Slow down … FIRE is not a race

(FYI … “Sank Farten” means “slow down” in Swedish. I’ve been yelling it at speeding cars on my street lately, but I just get strange looks in return :))

When I first stumbled across the FIRE movement, I’ll admit I was a little narrow-minded. I thought the goal of FIRE was to accumulate an insane amount of savings to reach financial independence as fast as possible and hit retirement at the earliest age you can.

This naive thinking was both a blessing and a curse.

It was a blessing because it made me focus and take my financial education seriously. But it was also a curse because always prioritizing money is not a sustainable lifetime quest. Putting money first is OK sometimes, but if you prioritize it for too long, you could miss out on other important experiences.

A breakthrough moment for me came a couple of years ago at my favorite place (where I do all my important thinking) — the bar!

You can simmer down your FIRE

My friend and I were out drinking and talking about finances. This was right around the time I’d quit my job and was re-thinking my career choices and how I could pursue early retirement. We were a few beers deep when he asked me, “So, when you go back to work, how long will it be until you can fully retire?”

Since I didn’t have my spreadsheet with me, I just spat out some round-figure numbers to answer the question. I said something like:

“Well, if I can get a miserable soul-sucking job that pays me $200k per year, and I really manage my expenses, I can probably hit financial independence in 5 years. Or, if I find a slightly less miserable soul-sucking job that doesn’t pay as much money — say, $100k per year — I can reach FI in 10 years. Or, maybe I could find a fun and cool job that I actually like for $50k per year, and achieve FI in 20 years.”

That’s when it hit me: I’ve passed the point of inevitability. No matter if it takes me 5, 10, or 20 years to achieve financial independence, I will eventually cross the finish line. The biggest difference in which path I take is determined by how much I enjoy the journey in the meantime.

I realized that there’s no rush for me. I wanted to slow down and enjoy the ride.

This is when I discovered “Coast FI” … and happiness became my focus, not money.

Coast FI: What is it?

This is a variation on FIRE (financial independence, retire early). Basically, at some point in your financial journey, you will have built up enough wealth that you no longer need to contribute to your retirement accounts. You can just let compound interest do its thing, and your net worth will naturally grow higher and higher until you achieve your FI number.

Consider this scenario:

Let’s say my current net worth is $500k, all invested in a broad stock market index fund. And let’s assume my FI goal is to have $1 million in my retirement account. Since I’m only at the halfway mark, this is nowhere near enough to think about a traditional retirement just yet.

But if the $500k is left sitting untouched, the money will slowly grow over time thanks to compound interest. Given a 7% average interest rate, the assets in that account will double in about 10 years, to $1 million. This will happen naturally, without me adding any more contributions from paychecks.

Over the next 10 years, I could drop my savings rate to 0%, and I would need to earn only enough money to cover my ongoing living expenses. I could potentially slow down work, take a gap year or sabbatical, or explore lower-paying and more gratifying employment opportunities.

Coast FI can feel a bit like semi-retirement. Most of the freedoms that come from financial independence can be recognized before actually achieving FIRE — and in this scenario, at the halfway mark!

Yes, money is still important in coast FIRE

Don’t get me wrong, Coast FI doesn’t mean you can take your eye off the ball. In the scenario above, there are a few things that could go wrong.

First off, we could experience a bad 10-year stretch of investment returns in the stock market. This happened recently from January 2000 through December 2009 … they call this The Lost Decade, when the S&P 500 returned an average of -0.95% annually. Ouch! Not only would this completely blow a 10-year timeline to FI, but you’d also miss a big opportunity if you’re not saving/investing anything during a down market.

Another potential disaster would be if you become lazy and ease up on all the frugal and thrifty habits you used to build up your savings in the first place. Money still needs to be an important part of decision-making. You can’t start running up your annual expenses — you have to work to keep them in check.

Finally, time is the biggest factor here. You need time for compound interest to really work its magic. So Coast FI is typically better suited for younger investors who have a longer time period to work with.

Benefits of slowing down your FIRE

For me, there’s a sense of relief that came from deliberately slowing down my path to FIRE. I used to put a lot of pressure on myself to retire early, build a massive net worth, and do it all as fast as possible.

But now that stress is gone. I’ve learned that FIRE is not a race or competition. There is no wrong or right way to do it. Taking a slower route means I can relax more and enjoy life.

Another benefit is having more work opportunities. Growing up, I always thought your income would keep rising and rising with each new job or promotion. Accepting anything less than what you previously earned would be a step backward.

But I started realizing that as my income rose and I became more specialized, there were actually fewer work opportunities for me. For example: There might be only 10 companies in Los Angeles that would hire me at a salary of $100k/year …. But there are probably 5,000 companies that might hire me at $50k.

Having a bigger pool of available jobs to choose from lets me explore new and exciting things. I can make my career decisions based on fun and flexibility, not salary.

More coast FI resources

Here are some cool articles and resources by fellow bloggers that you might like:

When can I Coast FI? by Brewing FIRE

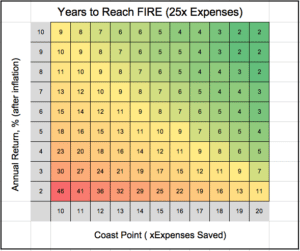

Adam has created a few tables to help decide if Coast FIRE is right for you. Based on your current situation and numbers, you can work out how many years it would take you to get to your coast FIRE number:

Slow FI Interview Series by the Fioneers

Jess and Corey are not only on the Coast FI train themselves, but they have also interviewed a bunch of others who are intentionally pushing out their retirement dates. I love their phrase and goal of “achieving incremental financial freedom.”

What is Coast FIRE? by Four Pillar Freedom

Zach has some wicked visual examples of how investments grow by themselves to achieve a specific coast FI number. He also has a formula you can use to calculate how much you need to be able to start coasting to FIRE yourself!

No matter what flavor of financial independence you’re pursuing, I strongly encourage you to build a life you will be proud of and enjoy as much of it as you can along the way.

Sank farten! And have a great weekend!

Anybody else working toward coast FI? (Did anyone start later in life?) How about switching jobs to trade more money for a more joyful journey?

*Sign pic up top by jasejc!

Via Finance http://www.rssmix.com/

No comments:

Post a Comment