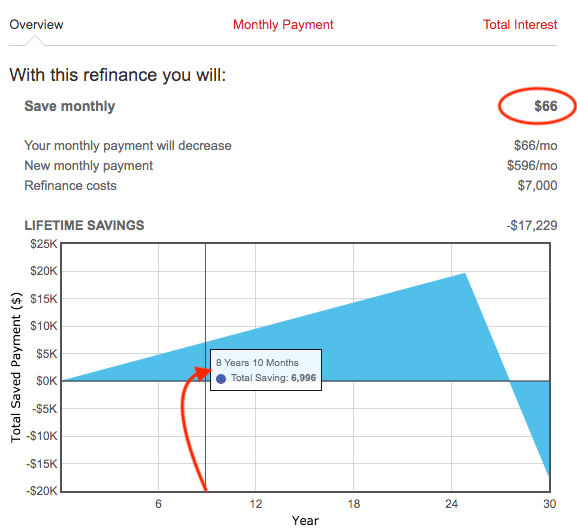

All in all, this refinance option would reduce my monthly payments by $66 per month, and add $7k to my overall loan amount for closing costs.

(I’m using a refinance calculator available on Realtor.com)

Is this a good deal? Well, it depends on my investment goals…

The purpose of refinancing

With a mortgage on the house you live in, most people want to pay down their debt as quickly as possible, reduce their overall interest to the bank, or drastically lower their monthly mortgage payment. These are the common reasons people refinance.

This being an investment property, my motives are a little different than a primary residence. I don’t really care about paying off the loan early, nor do I mind about the total interest paid over the life of the loan. My main consideration is increasing cash flow. This is the difference between the rental income and my expenses.

So for me, the biggest benefit of refinancing today would be the reduction in the monthly mortgage payment. This would be an extra 66 bucks in my pocket each month.

But, it comes at a price. I’d have to invest (or borrow) another $7,000 to achieve this $66/m reduction. In the picture above you can see it will take 8 years and 10 months to reach a breakeven point.

At these figures, I don’t think a basic refinance makes sense right now.

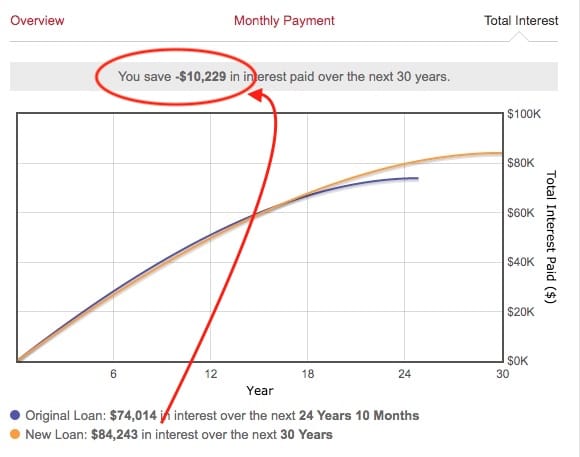

Just for fun, check out the total interest paid on the new loan vs. the old loan. If I was to go ahead with this refi, and keep the loan for a full 30 years, I’d end up paying an additional $10,229 in mortgage interest over the loan term. Kind of sneaky!

What about a cash out refinance?

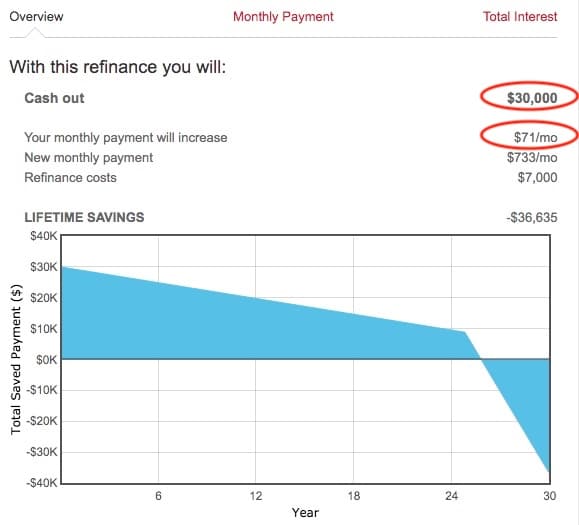

This rental property has appreciated in value since I bought it 5 years ago. It was worth ~$189k then and now worth about $220k. This gives me an option to pull out some of the equity, while also refinancing to a lower rate.

Most lenders will only loan up 75% of the value on an investment property, so I need to make sure my loan doesn’t exceed $165k (75% of 220k). Let’s see what the loan would look like if I pulled out $30,000 in cash:

Cash out refi option

- New interest rate: 3.65%

- Loan term: 30 years

- Closing costs: $7000

- Loan amount: $160,235 (current balance + $7k closing costs + $30k CASH OUT)

- New monthly payment: $733 per month

Now THIS is a really interesting option… Increasing my loan amount by $37,000 would only cost me $71 per month in higher mortgage payments. Where else can you borrow $30k in cash right now and have it cost you only $71 per month?

Is this a good deal? Well, it still depends on my investment goals!

What could I do with the extra $30k if I had it in cash right now? Where would I invest it, and could I make more than $71 per month from it in the long run?

Probably! I could stick it into the stock market and probably make a good return in the long run. But…

Bad news: I probably can’t qualify for a refinance right now. :(

The refinancing process is just as hard as applying for a brand new rental property loan. The loan officer will comb through every single nook and cranny of my financial life, and they probably won’t like what they see. :(

I have a ton of the good qualities needed: My credit score is excellent, my net worth is great for my age, I have plenty of cash reserves, and my overall debt to equity ratio is conservative. But the biggest concern they will have is my current personal income and last few years of work history. I’m just coming off a 2 year sabbatical, and right now my income covers my basic living expenses, but not much more.

I have 5 mortgages currently (for 5 different rentals). And although all the monthly debts are easily paid by the incoming rent, most conventional lenders want to know that my personal income can service my overall debts. Some lenders will take into consideration incoming rent streams as a source of income (maybe at a reduced rate), but it’s a tough sell.

Portfolio loan, private money lending, or commercial loan?

There is some hope. I could make friends with a small lender that favors real estate investing. I could put on a suit and tie, gather all my paperwork, sit down with the bank VP and mathematically prove to them that this cash out refi would only increase my monthly expenses by $71 per month (I can definitely afford this!).

But, since these smaller lenders deal with ‘riskier’ loans, they will want more reward for their investment. They will have much higher interest rates – possibly 2-3% higher – which puts me waaaay back to the start of this whole thought process… Will the new mortgage rate they offer me be worth refinancing? Probably not.

All in all, refinancing is something I’ll constantly evaluate. But at this point I think I’ll keep things as they are. :)

TLDR; Summary

- A standard refinance would save me $66 per month!

- But it would cost $7000, so the payback is almost 9 years.

- A cash out refi looks awesome! I could pull out $30k in equity.

- Unfortunately I can’t qualify for this (right now)

- I’ll be reassessing soon as my income grows/stabilizes!

I know a bunch of you guys probably refinanced recently … Tell me your awesome success stories! Have you done a rental property refinance? Any cash-out stories for reinvestment elsewhere?

Via Finance http://www.rssmix.com/

No comments:

Post a Comment