How to Give Stock to Children With a UGMA Custodial Account

When my wife was a baby, one of her Aunties created a gift account and put a few thousand dollars in it. This Aunt was pretty financially savvy and didn’t have any kids of her own. She put the money in a UGMA account (named for legislation called the Unifed Gifts to Minors Act) and invested it in a broad, low-cost mutual fund that would multiply over time as my wife grew up.

Today, this investment account has about $35k in it.

It’s a bit embarrassing for us to talk about. My wife and I are extremely proud people … the do-it-yourself type. We don’t like taking handouts, and large gifts make us uncomfortable.

But, over time, we’ve found ways to accept the gracious gifts and blessings that come our way. One of those ways is to pay it forward. The blessings that rain down on us throughout life –> we pay it forward and try to make it rain on others!

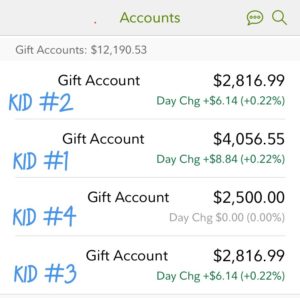

About four years ago, when our first nephew was born, my wife and I set up a UGMA account for him with $2,500 invested in a total stock market index fund. Same with the second, third and fourth nephews as they were born … a total of $10k gifted so far! When they turn legal age, they can access the account for college savings, a down payment for real estate, or keep the money as an investment counting toward their own FI number!

We set up all the accounts with Fidelity, which was a really easy process online that I’ll share at the end of this post.

Benefits of Investing With the Uniform Gifts to Minors Act (UGMA)

Originally, my plan was to just buy some stocks in my regular personal brokerage account and figure out the transfer later when my nephews were older. But, after calling my Fidelity rep and talking through the options, my wife and I learned about UGMA custodial accounts and really liked what they had to offer.

The Uniform Gifts to Minors Act was created back in the 50’s. It allows people to transfer assets to kids but remain in control of those assets until the child reaches legal age. It’s like setting up a trust but way easier.

We also checked out the 529 plan option and college savings accounts. But going to college is a decision we wanted to leave to the kids and their parents. Personally, I never went to college, but my wife did. We didn’t want to set up a college savings account where our nephews felt pressured to attend school just because they have the money to do so.

Also, for the amount we are gifting, we are not too concerned about the tax benefits of college savings accounts. Kiddie tax should be small — and we might even be able to do some capital gain harvesting while the child is young with no income.

Roth IRAs vs. UGMA

Children can open Roth IRA’s, and there’s no age limit. But, the child needs to earn some type of income. Earnings need to be at least as much as the amount that’s being contributed to the Roth.

The process and account type for Roth IRAs are very similar to those for UGMAs — you open the account and assign an adult as the custodian — and then it’s transferred to the kid when they are legal age. Some brokerage firms don’t offer custodial IRAs, but Fidelity and Charles Schwab do.

Since none of my baby nephews earn income, we couldn’t set up a Roth for them.

Why I Like UGMA Accounts and Why We Chose Fidelity

- No lawyers, no messy trust paperwork, costs $0 to set up and $0 expense to maintain!

- Online set-up usually takes 10 minutes. All you need is the child’s name, DOB, SSN, and address.

- You can assign any adult as the “custodian” (like a “trustee” of a trust), and they have full control of investments until the child turns legal age. (For my nephews’ accounts, I put myself as the custodian and will transfer it over to their parents at a later date.)

- The asset counts against the minor’s estate, so tax will be calculated at the child’s tax rate.

- With Fidelity, there are no trade fees or a minimum amount of money you have to give. You could transfer just $1 if you want. (But some index/mutual funds have trade minimums, which you need to abide by as usual.)

- When the child turns legal age, the account can transfer to their name like a regular brokerage account. They can do whatever they want with the funds.

What to Know Before Setting Up a Gift Account

- The Uniform Transfers to Minors Act (UTMA) is a little different than the Uniform Gifts to Minors Act, mainly the tax liability and maturity time. Might want to consult your brokerage firm and tax advisor if you are planning to give massive amounts of money or stock away!

- Depending on which U.S. state you live in, the child gets ownership at age 18, 19, or 21. Here’s a site showing the Age of Majority for each state for UGMA and UTMA.

- This is an irrevocable transfer! You can’t change your mind later and take your money back. The child owns it, not you or the parents.

- Having a large UTMA might affect the kid’s financial aid eligibility later in life!

- For all you Uncle Scrooges out there … If you’re giving more than $15,000, you’ll have to pay gift tax to the IRS. Here’s the gift tax limits and FAQ.

Compound Interest … The 8th Wonder of the World, Especially For Kids

Every time I log into my Fidelity dashboard, I get to see the progress of my nephews’ accounts. There’s nothing sexier than watching money grow over time. :) Even though these are gifts for them, I’m getting so much pleasure enjoying the ride and imagining the future balance!

We’re still 14 years away until the oldest one can access the money in his UGMA, (which has already grown to more than $4,000). But here’s what it might look like in the future, with compound interest …

Assuming an 8% growth rate, with a $4k starting balance today, if left untouched …

- At age 18, the account could be worth: $11,748!

- At age 30, the account might be: $29,585! Woohoo!

- When he’s 40, he could have $137,896. Boom!

- If he keeps the account until age 70, it’ll be $642,728! Booyah!

I hope my nephews are wise and continue to keep the cash invested, just like my wife hasn’t touched her gift account and is still letting it grow.

How to Open and Set Up an UGMA Account … It’s This Easy …

I created a custodian account last month with Fidelity for my newest baby nephew. Here’s the process! Takes less than 10 minutes …

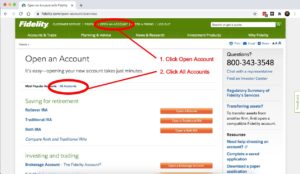

- Go to the Fidelity homepage; click on “Open an Account” at the top, then “All Accounts”:

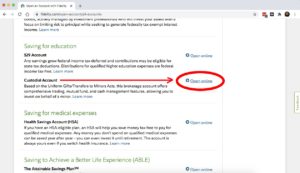

- Scroll down and find “Custodial Account” and click “Open Online”:

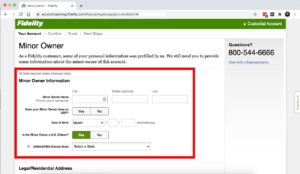

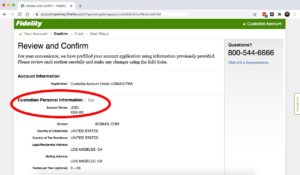

- Fill out the minor beneficiary information. You’ll need their legal name, DOB, SSN, & address. This is their address, not yours! (When babies are born in the U.S., it can take a few months for a SSN to be assigned — be patient

)

)

- Fill in the custodian or trustee information. Can be a parent, grandparent, trusted financial professional, or yourself! If you are already a Fidelity customer, and logged into your account, this part will automatically be filled out with your info. If you want to appoint someone else, you can.

- Open, read, and confirm all the account docs. It’s important to note that you can save the application and pick up where you left off at any time. My trick for reading long contracts is to print out all the pages, then read for about 20 minutes each morning.

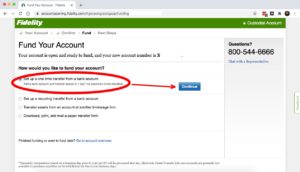

- Choose how you want to add money to the account! I went with the one-time transfer from a bank.

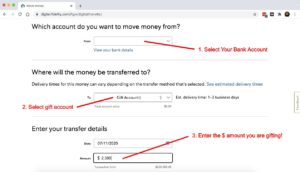

- Transfer from your bank to the gift account. If you don’t see your bank account info here, you’ll need to link a new bank account. This is a fairly seamless process, just like connecting to a regular brokerage account. You need your bank routing and account number handy.

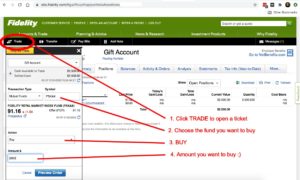

- Bank money transfers can take 1-3 days. But once the money lands in the account, don’t forget to invest it in an index or stock!!! I’m going with Fidelity’s Total Stock Market Index. (You can also set up recurring transfers, in case you want to divert a small portion of your income instead of a lump sum).

- Pour yourself an ice cold beverage. And relax knowing that you’re helping your little loved one financially and are teaching the ankle biters about investments.

This is me visiting my newest baby nephew on the East Coast earlier this year!

Hope this post helps anyone out there looking to gift stocks to minors! Let me know if you have any questions in the comments

Have a good one!

* Top pic by Micheile Henderson!

Via Finance http://www.rssmix.com/

No comments:

Post a Comment