My New 401k Plan … What’s Great (And Not So Great)

Woo hoo, it’s official! I’ve changed contracts at work and my new 401k retirement plan is being set up next month.

I want to share with you guys the plan overview, cool and interesting things I learned reading the benefits brochure, sneaky fees and stuff to watch out for, and my brief chat with the plan administrator.

At first glance: Reading the boring 401k brochure

Imagine my excitement when I opened the benefits brochure and read the headline: “Profit Sharing” 401(k) Plan!

Profit sharing!? Did I just join some awesome company that will split some profits with me?

Sadly, I found out the answer is No. Although the plan itself is called a “Profit Sharing” Plan, that just means it has sharing capabilities … the company I work with chooses to share zero profits with me. :(

Similarly, the first few brochure pages talk about employer-matched contributions … but again, even though this plan is capable of employer matching, it’s not something that will be acted on at this time. So it looks like no free money for me :( If I want this 401k account to grow, I need to contribute everything myself!

One more sucky thing I realized right away — the plan only kicks in on the 1st of the month, after completing 30 days of service. So even though Aug 10th was my official start date on my new contract, my 401k won’t actually start until October 1st. Seems like forever away!

Bummer, but I’m still excited to have this benefit option. It’s the only pre-tax retirement account I will be contributing to.

Here’s some more info:

Automatic 401k enrollment a.k.a. forced savings!

One cool thing I noticed and love … This plan has automatic enrollment for new hires. What this means is when a new employee is hired, the company automatically enrolls them in a 401k plan. It starts with a contribution rate of 6% of their annual salary!

What I love about this is a) I don’t have to set up an account manually — the onboarding process takes care of it all for me — and b) the average American that pays no attention to their retirement benefits is forced to open a 401k and start investing. Employees have to purposefully “opt out” if they don’t want to participate.

Vanguard says 401k participation rates nearly double (to 93%) when companies use auto-enroll, compared with 47% participation when employees voluntarily choose to save. If the company I worked for 10 years ago had this set up, I’m sure I would have been part of the 93%, and I might have had a bigger retirement savings pile today.

More companies should do auto-enroll retirement benefits!

Administration fee disclosure

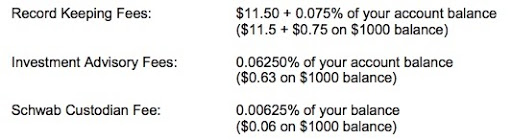

Here’s the plan sponsor fee breakdown. This is on a quarterly basis, not annual fees:

*This doesn’t include fees for the investment fund itself. These are just admin fees for having an active account.

At first glance these seem minor, but it adds up quickly. If I had a $20,000 balance in this 401k plan, the annual fee would be:

Record Keeping: $11.50 x 4 quarters = ($46) + $15 x 4 quarters = ($60)

Advisory Fees: $12.60 x 4 = ($50.4)

Schwab Custodian Fee: $1.20 x 4 = ($4.80)

Total Admin Fees: $161 (annual)

**Quick note to anyone with old 401k accounts from previous employers. These are the types of tiny fees that seem small but can add up a lot over time (and yours might be higher). You can usually transfer (or roll over) your old 401(k) accounts to Regular IRAs at large brokerage firms with FREE account and admin fees. No matter the balance, it’s worth consolidating any/all of your old 401ks into one retirement account. Why pay when you can have it for free?!

“Suggested contributions” to a 401k plan

The brochure includes all types of fun graphs and basic information on how saving is a good thing to do. It talks about compound interest, inflation, stocks vs. bonds, etc. Then comes a fun section about how much you should contribute to your 401k or retirement plan.

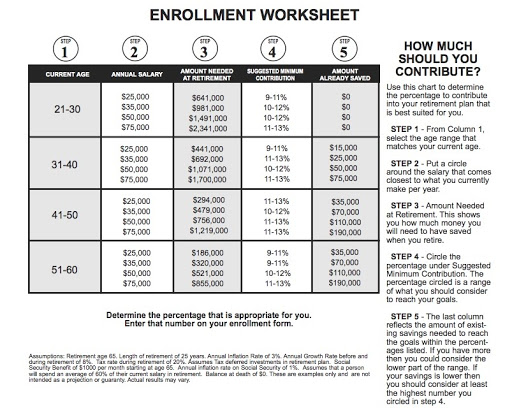

Here’s a worksheet the brochure provides:

I found this chart interesting for a few reasons:

- First, I noticed that all the contribution rates are between 9-13 percent. Doesn’t matter your age, income, current net worth, it all comes down to a minimum of 9% and a max of 13%.

Hmmm.

Hmmm. - There are a crap ton of assumptions in the footnotes for inflation rates, growth rates, assumed social security, tax rates, spending percentages, etc. Looks like a fair bit of wiggle room in there.

- It doesn’t explain how the “amount needed to retire” is calculated. This isn’t a bad thing, most people don’t know what the 4% rule is and have no clue how much they need to retire with. So at least this gives them a $ figure to think about and shoot for.

- It looks like nobody at this company earns more than $75k per year?

As pretty as this chart is, these recommended contributions won’t work for me. FIRE folk need to think outside the box and consider their entire net worth and overall investment objectives. Whilst 9-13% may be OK for 401k contributions, I believe most people looking to retire early have a much higher savings rate — split across pre tax and post tax investment vehicles.

For me, I’m still thinking about my contribution allocation for this 401k and will share more soon!

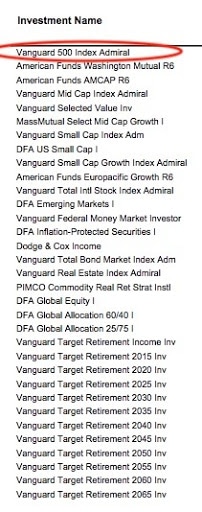

Choosing an investment option

There are about 30 available funds to choose from. Here’s a list of them all. Each investment option came with a long and boring summary page of what the fund is about, past returns, how it’s diversified, etc. I didn’t bother reading into them because I spotted the one I wanted right away … at the top of the list! The Vanguard 500 Index Admiral fund.

Here’s a Google snapshot of this fund: VFIAX

Note the low expense ratio of 0.04%. VFIAX is a good fit for me because of those low expenses, and it uses a passive management — or indexing — approach to track the S&P 500 Index.

*Note, if I didn’t purposefully select a fund myself, I would be auto-enrolled into a target date retirement fund. Since I’m 35 years old, they would assume I would retire at age 65 in the year 2050 … And the fund they would auto-select for me would be VFIFX. It has a little more conservative approach than VFIAX and an expense ratio of 0.15% instead of 0.04%.

Questions for the 401k plan administrator:

The benefits brochure had a few contacts listed inside for a financial advisor and the 401k plan administrator. Just out of curiosity, I called the admin for a quick chat.

Here’s a few things I asked him:

- The brochure I received was from 2018. So my first question was if there was a more current one. He assured me no options had changed and I had the latest info.

- I asked about the employer contribution and profit sharing — just to confirm I had read everything right. Unfortunately, he confirmed there was no matching :(

- Since I didn’t have access to the online portal yet (still don’t actually), I was curious what the process is to change my contribution %, swap investment funds, and how long that stuff takes. Good news here — it’s all relatively quick and easy in the self serve portal. Changes take effect in the immediate next pay period.

- I asked if the plan sponsor (or my employer) had a maximum contribution amount. They don’t, as long as I don’t go over the IRS contribution limit, which is $19,500 for 2020. (Some companies don’t allow you to do a 100% salary deferral — which I am considering for the remainder of 2020 to stay in the lowest income tax bracket.)

- I asked “what happens to my account if I leave the company?” and if there were any fees to move away from them. (There are no fees, and if I leave, the fund stays invested in whatever it’s left in.)

- Lastly, we talked a little about additional *after tax* contributions which the plan allows. Honestly, I’m still a little confused about this and I don’t earn enough income to mess around with that stuff just yet. I’ll stick with my Roth IRA for now!

TLDR & all things considered

- I’m a big boy now, got a new 401k plan! Woot woot!

- But there’s no matching or employer contribution :(

- Decent available investment funds → I’m gonna invest all in VFIAX (tracks sp500)

- Regular retirement advice in benefits brochures isn’t fit for FIRE enthusiasts

- If you have an old 401k account with a previous employer, roll that $$ over and avoid some fees!

- Call your 401k plan admin if you’re ever confused. Grill them with questions — they love it!

- This is my only pre tax retirement plan that I will be contributing to. It’ll be starting at $0, let’s track this sucker over time!

PS. Nowhere within the 66 page benefits package did it mention the words financial independence, financial freedom, *early retirement*, savings rate, safe withdrawal rate, or any of the $exy words that FI folk use on a daily basis. Kind of sad :( It’s time these benefits brochures get a big face lift! Don’t you think?

*Photo up top by Urban Data on Flickr. Cheers!

Via Finance http://www.rssmix.com/

No comments:

Post a Comment