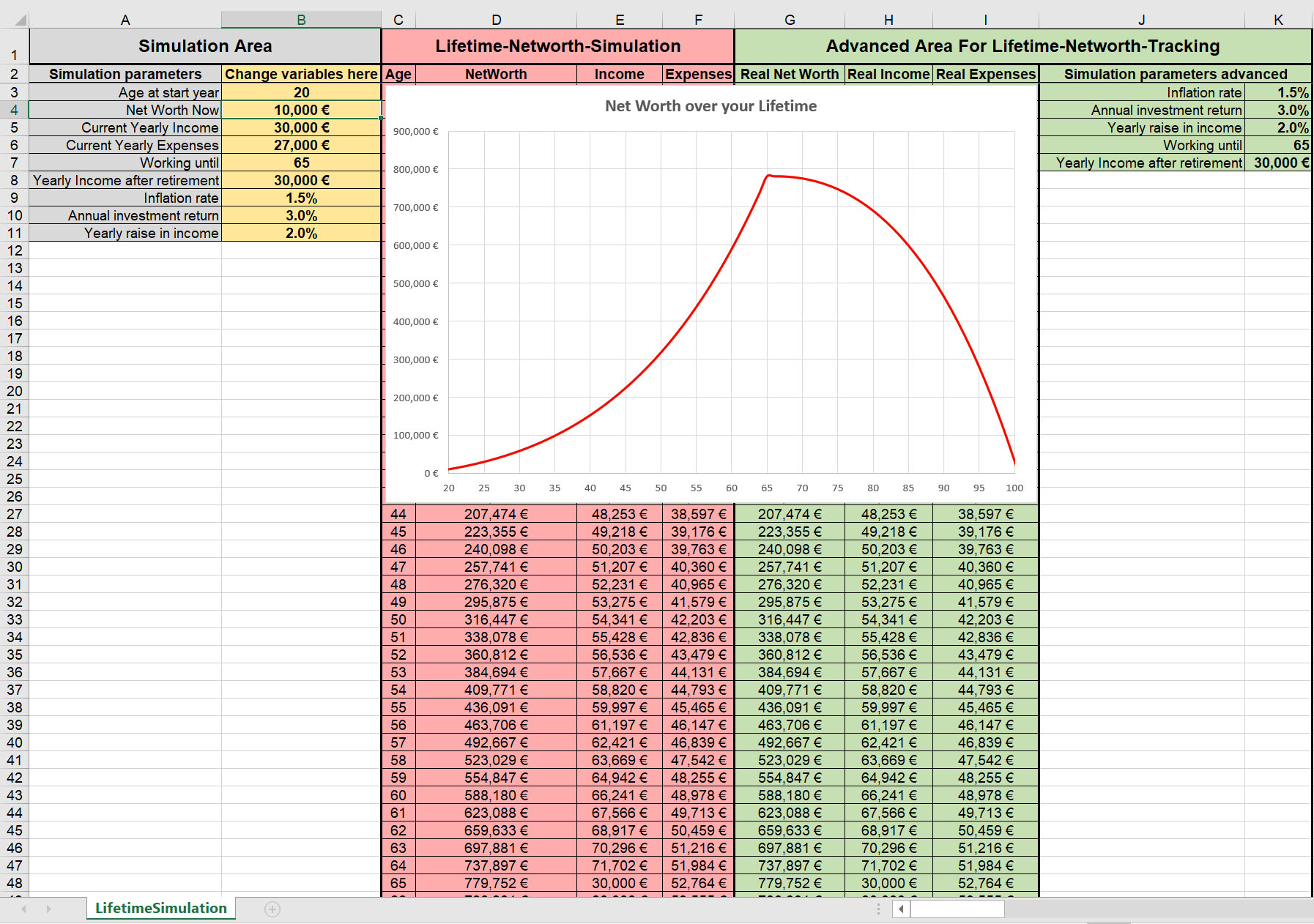

The Lifetime-Net Worth-Simulator

Happy Memorial Day everyone!!

While you’re out reflecting and celebrating today, let me suggest another fun (and FREE) activity to include for your enjoyment: Filling out this Lifetime-Net Worth-Simulator!

From a new blogger on the scene, Money Is a Solved Problem, who wants to help in his own way of giving you freedom :) And considering it’s only his 2nd post on the blog, I’d say he’s off to a great start!

[Download spreadsheet here (Excel)]

The currency is currently set to Euros (€) as lives in Sweden, but as he notes, “If you do not like € replace it with $. If you are living in 2950 when both do not exist anymore, replace them with your currency. I hope Excel is still a thing in 2950.” Lol….

But here’s why I like this compared to others – it shows the FULL CYCLE of your money and not just to your *retirement date*! Even though that latter half is the part most of us don’t want to see as it has our money going in the OPPOSITE direction, haha…

But since that’s the circle of life, it helps to give you a better overall picture of things :)

It can also help you with the following according to him by playing around with the variables a little:

- How powerful compound interest can be

- How inflation can eat up your savings!

- How your income, expenses and annual investment returns affect your long term worth

- That you can amass a lot of money working at a normal job and keeping expenses low

- That you need a very high income if you want to become a billionaire ;)

- And overall how NOT to run out of money when you’re older

Here’s the link to his full blog post on it to learn more: The Lifetime-Net Worth-Simulator

And then here’s the direct download link again to it: Simulator Spreadsheet

Let me know if it gives you any epiphanies!! :)

******

PS: to put things in even more perspective, pair this with your Lifetime Wealth Ratio!

********

[Prefer to get these blog posts *weekly* instead of daily? Sign up to my new weekly digest here, and get other thoughts on life/business/money as well: jmoney.biz/newsletter]

No comments:

Post a Comment