The 100-Day Financial Goal Journal!

Morning, friends!!!

Welcome back to everyone who wasn’t scared away from yesterday’s post! ;)

One of my favorite Canadian bloggers just released an AWESOME new money journal out there, and wanted to make sure y’all were aware of it as it looks pretty good! And unlike other typical $$$ journals, this one helps you to *hone into* more specific goals to shoot for, and then even more importantly – GIVES YOU A TARGET DATE TO SHOOT FOR – so that you can actually accomplish it in the end ;) Specifically, 100 days!

It comes from Alyssa over at MixedUpMoney.com, and below you’ll find a summary on it as well as a fun little interview I just did with her to learn more…

Hope you guys like it!!

Make sure to read to the end for a chance to win a free copy! ;)

******

“The 100-Day Financial Goal Journal:

Build a Plan for Your Financial Future”

From Alyssa’s blog post:

This 100-day financial goal journal is for anyone who is sick of feeling behind when it comes to their money situation. Rather than pick up the typical personal finance book about how to get wealthy as an entrepreneur, how to retire early or how to pay off your debt by living life bare bones, this modern diary can get you on the right track with your financial situation, without having to skip the fun parts of what money is really for: to be enjoyed…

This journal can provide a quick introduction to personal finance, and a deep dive into how you value your money and what you want to achieve in your financial life.

Looking to start an emergency fund? Save for a big purchase? Or make a dent in credit card or student loan debt? Let this journal be your guide. It features prompts that will help you reach your biggest personal finance–related goal, plus daily pages for recording your expenses, reflecting on your everyday spending and saving decisions, and tracking your progress.

******

Cost: $17.95

Amazon link: The 100-Day Financial Goal Journal: Build a Plan for Your Financial Future

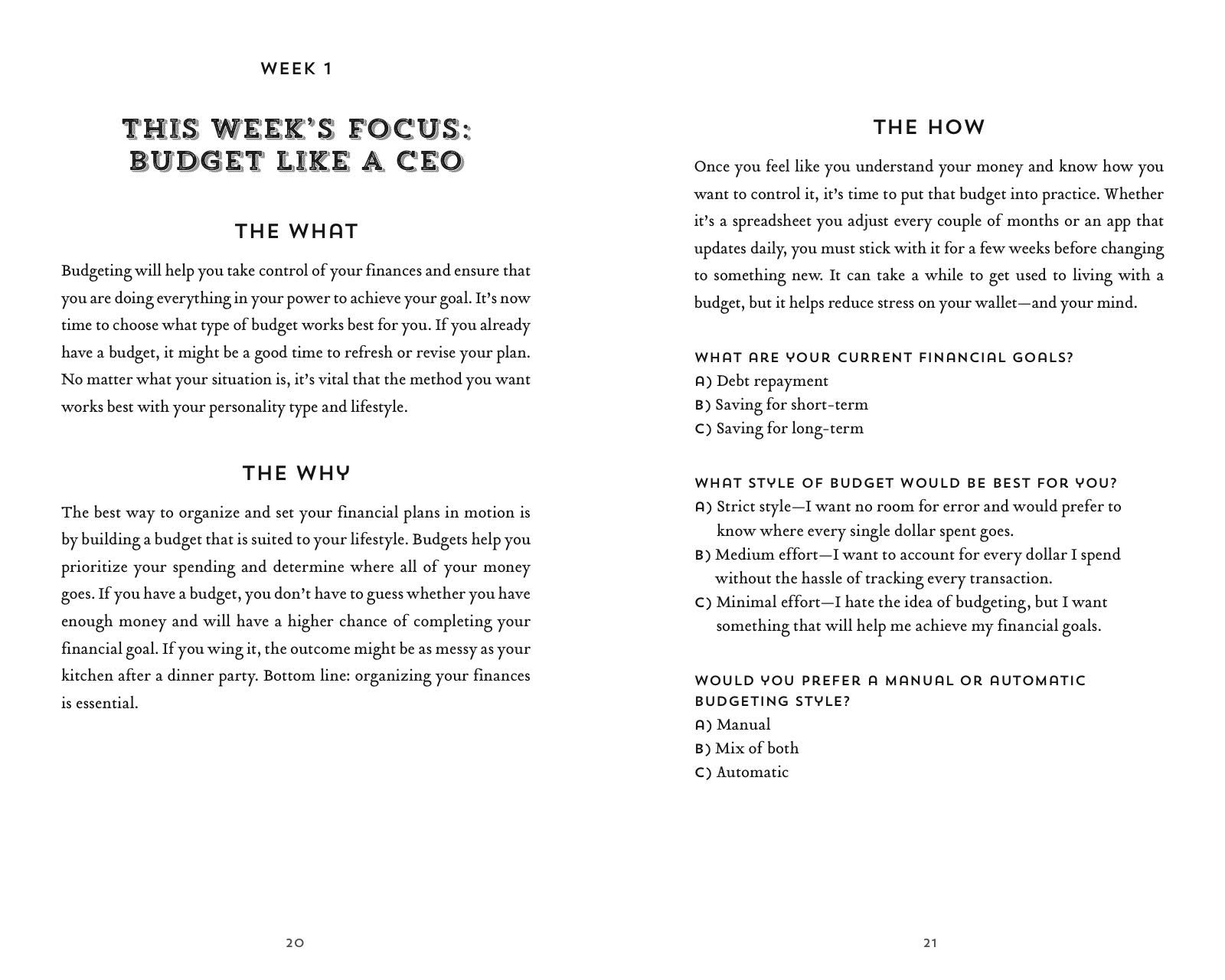

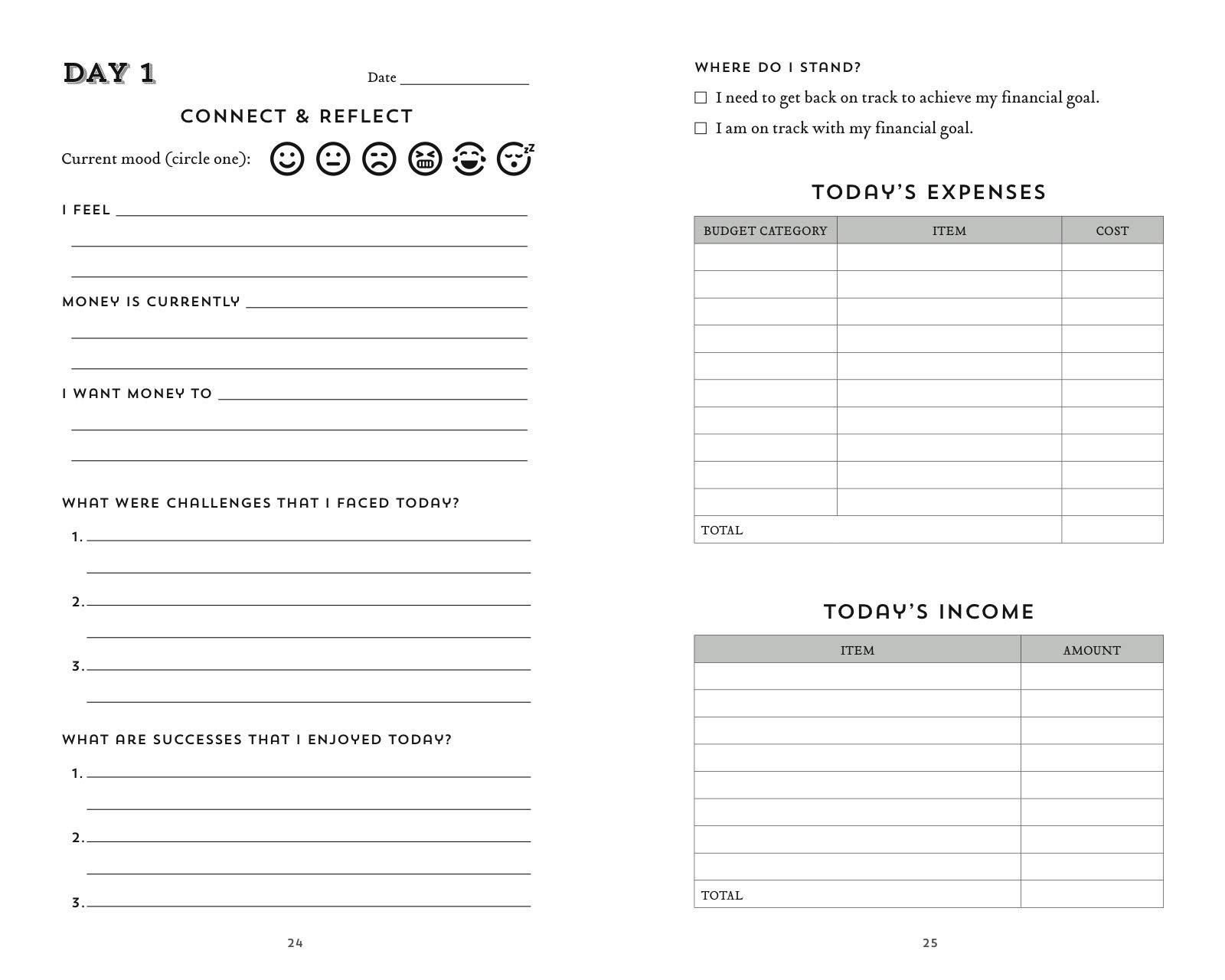

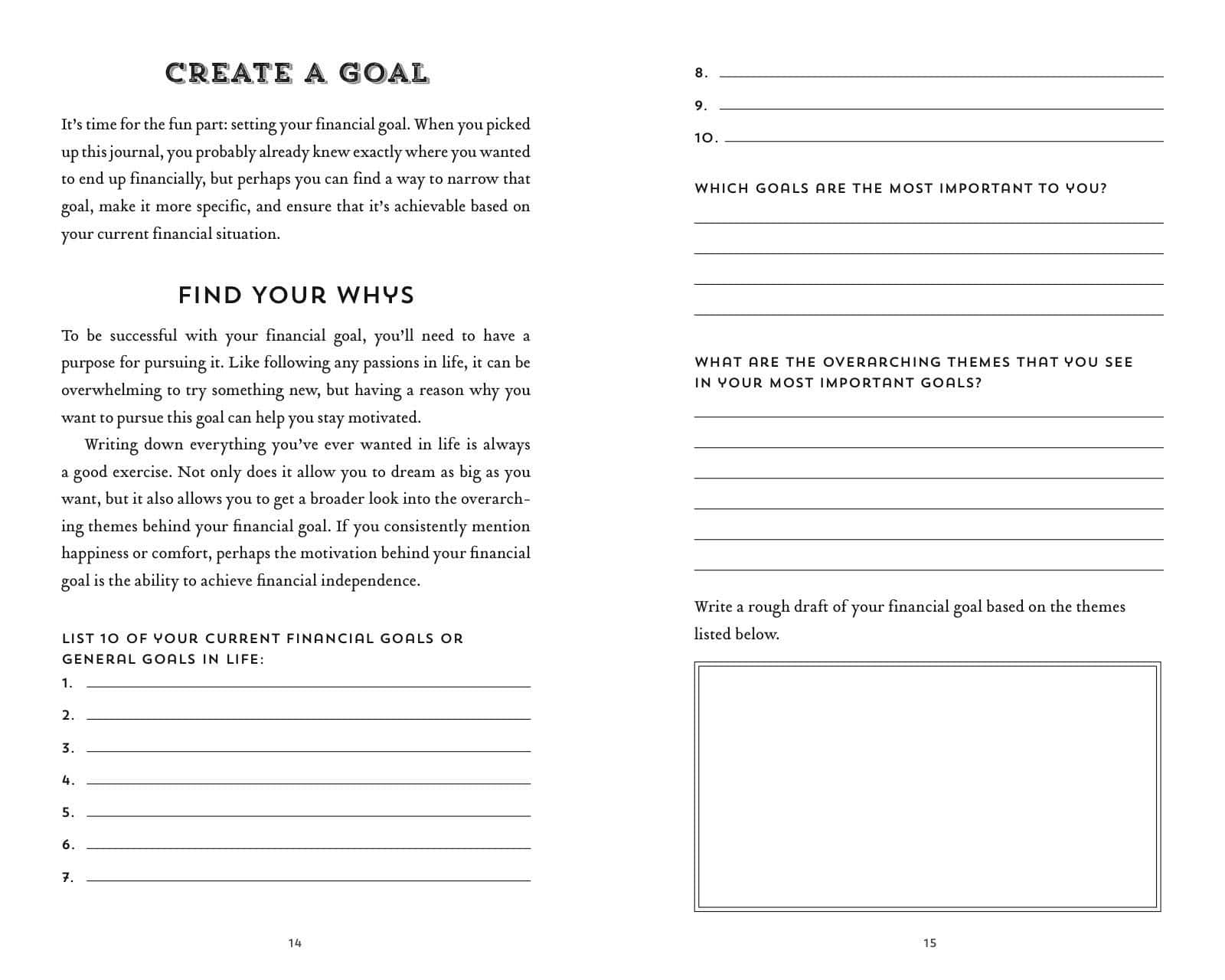

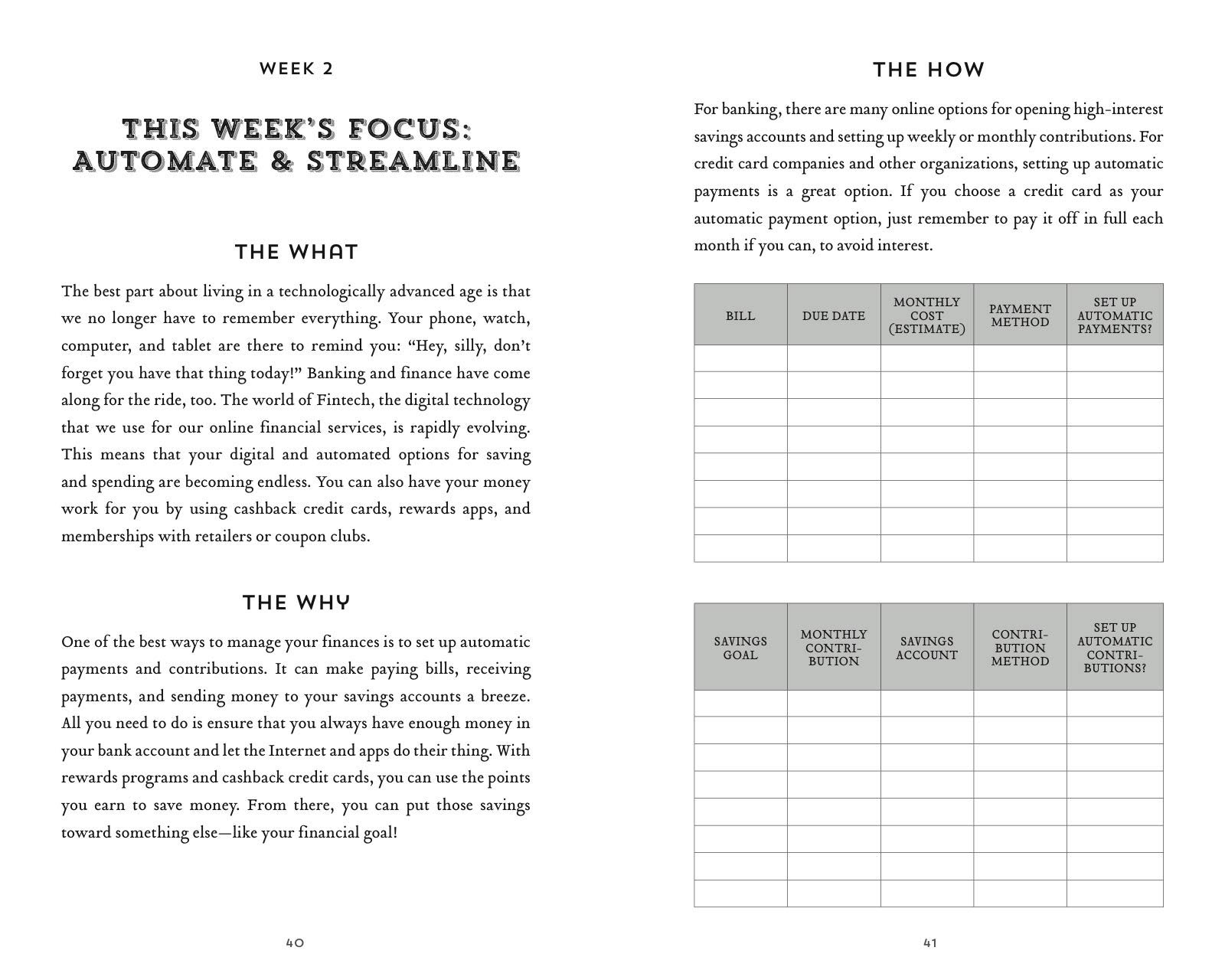

And then here’s a look at some of the internal pages of the journal… (click to make bigger):

******

One on One with Alyssa:

Love the idea for this journal so much! What made you come up with it?

For me, money doesn’t have an impact unless I track and plan in a tangible way. I’ve tried

to use apps and I’ve tried to switch everything to an automated system, but ultimately, I still

love to write things down by hand. Not only does it make my spending habits come to life, it

really makes me think about the decisions I make and if they’re keeping me on track to

accomplish a financial goal.

If you don’t have a money diary where you can share all of your deepest thoughts (because

personal finance is very emotional), you’re missing out! At least, that’s what I think anyways.

I’ll still say, though, spreadsheets are life. I think you need balance, and this journal is just

another fun and simple way to control your money.

Do you typically track your own money more manually than automatically?

I’ve got a really good mix of tools I use to manage my finances. First, I have a monthly budget that I store on Google Sheets because it’s super easy to plop numbers in and shift things around whenever I need to. Second, and for discretionary spending, I use Cleo (a money management app) that’s really just for fun. She’s an AI bot that sends me sassy messages if I’m spending too much money at Starbucks, but doesn’t judge me for it — because, judging how other people spend their money is silly.

Lastly, and most importantly, I have my journal to write down financial goals and keep track of my savings. If I automate those goals, which is a part of the plan, I sometimes forget to check where I’m at, whereas if I write everything down (including my mood) and find that I could toss a small lump sum towards the goal to achieve it a few weeks earlier, I’m more likely to find success.

What’s one of the best goals to shoot for with this journal?

The bottom line with this journal is creating a money goal that is actually realistic to accomplish in a short amount of time. 100 days isn’t very long, so attempting to save for a down payment might not be your best option (unless you’ve gotten a head start). Instead, you could focus on paying off a specific amount of credit card debt, or save for a vacation you have planned for the near future.

Right now, the best goal to shoot for with this journal is easily an emergency fund. Even if you already have one, it might be ideal to top it up by a few hundred bucks.

It looks like it can be used by pretty much anyone, whether they live in the 2nd best country in the world (Canada) or the first (The U.S.) ;) And possibly even other countries around the world too, like even Zimbawbe?

Shoutout to Zimbabwe, because, yes! This journal is universal, meaning that no matter where you live or what kind of money you hold in your bank account, you can take these tips and tricks, and follow the daily prompts to seriously smash a financial goal.

PS: Canada is number one, I just read about it in the news.

Can you tell us more about your blog in general for those of us who aren’t smart enough to follow you yet? ;)

Oh my gosh! Of course. I’ve been running Mixed Up Money for five years now and what started as a place for me to hold myself accountable while paying off my consumer debt has transformed into a really fun and safe space to talk about finance. My blog is not about preaching money topics, and we don’t expect you to be perfect. Instead, I tell personal stories of wins and fails when it comes to money. I also provide you with tips and tools to create a healthy vision of what financial success looks like — for you and only you.

You can follow me on Twitter for sarcastic jokes, Instagram for inspiring financial illustrations and TikTok to watch me sing songs to my daughter. Because, yes, I’m on TikTok.

And lastly, just for me, WHAT’S THE SECRET TO MAKING GIRL BABIES!! I cannot figure it out for the life of me!!

I heard if you eat enough Girl Scout cookies, a baby girl gets mailed to your front step.

[EDITOR’S NOTE: She actually wrote “Girl Guide” cookies, but I’m assuming that’s the same thing as girl scout cookies here in the U.S., but if not I’ll be making a personal trip up to Canada to grab as many boxes as I can get my hands on! I am not risking it if we go for a 4th!! ;)]

******

[The 100-Day Financial Goal Journal via Amazon, $17.95]

[The 100-Day Financial Goal Journal via Amazon, $17.95]

So there you have it! A great new resource out there for anyone looking to turbocharge their goals :)

And a little birdy tells me Alyssa will be offering up a FREE copy to one lucky commenter on the blog this week, so if you’d like to be entered for it just answer the following question down below or via email and you’ll be automatically entered to win!

What’s *one* goal you’d love to accomplish in the next 100 days? Financial, or otherwise?

Open to both U.S. and Canadian readers, good luck!! We’ll let the giveaway run until the end of the upcoming weekend, and then randomly pick the winner that next Monday morning!

Congrats again Alyssa!!

*****

Amazon links above are affiliate links

********

[Prefer to get these blog posts *weekly* instead of daily? Sign up to my new weekly digest here, and get other thoughts on life/business/money as well: jmoney.biz/newsletter]

No comments:

Post a Comment